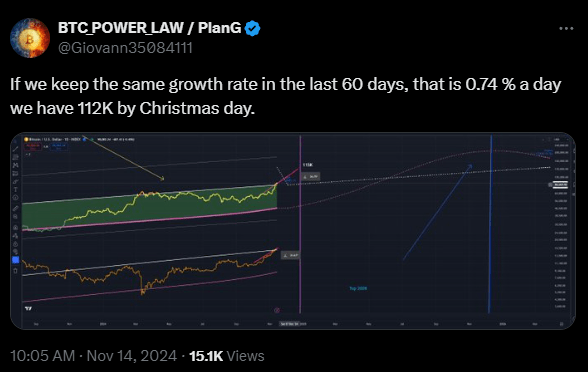

Bitcoin’s recent surge has captured the attention of investors and analysts alike. Over the past 60 days, the cryptocurrency has experienced an average daily growth rate of approximately 0.74%.

If this trend continues, projections indicate that Bitcoin could reach $112,000 by December 25, 2024.

As of November 16, 2024, Bitcoin’s price stands at $90,300, reflecting a significant increase from its value two months prior.

This upward trajectory has been fueled by factors such as increased institutional investment, favorable regulatory developments, and growing mainstream adoption.

Notably, the recent approval of Bitcoin exchange-traded funds (ETFs) has provided investors with more accessible avenues to participate in the cryptocurrency market.

Market analysts remain optimistic about Bitcoin’s potential to reach new heights by the end of the year.

However, they also caution that the cryptocurrency’s inherent volatility necessitates careful consideration and risk management.

Investors are advised to stay informed about market trends and to consult with financial advisors before making investment decisions.

The power law is a mathematical relationship where one quantity varies as a power of another. It is often expressed in the form y=axky = ax^ky=axk, where aaa is a constant, xxx is the independent variable, and kkk is the power or exponent.

Power laws describe many natural and social phenomena, such as income distribution, city populations, and the frequency of earthquakes, where smaller events occur more often than larger ones.

This scaling behavior is significant in understanding systems with broad variability, highlighting how a small number of large occurrences dominate in many datasets.

The power law, as applied to Bitcoin, describes how its price or adoption scales disproportionately with certain factors, such as network effects or investment inflows. For instance, as more participants join the Bitcoin network, the value of the network tends to grow exponentially rather than linearly.

This relationship highlights Bitcoin’s potential for extreme growth as it benefits from a compounding effect of adoption and use.

Understanding Bitcoin through the lens of the power law helps explain why small initial investments or technological developments can lead to massive changes in its overall market capitalization.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True.If you would like to support to help further secure the integrity of our research initiatives, please donate here

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes

Leave a comment