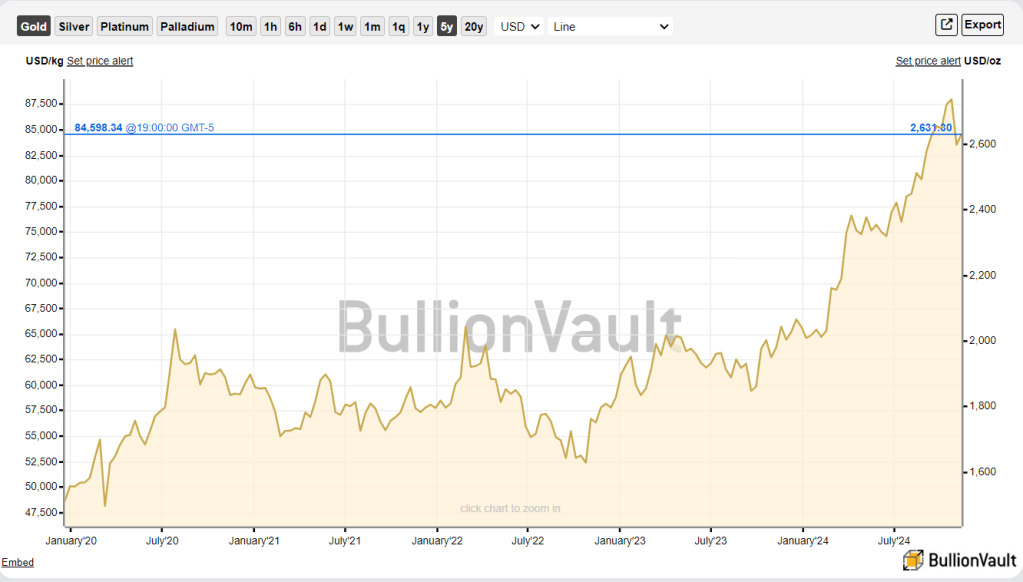

Gold prices have risen by 24% year-to-date, reaching a one-week high of $2,621.95 per ounce on November 19, 2024. This increase is attributed to a softer U.S. dollar and market anticipation of Federal Reserve interest rate decisions.

Analysts at Goldman Sachs project that gold could reach $3,000 per ounce by the end of 2025, driven by central bank purchases and potential U.S. interest rate cuts.

Bitcoin has experienced a 113% increase year-to-date, recently trading below $91,600 after peaking at $92,593. The cryptocurrency’s surge is fueled by institutional investments and the approval of Bitcoin exchange-traded funds (ETFs).

Analysts predict that Bitcoin could reach $100,000 by the end of the year, with some forecasts suggesting a potential rise to $200,000 by the end of 2025.

A growing number of investors are incorporating both gold and Bitcoin into their portfolios to hedge against economic uncertainties. A survey by State Street Global Advisors revealed that 38% of investors with at least $250,000 in assets held gold in 2024, up from 20% in 2023.

Similarly, significant inflows into Bitcoin ETFs have been observed, indicating increased institutional interest in the cryptocurrency.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True.If you would like to support to help further secure the integrity of our research initiatives, please donate here

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes

Leave a comment