This report will remain under active revision until June 19, 2026. Content may be added, updated, or refined as additional information becomes available. Findings are subject to change throughout the reporting period.

Preface

I began exploring scientific theories in middle school – around the sixth or seventh grade – and by my high school years, I encountered the concept of the Singularity.

The idea of a moment in time where technological change accelerates beyond comprehension, never left me.

Years later, while working directly in Bitcoin mining – handling ASIC machines, tracking efficiency data, and managing infrastructure – I began to recognize a pattern. Hardware was progressing but there were still constraints on progress. There was visible improvement, but also invisible resistance.

That tension is what led to this theory. I began to ask questions regarding the computational power of the machine.

Energy related questions of the machine like, “Will there ever be a 1 PH/s machine?”

After coming across concepts like J/TH efficiency, I came to the realization that energy efficiency in Bitcoin Mining is just as important – if not more important – than compute power.

In this ‘open source dissertation,’ I define what I call The Bitcoin Mining Singularity: the moment when one joule of energy produces one terahash per second (1 J/TH) of computational power.

The acceleration of Bitcoin mining efficiency and increase in the computational power of an individual machine stands as a prime case study in technological evolution, one that can be best understood through a multidisciplinary analytical lens.

This dissertation introduces the Power Efficiency Theory to quantify and predict the interaction between exponential improvements in ASIC hardware and the intrinsic boundaries imposed by physical law and market economics.

Anchored in Ray Kurzweil’s Law of Accelerating Returns and Jason P. Lowery’s Power Projection Thesis in his book “Softwar,” this research integrates extensive empirical evidence from Blockware Intelligence’s documented trend of diminishing efficiency returns, economic signals captured by Luxor’s Hashprice Index, and the foundational thermodynamic restrictions described by the Landauer limit.

Historical ASIC data demonstrates a consistent year-over-year improvement in joules per terahash (J/TH) within a 15–25% range, suggesting that diminishing efficiency returns (a slow and steady, anti-acceleration form of technological progress) is still dominant in the bitcoin mining sector.

However, by juxtaposing these advancements with both economic and physical constraints, the model projects a nuanced future: the achievement of the Bitcoin Mining Singularity (1 J/TH) by 2033–2039, followed by a gradual, protracted convergence toward the theoretical efficiency minimum, expected only by the late 21st or early 22nd century.

Master Thesis

The consensus across the ASIC mining industry suggests we are approaching a theoretical limit in ASIC chip joule-per-terahash (J/TH) efficiency.

Based on the year-over-year efficiency data available (including the recently released Whatsminer M7x Models), I estimate that Bitcoin mining ASICs will reach the 1 J/TH milestone some time in between the year 2033-2039

Power Efficiency Theory is a dynamic model that measures:

1. The rate of ASIC energy efficiency (J/TH) improvement in bitcoin mining hardware and the likely point at which we will reach ‘The Bitcoin Mining Singularity.’

2. The future computational power (PH/s) growth of bitcoin mining machines.

3. The Absolute limit of J/TH/s Efficiency in bitcoin mining computational power

4. The price of bitcoin in relation to the ASIC J/TH rate of efficiency.

Ultimately the theory is utilizing exponential decay and growth models, the Law of Accelerating Returns, and Diminishing Efficiency Returns in Bitcoin mining hardware to determine certain “points of capitulation” .

By tracing measurable improvements in energy efficiency, specifically in joules per terahash (J/TH), across successive ASIC generations, I demonstrate that Bitcoin mining progress is neither purely exponential nor strictly limited.

Based on historical and projected year-over-year efficiency gains of 15 – 25 percent, I anticipate that the Bitcoin Mining Singularity, defined as the moment when one Joule per terahash per second is achieved, will likely occur between 2033 and 2039.

Further more, I anticipate the hashrate per-machine and the hashrate to energy efficiency ratio will increase exponentially by 2-3 orders of magnitude, as similarly told by ray Kurzweil’s claim of the Law of Accelerating Returns.

In addition to the mathematical predictions, we speculate on the potential changes in chip architecture, if any, during this technological renaissance of bitcoin mining machines.

Executive Summary

This dissertation formalizes the Theory of Thermoeconomic Capitulation, a dynamic framework modeling the nonlinear progression of Bitcoin mining hardware efficiency (J/TH) and hashpower (PH/s) under thermodynamic and financial constraints. Rooted in empirical ASIC data (2016–2025) and governed by the YoY efficiency return equation:

J(t) = Jo x (1 – r)(t – 2025),

where J(t) is efficiency at time t, J0J0 is baseline efficiency (9.5 J/TH in 2025), and rr is the annual improvement rate (15–25%)—the analysis projects the Bitcoin Mining Singularity (1 J/TH) between 2033–2036.

Contrary to Kurzweil’s unconstrained acceleration, the model reveals a sigmoidal “Capitulation Curve” where efficiency returns decelerate as they approach Landauer’s thermodynamic limit (0.000028 J/TH).

Concurrently, hashpower growth follows:

H(t) = H0 ⋅ (1+r) (t−2025)

with r as annual hashrate growth Even conservative scenarios (25% YoY) show 10 PH/s machines by 2033 and 1 EH/s by 2044, compressing decades of progress into years.

Key Findings:

- Efficiency: 25% annual gains drive J/TH to 1 by 2033, but diminishing returns emerge post-10 J/TH due to thermal/financial friction.

- Hashpower YoY average: Exponential growth of hashpower Could possibly render current ASICs obsolete within 3–5 years, demanding modular infrastructure. We are currently on pace to multiply raw hashpower by 3 orders of magnitude (10PH/s, 100PH/s, and 1 EH/s machine) all before the year 2040.

- Long-term imits: Landauer’s Principle sets an absolute floor (2068–2102 for 15%-25% returns), beyond which no further efficiency is possible.

- Economics: Dollar-per-terahash costs with open source products exhibit a nuanced capitulation, resisting Kurzweilian acceleration. (e.g., Bitaxe devices at $50-$150/TH vs. industrial ASICs at $6/TH).

Introduction

The convergence of energy efficiency and computational output in Bitcoin mining is a milestone in the global evolution of post-industrial labor, energy monetization, and distributed digital infrastructure.

Leaning largely on historical ASIC efficiency improvements (see the Blockware study on diminishing bitcoin mining efficiency table below), the bitcoin mining singularity is evaluated with Ray Kurzweil‘s acceleration models in mind.

I argue that the Bitcoin Mining Singularity, projected to occur by 2033*, is a measurable trajectory embedded in hardware engineering.

Bitcoin mining transforms energy into value via the SHA-256 hashing algorithm, producing mathematically verifiable proof-of-work (PoW).

The central unit of mining output is the terahash per second (TH/s), while the resource cost is energy, measured in joules.

As machines increase in efficiency, fewer joules are required to generate each unit of hashpower.

The Bitcoin Mining Singularity is the theoretical point where 1 joule generates 1 TH/s, collapsing the energy-to-output ratio into a near-symmetrical relationship.

Predicting the Bitcoin Mining Singularity: (Power) Efficiency Trends in ASIC Development

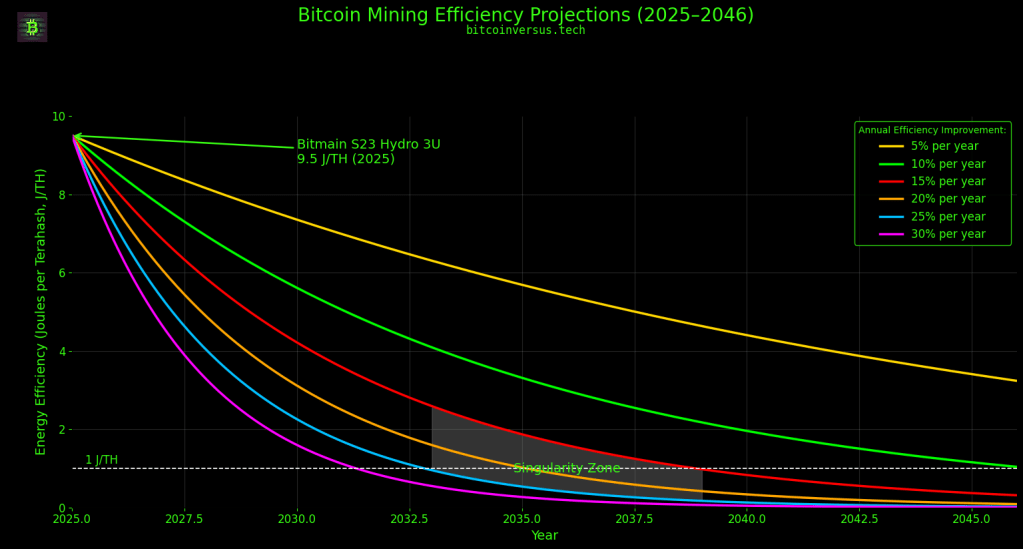

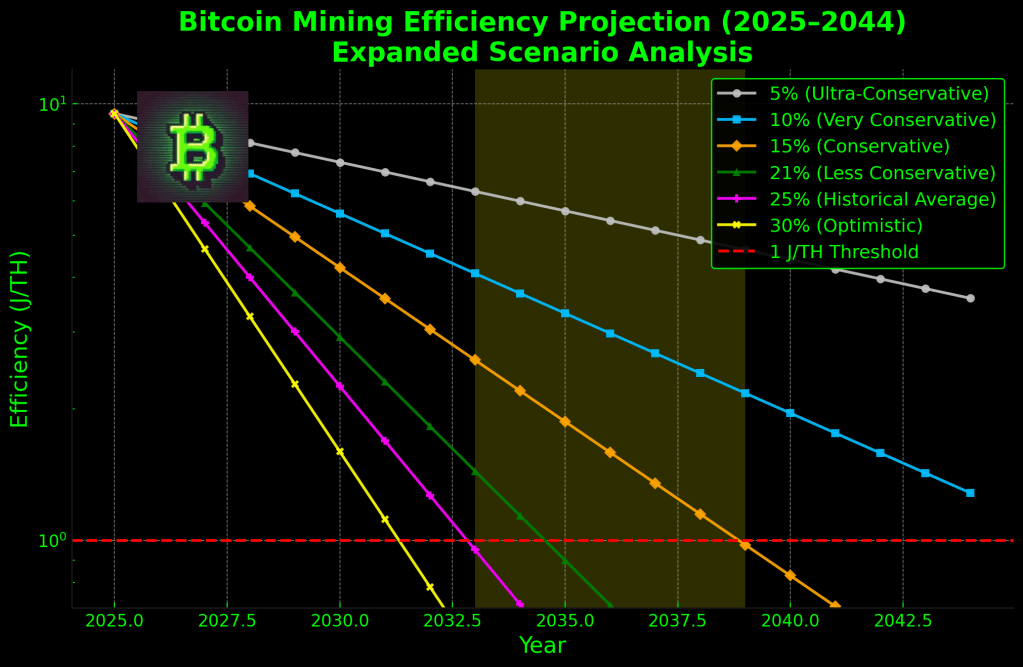

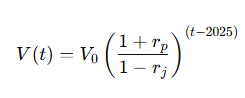

Across the history of Bitcoin ASIC hardware, the average annual improvement in energy efficiency (J/TH) is consistently between 15% and 25%.

For this reason, our J/TH efficiency chart adopts the 15%, 21%, and 25% rates as the core scenarios, reflecting both conservative and historically representative values.

To further strengthen the predictive model and account for a broader range of possible outcomes, we additionally include 5%, 10%, and 30% rates, thereby providing a more robust and comprehensive outlook on potential future YoY efficiency trajectories.

From 2016 to 2025, Bitcoin mining hardware has followed an exponential decline in joules per terahash, consistent with nonlinear engineering returns. The figure below illustrates key machine generations and their respective efficiency metrics:

| Year | ASIC Model | Energy Efficiency (J/TH) |

| 2016 | Antminer S9 | 100 |

| 2017 | Whatsminer M3 | 90 |

| 2018 | Antminer S15 | 57 |

| 2020 | Antminer S19 | 30 |

| 2022 | Whatsminer M30S++ | 28 |

| 2024 | Antminer S21 | 15, 13.5 |

| 2025 | Seal Miner A3 | 9.7 |

| 2026 | S23 Hyd 3U | 9.5 |

| 2028 | Projected ASIC | 5.45375 |

| 2031 | Projected ASIC | 2.30080078 |

| 2034 | Singularity ASIC | 1 |

Table 1: The ASIC efficiency table shows that if we stay at a constant 25% improvement, we will reach the Bitcoin Mining Singularity as early as 2033. There is a chance that the singularity happens slightly earlier or later but it seems that with consistent gains, the ideal time frame for the singularity to begin will be sometime in between 2033-2036.

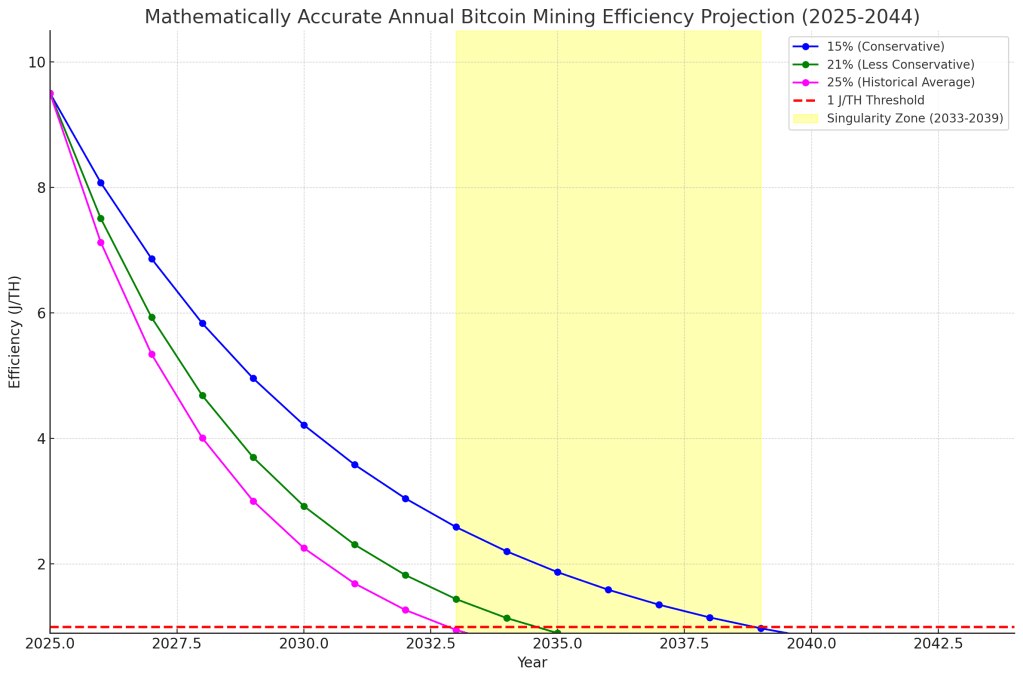

To anticipate the bitcoin mining singularity, we start with an initial efficiency of 9.5 joules per terahash (J/TH) in 2025, is modeled through three distinct scenarios of annual improvement, employing an exponential decay function rooted in the Thermoeconomic Capitulation equation. This equation, expressed as:

J(t) = J0 x (1 – r)(t – 2025),

Or more specifically expressed as:

J/THyear = Initial J/TH x (1−r)year−2025

where J(t) represents the efficiency in joules per terahash at year t, J₀ is the initial efficiency (9.5 J/TH), r is the annual percentage reduction rate, and t is the year, facilitates the projection of efficiency declines over time.

The scenarios include a conservative rate of 15% per year (blue), a less conservative rate of 21% per year (green), and a historical industry average of 25% per year (magenta), each reflecting varying degrees of technological advancement.

These trajectories are plotted to demonstrate the progressive reduction in energy consumption per terahash, with the horizontal red dashed line indicating the theoretical “Bitcoin Mining Singularity” threshold of 1 J/TH, a critical milestone signifying optimal energy efficiency.

