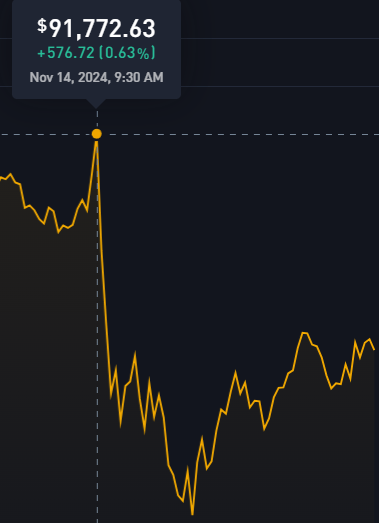

Bitcoin’s price took a notable dip near the close of trading on Wall Street, dropping to approximately $87,000. After opening the day at about $91,772, Bitcoin’s value fluctuated as the market reacted to a mixture of economic indicators and investor sentiment.

By the end of the day, the cryptocurrency had settled around $87,500 signaling potential stabilization after a sharp downturn.

Market analysts point to growing economic uncertainty as a significant factor contributing to Bitcoin’s volatility. Recent U.S. Federal Reserve comments on inflation and interest rate policies have intensified concerns among investors, spurring fluctuations across various asset classes, including cryptocurrency.

Many traders view Bitcoin as a hedge against inflation, yet its price remains sensitive to broader economic shifts.

Bitcoin’s market dominance continues to reflect investor confidence in the digital asset, even amidst sharp intraday movements.

As Bitcoin’s dominance index hovers around its highest level since 2021, analysts anticipate continued interest from institutional investors looking to diversify portfolios.

Market experts argue that such support from larger players could pave the way for further gains in the cryptocurrency market despite recent volatility.

Cryptocurrency market observers are cautiously optimistic, emphasizing the importance of monitoring upcoming economic reports and policy statements. The interplay between traditional financial markets and the cryptocurrency sector suggests that Bitcoin could experience further movements as global economic trends unfold.

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment