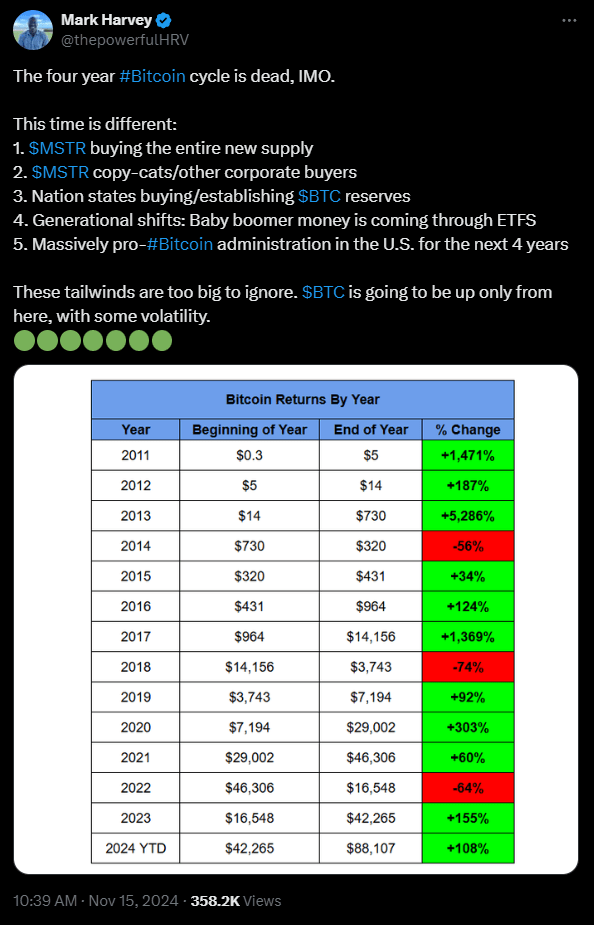

The traditional four-year Bitcoin cycle, characterized by predictable boom and bust phases, is undergoing significant transformation due to increased adoption by corporations and nation-states.

Mark Harvey, a prominent engineer and cryptocurrency analyst, asserts that this cycle is now obsolete, citing several key developments.

MicroStrategy Inc. (MSTR) has been at the forefront of corporate Bitcoin acquisition. The company has consistently purchased substantial amounts of Bitcoin, effectively absorbing a significant portion of new supply.

This strategy has inspired other corporations to follow suit, further increasing demand and reducing market volatility.

Nation-states are also entering the Bitcoin market. El Salvador, under President Nayib Bukele, became the first country to adopt Bitcoin as legal tender in 2021. The nation has since mined approximately 474 bitcoins using geothermal energy, adding to its state holdings.

Additionally, U.S. Senator Cynthia Lummis introduced legislation proposing the establishment of a strategic Bitcoin reserve, aiming to acquire up to 1 million bitcoins over a set period.

The approval of Bitcoin Exchange-Traded Funds (ETFs) has facilitated greater investment from institutional investors, including baby boomers. These ETFs provide a regulated and accessible avenue for investing in Bitcoin, contributing to increased market stability and liquidity.

The recent re-election of pro-crypto U.S. President Donald Trump has further increased confidence in the cryptocurrency market. His administration’s favorable stance towards digital assets is expected to encourage broader adoption and integration of Bitcoin into the financial system.

These developments collectively suggest a departure from the traditional Bitcoin market cycles, indicating a more sustained and stable growth trajectory for the cryptocurrency.

Leave a comment