The yellow shaded region, termed the Singularity Zone (2033–2039), anticipates the projected timeframe for crossing this threshold under realistic industry conditions, with the 25% scenario achieving 1 J/TH in early 2033, the 21% scenario in mid-2034, and the 15% scenario in late 2038.

This mathematical framework underscores the nonlinear nature of efficiency returns, highlighting the sensitivity of the timeline to the assumed annual improvement rate and providing a robust basis for anticipating future hardware performance in the Bitcoin mining sector.

The Bitcoin Mining Singularity is the theoretical point in which one joule of energy produces one terahash per second (1 J/TH). This point of energy efficiency could arrive sooner (or later) than originally estimated.

My projections are based on 15 to 25 percent annual returns in efficiency. This would place the Singularity between 2033 and 2039.

However, with the introduction of the Seal 03 miner in 2025, which is reported to reach 9.7 J/TH, the pace has accelerated dramatically. This marks a 28% improvement over the S21 XP (13.5 J/TH in 2024), achieved in less than a year.

Using this sharper trend, and assuming continued annual returns in the 15% – 25% range, the 1 J/TH milestone is expected by 2033 and 2039 at the latest.

This prediction is grounded in over a decade of real hardware data, where each generation of ASIC miners consistently reduces energy use while increasing hash output.

From the Antminer S9 in 2016 to the S21 Pro and S21 XP in 2024, the pattern has been measurable and compounding. The leap made by the Sealminer A3 (9.7 J/TH, 2025) in and the S23 Hyd 3U (9.5 J/TH, 2025) confirms that this trend is accelerating.

Table 5: This chart tracks the evolution of ASIC efficiency from 2000 W/TH in 2013 to just 13.5 W/TH in 2024. Early models saw dramatic year-over-year efficiency improvements exceeding 60%, while recent returns have narrowed to under 15% YoY as exponential improvements begin to encounter physical and economic limits. The average rate of change in efficiency is 25.274%. This would place the point of singularity at the year 2033. A conservative alternate projection places the 1 J/TH in late 2038. Image Source: Blockware

Final Projections in Hashrate growth Scenarios for ASIC Machines

In the previous attempt to predict the future Hashrate for ASIC machines, the equation and the numbers were mathematically correct, but we needed to get the most efficient data possible instead of just picking out numbers that were merely anticipated and had no mathematical basis.

For the math to make sense, we need to know why it was actually used for the ASIC machine hashrate prediction model.

Projection Methodology

The starting point is set at 1.16 PH/s, corresponding to the top-end machine performance of the Bitmain S23 XP Hyd 3U, released in 2025 (officially released in 2026). All projections employ the formula:

H(t) = H0 ⋅ (1+r) (t−2025)

Or more specifically expressed as:

Hashrateyear = 1160 × (1+r)(year−2025)

This formula allows us to estimate the expected hashrate of a top-tier mining machine in any given future year, starting from 1160 TH/s in 2025, by multiplying by (1 + r) raised to the number of years since 2025, where r is the assumed annual percentage growth rate.

For the math to make sense, we need to know why it was actually used for the ASIC machine hashrate prediction model.

