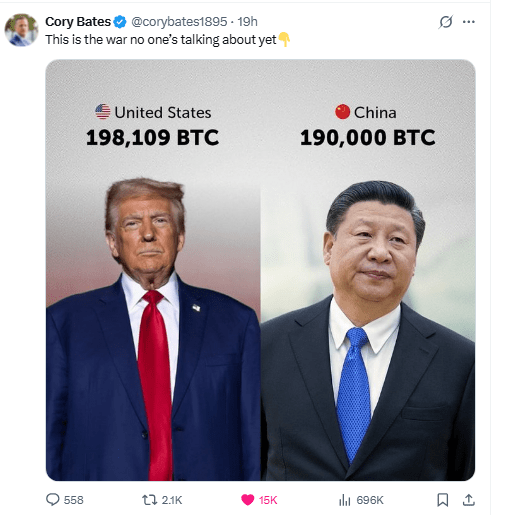

The United States and China are among the largest holders of Bitcoin globally, with their reserves primarily accumulated through asset forfeitures.

As of December 13, 2024, the U.S. government holds approximately 207,189 BTC, valued at around $17.4 billion. Similarly, China possesses about 194,000 BTC, worth approximately $16.2 billion.

These substantial holdings underscore the strategic importance both nations place on digital assets.

In a significant policy shift, President Donald Trump signed an executive order on March 6, 2025, establishing a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile.

This initiative aims to leverage Bitcoin’s fixed supply and strategic advantages by treating it as a reserve asset. The reserve will be capitalized with Bitcoin forfeited in criminal or civil asset proceedings, ensuring that these assets are maintained to meet governmental objectives without being sold.

The executive order also mandates the development of budget-neutral strategies for acquiring additional Bitcoin, emphasizing the importance of managing national digital assets to maximize the country’s position in the global financial system.

China’s Bitcoin holdings primarily stem from seizures related to fraudulent schemes, notably the PlusToken scam in 2019, which resulted in the confiscation of nearly 195,000 BTC.

While there is speculation that China may have liquidated a portion of these assets, the government has not officially disclosed its current Bitcoin holdings or any sale strategies. This lack of transparency makes it challenging to ascertain the exact status of China’s digital asset reserves.

The substantial Bitcoin reserves held by both the United States and China highlight a burgeoning economic and technological rivalry in the realm of digital assets.

As cryptocurrencies become increasingly integrated into global financial systems, the strategic accumulation and management of such assets by nation-states could significantly influence their economic positioning and technological leadership in the digital age.

Leave a comment