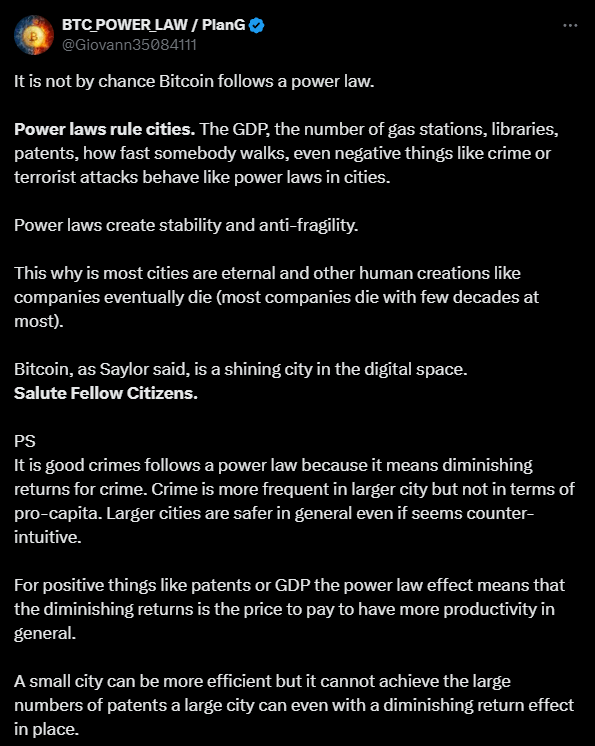

Bitcoin’s price trajectory has been observed to follow a power law distribution, a pattern commonly found in urban metrics such as GDP, number of patents, and crime rates.

This similarity suggests that Bitcoin’s growth and stability may be influenced by principles governing complex systems like cities.

Power laws describe relationships where a relative change in one quantity results in a proportional relative change in another, often observed in natural and social phenomena.

In urban contexts, metrics such as economic output and innovation scale superlinearly with population size, indicating that larger cities generate disproportionately higher levels of these outputs.

Applying this concept to Bitcoin, some analysts propose that its network growth and value may adhere to similar scaling laws. The Bitcoin Power Law model suggests that as the network expands, its value increases in a predictable pattern, potentially reaching significant milestones in the coming decades.

This perspective aligns with views that consider Bitcoin as a digital city, embodying characteristics of resilience and scalability inherent in urban systems.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True. If you would like to support to help further secure the integrity of our research initiatives, please donate here

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes

Leave a comment