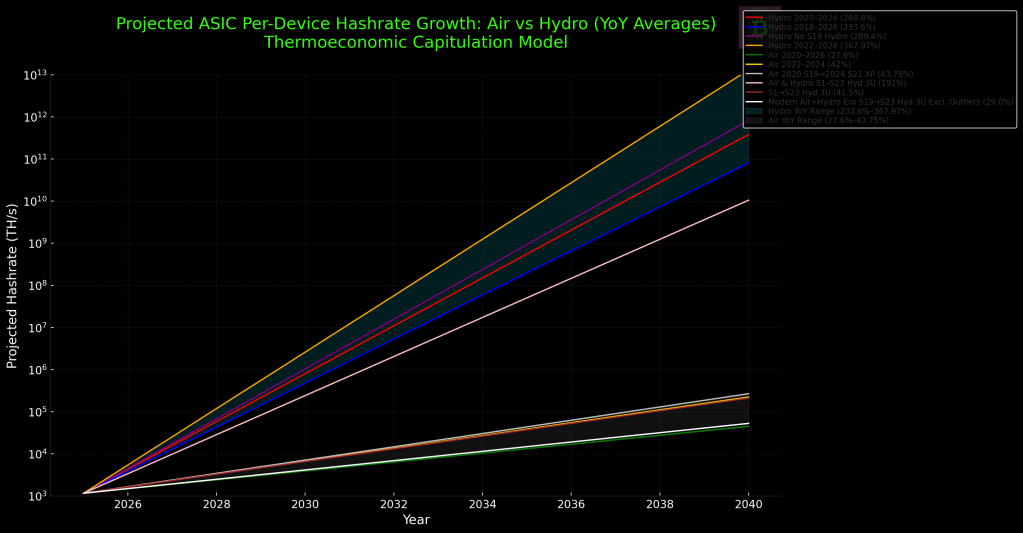

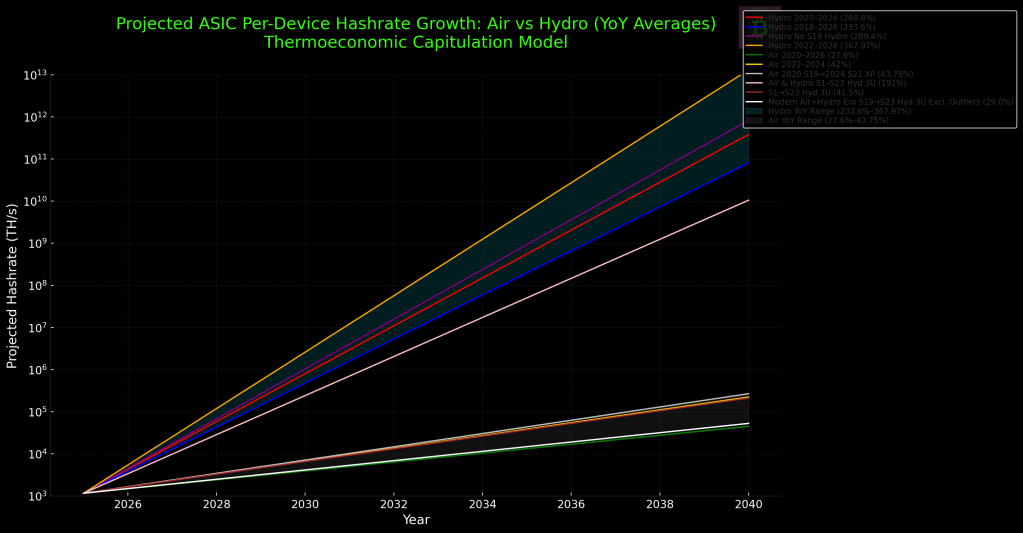

In order to make the Hashrate prediction chart more mathematically realistic, we extracted the year-over-year averages of Air cooled and Hydro – Cooled machines separately, rather than combining the two coolant methods annual average percentage gains.

Additionally, I added an all-inclusive average for air cooled and hydro-cooled machines to show more potential rates of growth for individual machine hashpower.

Analysis of the average year-over-year (YoY) hashrate growth rates shows a dramatic divergence between hydro-cooled and air-cooled ASICs.

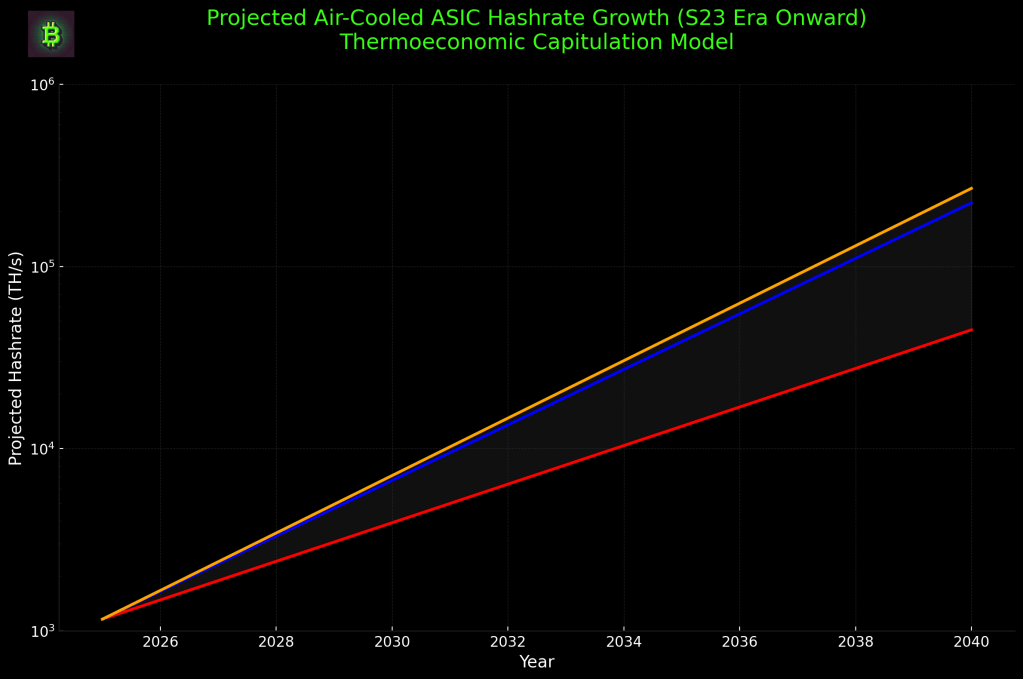

Air-Cooled ASIC Hashrate Growth Projections

The projected growth trajectories for air-cooled Bitcoin mining ASICs reveal a steady but ultimately limiting pattern of technological advancement.

The model evaluates three representative year-over-year (YoY) growth rates based on observed release cycles for flagship air-cooled machines since 2020: a conservative 27.6% (red), a middle-range 42% (blue), and an aggressive 43.75% (orange), the latter two reflecting peak annualized improvements between the S19 and S21 XP series.

In terms of orders of magnitude, the growth profiles demonstrate clear milestones, but is still an order of magnitude slower than hydro-cooled machines.

The conservative 27.6% line crosses 10,000 TH/s (10 PH/s) in 2035 and approaches 100,000 TH/s (100 PH/s) near the end of the modeled period, around 2046. It does not reach 1,000,000 TH/s (1 EH/s) before 2040.

The middle-range (42%) and aggressive (43.75%) curves both surpass 10,000 TH/s by approximately 2033, reach 100,000 TH/s between 2039 and 2040, and, even under optimal conditions, do not attain the 1 EH/s (10^6 TH/s) milestone within the 2025–2040 window.

The data makes it clear that air-cooled ASICs are facing real barriers to faster progress. While hydro-cooled machines routinely post dramatic year-over-year gains, air-cooled models are now advancing at a far more measured pace.

This growth is steady and reliable—much like the trend once seen with Moore’s Law—but each step forward is smaller than the last, and the limits of air cooling are becoming more obvious.

For air-cooled systems, moving from 10 PH/s to 100 PH/s is projected to take well over a decade. Reaching the 1 EH/s mark is not expected within the next 15 years unless there’s a significant leap in cooling technology or chip efficiency. The timeline for hitting each new order of magnitude keeps stretching out, underscoring the reality that traditional air cooling is reaching its practical ceiling.

In summary, while air-cooled ASICs will likely continue to improve, the rate of those improvements is slowing, making it increasingly difficult to achieve the kind of rapid progress seen in the early years of Bitcoin mining. Unless there’s a disruptive breakthrough, air-cooled hardware may become less competitive as new generations of miners demand much higher hashrates and greater efficiency

Immersion Cooling ASIC Hashrate Growth Analysis and Projections

(Be advised: This module is not complete)

Initial immersion-focused mining systems began modestly with the Avalon A1066I’s 50 TH/s output, marking the earliest standardized platform designed for stable submersion. Progress accelerated when S19j Pro units were modified for immersion, as removing fans and optimizing thermal transfer enabled sustained overclocking around 145 TH/s, a major leap for systems not originally engineered for oil-based cooling.

Purpose-built immersion units then redefined the upper limits of hashrate performance, with the M56S+ reaching 224 TH/s, the M56S++ climbing to roughly 240–256 TH/s, and the next generation M66S series increasing sharply to 298 TH/s on the M66S, 318 TH/s on the M66S+, and 356 TH/s on the M66S++.

Viewed through the model H(t) = H₀(1 + g)ᵗ, where H₀ aligns to the M66S++ benchmark, the year-over-year scaling suggests immersion ASICs trending toward multi-hundred-terahash gains per generation under moderate growth assumptions. With power following P(t) = H(t) × E(t), the simultaneous rise in hashrate and decline in J/TH converge to form the steep upward trajectory described in your original Singularity framework, reinforcing immersion cooling as the dominant driver of both thermal stability and computational expansion.

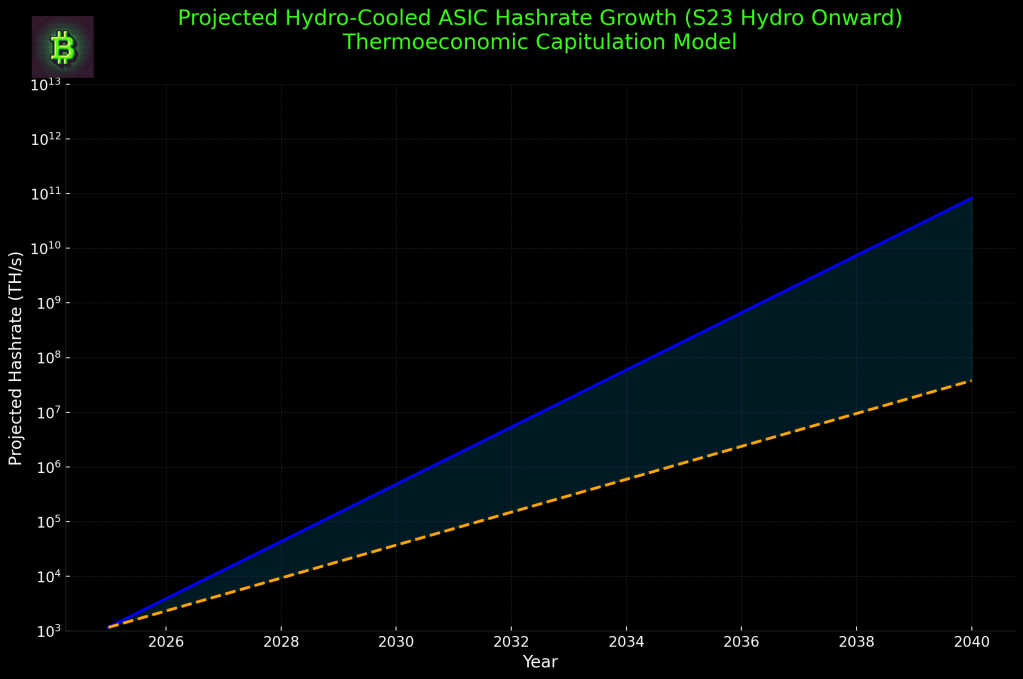

Hydro-Cooled ASIC Hashrate Growth Projections

Hydro-cooled machines are progressing approximately 10 times faster than air-cooled models, as demonstrated by mean YoY growth rates of 269.8%–367.97% for hydro versus 27.6%–43.75% for air.

For every doubling achieved by air cooling, hydro-cooled hardware is posting an order-of-magnitude gain or more.

Even at the higher end for air-cooled (43.75% YoY), the 10 PH/s milestone is not reached until 2033, with 100 PH/s projected around 2040. In contrast, all hydro-cooled growth scenarios reach each new order of magnitude years earlier, emphasizing the scale of the technological gap.

Hydro-Cooled ASIC Projected Hashrate Growth (S23 Hydro 3U Onward)

The chart below models the projected hashrate growth of top-tier hydro-cooled Bitcoin ASICs from 2025 to 2040. The analysis uses the S23 Hydro 3U as a baseline, incorporating both observed and hypothetical year-over-year (YoY) growth rates to illustrate the full spectrum of possible performance outcomes for next-generation hardware.

