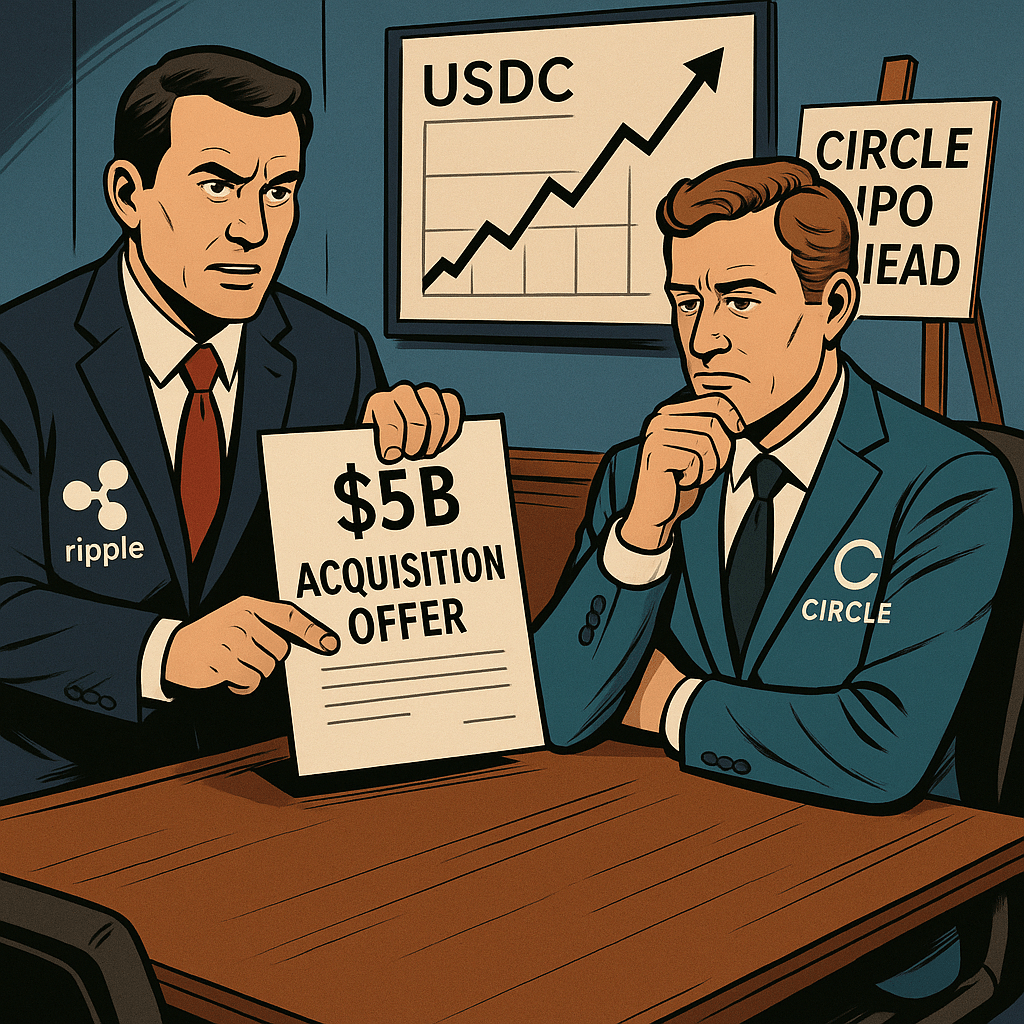

Ripple Labs Inc. made an acquisition offer ranging between $4 billion and $5 billion for Circle Internet Financial Ltd., the issuer of the USDC stablecoin. Circle declined the bid, considering it undervalued the company.

Circle is currently pursuing an initial public offering (IPO) with a target valuation of $5 billion, backed by underwriters JPMorgan and Citigroup. This marks Circle’s second attempt to go public, following a failed SPAC deal in 2021.

Ripple’s interest in acquiring Circle aligns with its strategy to expand beyond its XRP token and strengthen its position in the stablecoin market. By integrating USDC, Ripple aims to enhance its payment infrastructure with a fiat-backed stablecoin, potentially increasing its legitimacy and utility in government-sanctioned crypto spaces.

Circle’s business model involves operating as a narrow bank, deriving nearly all of its revenue from interest on short-term investments. This approach makes the company susceptible to volatile interest rates and regulatory uncertainties.

While Ripple’s offer was rejected, the move underscores the growing competition and strategic maneuvers within the stablecoin sector, as companies seek to solidify their positions in the evolving digital currency landscape.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True. If you would like to support to help further secure the integrity of our research initiatives, please donate here

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment