on September 7, 2021, El Salvador made history by officially adopting Bitcoin as legal tender. A bold decision at the time, the country’s Bitcoin Bond has since outperformed almost every emerging market with an impressive 70% return in 2023.

El Salvador’s digital currency leap has attracted the attention of significant institutional players, including JPMorgan, Eaton Vance, PGIM, Lord Abbett & Co LLC, Neuberger Berman Group LLC, and UBS Group AG, who have all added the El Salvador Bitcoin Bonds to their portfolios since April 2023. According to Bloomberg’s recent report, the increased demand for the nation’s Bitcoin bond is a stark contrast to initial apprehensions.

El Salvador’s aim was not merely financial but also socio-economic. Adopting Bitcoin as its national currency was primarily to combat poverty and help unbanked citizens. By introducing them to the world of digital currency via smartphones, the government envisioned creating a bridge for its populace to access previously unavailable financial services. Moreover, the move aimed to provide economic stability by mitigating inflation risks.

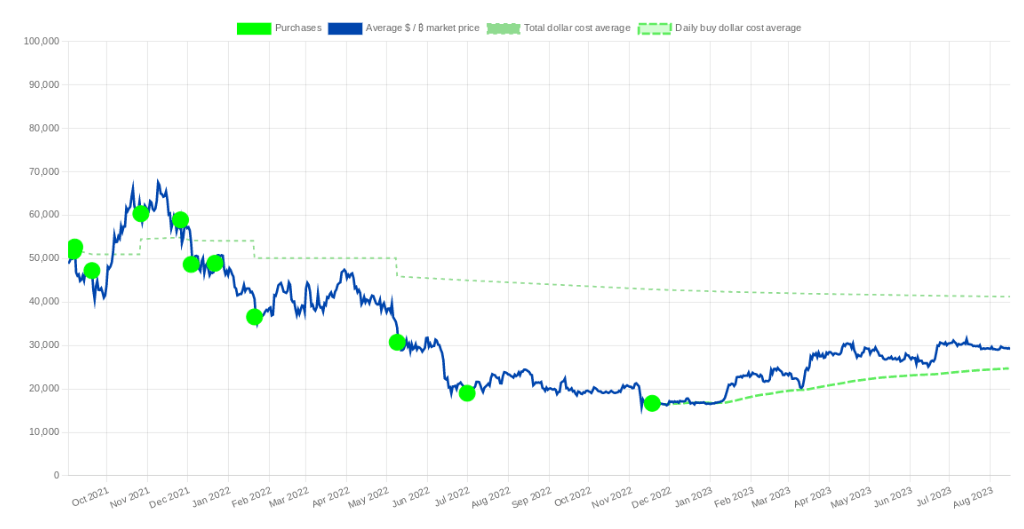

However, as with any significant shift, there was initial resistance and misunderstanding. A poll by the Central American University in September 2021 highlighted that the majority of Salvadorans were not clear about Bitcoin, and many disagreed with its adoption. Despite this, the government took decisive steps, purchasing ₿400 (equivalent to $20.9 million at the time) on September 6, a day before the Bitcoin Law came into effect. Businesses began accepting it, and foreign investors in Bitcoin were incentivized with benefits like eligibility for permanent residence in the country.

With the added boost of El Salvador’s successful Bitcoin Bond and the growing institutional interest, it is evident that despite criticisms, the nation’s Bitcoin journey remains on an optimistic trajectory.

Leave a comment