Hydro-cooled ASICs, growing at 233–367% annually, are projected to hit 10 PH/s by 2028–2029 and exahash-scale performance by 2040. Even a conservative 100% YoY growth rate for hydro-cooled machines places a 2 PH/s unit in production by 2027, underscoring the scale of the technological gap and the acceleration possible when advanced cooling is paired with modern ASIC design.

Blue Line (233.6% YoY projection for Hydro):

This line represents the (suprisingly) less conservative scenario, derived from actual industry data—specifically, the average YoY hashrate growth of hydro-cooled Bitmain machines since their introduction.

With a growth rate of 233.6%, the blue line reflects the historic performance of the sector, and is consistent with observed leaps in efficiency and throughput delivered by hydro-cooled ASICs. This trend demonstrates just how rapidly hydro-based cooling has transformed mining hardware, allowing for orders of magnitude improvements in a few product generations.

Gold Line (100% YoY projection for Hydro)

The orange-gold dashed line marks a scenario where each new generation of hydro-cooled ASIC doubles the hashrate of its predecessor every year—a 100% YoY increase.

In fact, given the data from recent hydro-cooled ASIC releases, where average annual gains have ranged between 233% and 367% (as shown in your previous air-vs-hydro comparison chart), this 100% trajectory is highly plausible and may even be conservative relative to the sector’s demonstrated pace.

Given the current state of hydro-cooled ASIC technology and the ongoing trend of rapidly accelerating hashrate growth, it is possible for the next generation of machines to achieve a full doubling of per-device hashrate ahead of the next Bitcoin halving. For instance, I anticipate a 2 PH/s in production or beta mode by the end of 2027.

What the Data for Hydro Cooled ASICS Reveals

Hydro-Cooled Progression is (potentially) Exponential:

Hydro-cooled systems are not just advancing rapidly, they are accelerating at a rate that compounds generationally, moving from terahash to petahash and eventually exahash performance per machine within a single decade. This explosive growth rate means that hydro is redefining what is technologically possible in Bitcoin mining hardware.

Hydro as the Future of Mining Sustainability:

The sustained, rapid YoY growth in hydro-cooled hardware highlights its superior ability to manage heat and power density, which are the primary bottlenecks in ASIC design. For operators aiming at long-term viability and infrastructure efficiency, hydro cooling represents the most future-proof investment.

Air-Cooled: Slow and Steady doesn’t Always Win the Race

Air-cooled ASICs display incremental, steady growth closely following a trajectory comparable to Moore’s Law. However, the gap between air and hydro is widening, with air-cooled models projected to reach the next order of magnitude a decade later than their hydro-cooled counterparts.

The Central Role of Cooling Technology:

The next major performance breakthroughs may not come from new chip architectures but from radical improvements in cooling technology. As thermodynamic and physical limits of silicon approach, hydro and immersion cooling are likely to deliver the next leap in hashrate efficiency, pushing the industry closer to the “singularity” of 1 J/TH/s.

While many analyses of Bitcoin mining efficiency focus almost exclusively on advances in ASIC chip architecture, real-world gains increasingly arise from the compounding effects of both silicon innovation and radical improvements in cooling technology.

In practice, efficiency gains are not the product of chip design alone, but also of breakthroughs in hydro and immersion cooling, which enable higher sustained clock speeds, improved stability, and longer operational lifespans for hardware.

When a 10 percent year-over-year improvement in chip architecture is paired with a comparable 10 percent gain from advanced cooling systems, the cumulative efficiency return approaches 20 percent annually; an outcome that is more practical and representative of top-tier mining operations than considering architectural advances in isolation.

As the physical and thermodynamic limits of silicon become increasingly apparent, the synergy between these two areas is likely to drive the next phase of hashrate efficiency, pushing the industry closer to the envisioned “singularity” of 1 J/TH/s.

Hardware Lifecycles may be getting shorter:

The data also implies that operational lifespans of flagship machines will continue to compress. As hashrate grows exponentially, older models will become obsolete more quickly, further incentivizing ongoing upgrades to the latest cooling and hardware solutions.

It is ultimately to be determined if current generation machines will be competitive in the future. There was no official research conducted on the price/machine value ratio in this particular report.

Historical Blended Average Explained

The pink line (the line in between both shaded areas) is a historic blended average—showing that, while hydro-cooled machines have set a new standard, even the full-market mean rate of 191% YoY would have been considered extraordinary by air-cooled standards, but is still a conservative projection compared to the current hydro-surge.

The blue line in the chart represents the lower bound of hydro-cooled ASIC growth, with an average year-over-year hashrate increase of 233.6%.

This conservative projection is significant because it illustrates that, even at the slowest observed hydro-cooled progression, the expected rate of performance improvement outpaces the most optimistic air-cooled trajectories by a wide margin.

Based on the latest performance data, it is reasonable to expect hydro-cooled ASICs to sustain at least a 100% YoY hashrate improvement over the next cycle—meaning performance should double annually from the S23 Hydro 3U benchmark onward. This conservative scenario projects a 10 PH/s hydro machine emerging between 2028 and 2029.

The data reinforces that, even at lower hydro-cooled YoY rates, technological progress dramatically outpaces air-cooled innovation, and the time to each hashrate milestone shrinks to a single product generation.

