Bitcoin’s price has surpassed $90,000 for the first time, driven by market optimism following President-elect Donald Trump’s victory and his pro-cryptocurrency stance.

The cryptocurrency reached a record high of $91,110, marking a 32% increase since the November 5 election.

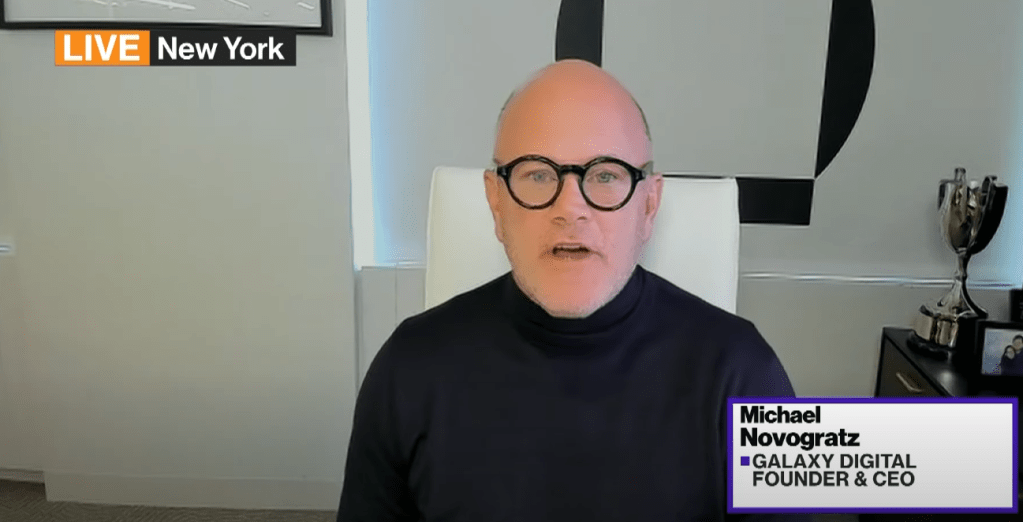

Galaxy Digital CEO Mike Novogratz suggests that if the U.S. establishes a Bitcoin reserve, the cryptocurrency’s value could soar to $500,000.

He argues that such a move would prompt other nations to acquire Bitcoin, significantly boosting demand and price.

The recent surge in Bitcoin’s value is also attributed to substantial inflows into spot Bitcoin ETFs, which saw $1.2 billion in net inflows on Monday. Technical analysis indicates a strong bullish trend, with a ‘golden cross’ formation and an RSI reading above 80, suggesting overbought conditions.

MicroStrategy Inc., the largest corporate holder of Bitcoin, announced plans to raise $42 billion over the next three years to purchase additional Bitcoin. This strategy aims to enhance shareholder value through the digital transformation of capital.

The cryptocurrency market’s resurgence contrasts sharply with its 2022 downturn following the collapse of major companies like FTX.

Both institutional and individual investors are increasingly engaging, reflected in record futures contracts at CME and rising Google searches.

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment