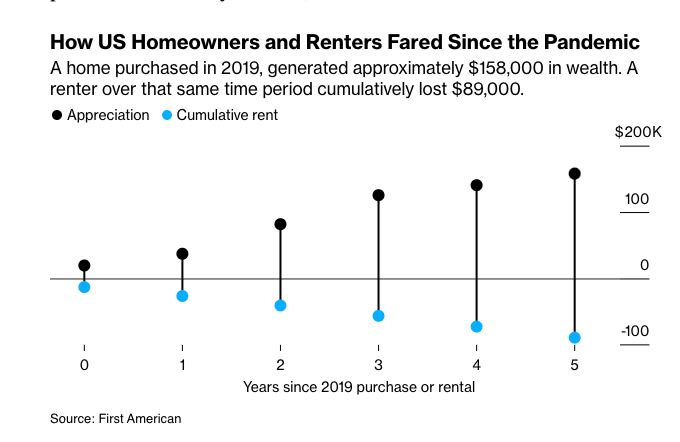

Recent analyses reveal a significant financial disparity between U.S. homeowners and renters over the past five years.

Individuals who purchased homes in 2019 have, on average, seen their net worth increase by approximately $158,000, primarily due to substantial home price appreciation during this period. In contrast, renters have missed out on this wealth accumulation, with estimates suggesting a potential loss of $89,000 in unrealized gains.

The surge in home values has been a key driver of wealth for homeowners. Data indicates that the average middle-class adult’s wealth peaked in March 2022, largely attributed to rising property values. However, this trend has also exacerbated the wealth gap between homeowners and renters, as those without property have not benefited from these gains.

The financial benefits of homeownership extend beyond property appreciation. Homeowners often experience greater financial stability and have access to home equity, which can be leveraged for investments or emergencies. Renters, lacking such assets, may find it more challenging to build wealth over time.

These findings underscore the importance of accessible homeownership opportunities. Policymakers and financial institutions are encouraged to consider strategies that make home buying more attainable, particularly for first-time buyers and low- to moderate-income families, to help bridge the wealth gap.

Homeownership is profitable (if you’re old enough to afford it):

Recent data indicates a notable increase in the average age of U.S. homeowners, reflecting a shift in housing accessibility and affordability.

This demographic change suggests that younger generations face growing challenges in entering the housing market, likely due to rising home prices, higher living costs, and limited savings.

In summary, the period since 2019 has highlighted the significant financial advantages of homeownership in the U.S., emphasizing the need for inclusive housing policies to ensure broader access to these wealth-building opportunities.

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment