The median age of U.S. homebuyers has reached a Average U.S. Homebuyer Age Climbs to 56 Amid Rising Ownership Costs

The average age of U.S. homebuyers has surged to 56, marking a six-year increase from 49 in 2023, according to the National Association of Realtors’ (NAR) annual report.

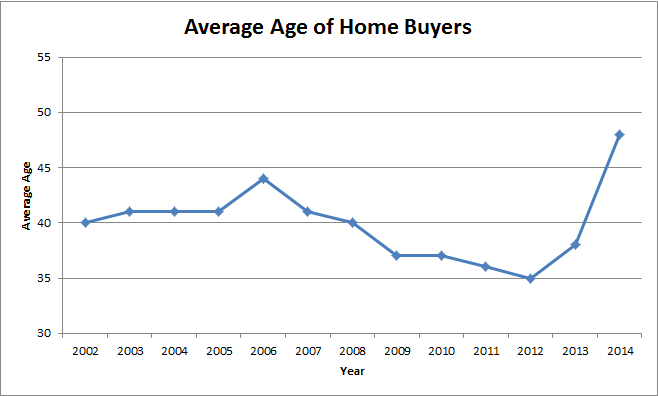

This milestone represents a historic high, with average homebuyer age rising from the low-to-mid 40s since the early 2010s. The change highlights the challenges younger buyers face due to escalating homeownership costs, including high mortgage rates and significant down payment requirements.

Alongside the increase in average buyer age, the median age of first-time homebuyers has also risen, now standing at 38, up from 35. Meanwhile, the proportion of first-time buyers has dwindled to 24% — the lowest level recorded since NAR began tracking this data in 1981, falling from 32% in the previous year. Bob Driscoll, Senior Vice President at Rockland Trust, remarked on the unprecedented difficulties for millennials attempting to purchase homes, attributing the trend to surging costs.

The rising median home price, now at $435,000 per NAR, and the doubling of the 30-year fixed mortgage rate to over 6% have intensified barriers to entry. For younger buyers, these high costs make it challenging to save for a down payment while managing student debt and other financial burdens. Currently, the median down payment is 18%, amounting to approximately $78,300 on a $435,000 property, close to the U.S. median household income of $80,610.

Even those able to gather down payments often lose bids to older buyers with established home equity or wealthier, all-cash buyers. The percentage of all-cash purchases has risen from 20% to 26% over the past year, creating a competitive landscape heavily weighted against younger and first-time buyers.

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment