The Institute for Supply Management (ISM) is a U.S.-based organization that conducts monthly surveys to assess business activity in the manufacturing and services sectors.

Its Purchasing Managers’ Index (PMI) is a widely recognized economic indicator that measures business activity levels by gathering data from purchasing managers across the country.

The PMI reflects overall economic conditions, providing insights into growth or contraction in the industry.

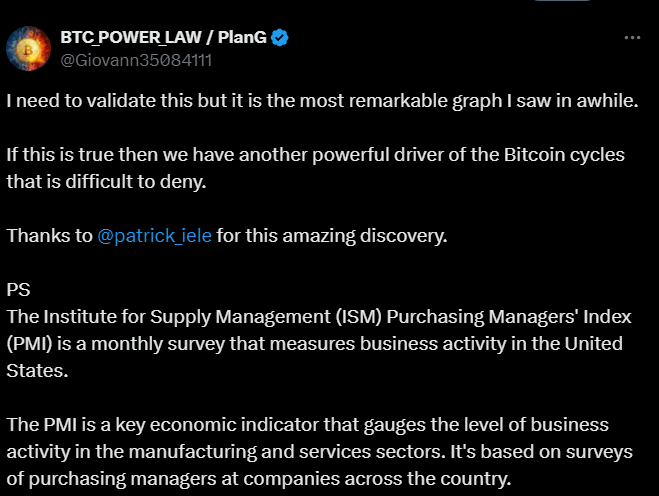

Recent discussions highlight a possible correlation between the ISM PMI and Bitcoin price cycles.

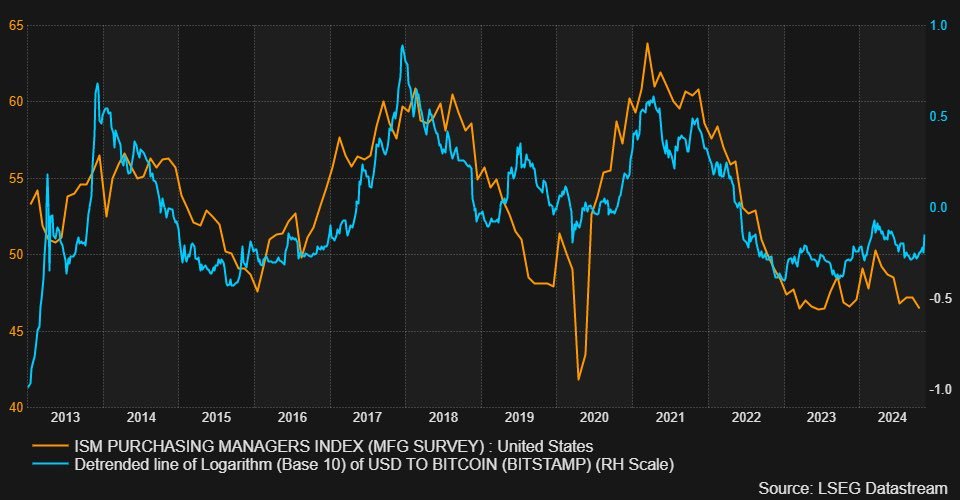

A graph comparing ISM PMI trends with Bitcoin’s logarithmic price movements has sparked interest within the crypto community, suggesting that economic activity levels might significantly influence Bitcoin’s market behavior.

Per Dr. Giovanni Santostasi, this discovery could provide a new framework for analyzing Bitcoin cycles and their relationship to macroeconomic indicators.

Experts propose validating this relationship by cross-referencing historical ISM PMI data with Bitcoin price movements, ensuring the latter is plotted logarithmically for accurate analysis.

Statistical methods, such as Pearson correlation, could quantify the strength of this association, helping determine whether these trends represent a meaningful pattern or mere coincidence.

Analyzing cyclical patterns between ISM PMI and Bitcoin prices could reveal deeper insights into how macroeconomic factors like industrial growth or contraction impact digital asset markets.

These findings, if substantiated, may redefine the way analysts approach cryptocurrency market cycles.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True. If you would like to support to help further secure the integrity of our research initiatives, please donate here

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes

Leave a comment