If the sector maintains even a fraction of the historic 233–367% YoY gains, the industry could see the 100% increase line not only met but exceeded before 2028.

The blue-to-yellow shaded region between these two lines represents the realistic range for future hydro-cooled ASIC performance, bounded by the conservative 233.6% historical growth and a more measured—but still dramatic—doubling scenario. This envelope visualizes the plausible improvement space for upcoming hardware, emphasizing the upside potential if innovation continues to compound.

Ultimately, Hydro-cooled ASICs are advancing at a pace that far outstrips both their air-cooled predecessors and most expectations, with 100% YoY gains being a realistic scenario given current industry dynamics.

This makes a compelling case for hydro-cooled solutions as the primary driver of hashrate and efficiency improvements over the next cycle, with the 100% line serving as a practical target—rather than an optimistic ceiling—for miners and manufacturers alike.

Conclusion of Hashrate Projection Analysis

The analysis of ASIC hashrate growth projections underscores a fundamental divergence in the evolution of Bitcoin mining hardware. Air-cooled machines, while still advancing, exhibit a decelerating trajectory constrained by thermal and physical limitations, with even the most optimistic projections failing to reach exahash-scale performance within the next 15 years.

In stark contrast, hydro-cooled ASICs are progressing at an exponential pace, routinely achieving order-of-magnitude improvements that render traditional air-cooled systems obsolete in terms of raw hashrate potential.

The data reveals that hydro-cooled machines are not merely incrementally better—they represent a paradigm shift in mining efficiency. With year-over-year growth rates between 233% and 367%, hydro-cooled ASICs are on track to reach 1 EH/s per machine by 2028, a milestone that air-cooled hardware may never achieve under current technological constraints.

This disparity highlights the growing necessity for miners to adopt advanced cooling solutions to remain competitive in an industry where hashrate growth is increasingly dominated by liquid-cooled systems.

Beyond raw performance, the implications of this shift are profound:

Sustainability & Efficiency: Hydro cooling’s superior thermal management allows for higher power densities and longer-term viability, reducing energy waste and operational costs.

Hardware Obsolescence: The accelerating pace of hydro-cooled advancements suggests shorter lifespans for older machines, incentivizing frequent upgrades to maintain profitability.

The Next Frontier in Mining: As chip efficiency approaches physical limits, future breakthroughs will likely come from cooling innovations rather than transistor scaling alone.

Hydro and immersion cooling are poised to drive the next wave of mining efficiency, potentially pushing toward the 1 J/TH benchmark.

Ultimately, the data makes an undeniable case: Hydro-cooled ASICs are the future of Bitcoin mining.

While air-cooled machines will continue to serve certain use cases, their diminishing returns in performance growth signal an industry-wide transition toward liquid-cooled solutions.

Miners who adapt early to this trend will secure a decisive advantage in the coming years, while those relying solely on air-cooled hardware risk falling behind in an increasingly competitive and efficiency-driven industry.

The Fundamental Breakthrough: Possible Material and Architectural Projections

The leap to 1 J/TH will likely require some sort of material and design shift (a “fundamental breakthrough” beyond traditional silicon).The most likely candidates to completely revamp chip architecture from the industry standard of silicon would be:

- Graphene, Gallium Nitride (GaN), or carbon nanotube architectures to reduce resistance and heat.

- Photonic logic circuits to increase cycle efficiency through light-based gates.

While the Law of Accelerating Returns suggests exponential progress, real-world ASIC development is beginning to encounter diminishing efficiency returns, as noted by firms like Blockware Intelligence.

As chip designs approach physical and thermodynamic limits (e.g., lower nanometer scales, voltage leakage, heat dissipation), each new generation yields smaller improvements in joules per terahash compared to earlier leaps.

Although technological potential accelerates, practical engineering constraints in Bitcoin mining may impose a logarithmic slowdown, not an endless exponential climb—possibly creating a plateau before the 1 J/TH milestone is reached.

These advancements, while experimental today, mirror historical transitions in semiconductor development.

Just as classical transistors hit limits before the advent of FinFETs or chiplet designs, Bitcoin mining may experience a similar leap.

Whether through 3D chip stacking, cryogenic cooling, photonic circuits, or quantum-enhanced logic, such a breakthrough could reset the diminishing returns curve, reigniting exponential gains and making the elusive 1 J/TH singularity not only possible but inevitable.

Thermoeconomic Capitulation is A New Model for Bitcoin Mining Efficiency Progression

Thermoeconomic Capitulation is the ongoing interaction between the Law of Accelerating Returns and the Law of Diminishing Returns in the progress of Bitcoin mining efficiency. It essentially defines the rate at which we approach the 1 J/TH singularity.

Thermoeconomic Capitulation describes how technological progress—such as better ASIC performance—continues, but is constantly slowed by practical limits like cost, heat, and complexity.

Instead of one law replacing the other, both operate at the same time: breakthroughs push efficiency forward, while physical and economic constraints (Diminishing efficiency) hold it back.

Thermoeconomic Capitulation captures this push-pull dynamic, showing how mining efficiency improves steadily, but always under pressure from opposing forces.

The chart accompanying this report introduces a new scientific concept: The Theory of Capitulating Returns.

This law posits that technological acceleration and diminishing returns are not opposing endpoints but interacting forces. They do not cancel one another out—they capitulate to each other.

That is, exponential growth pushes forward until it is met by a wall of cost, physics, and diminishing improvement, and in doing so, bends or reroutes—but does not vanish.

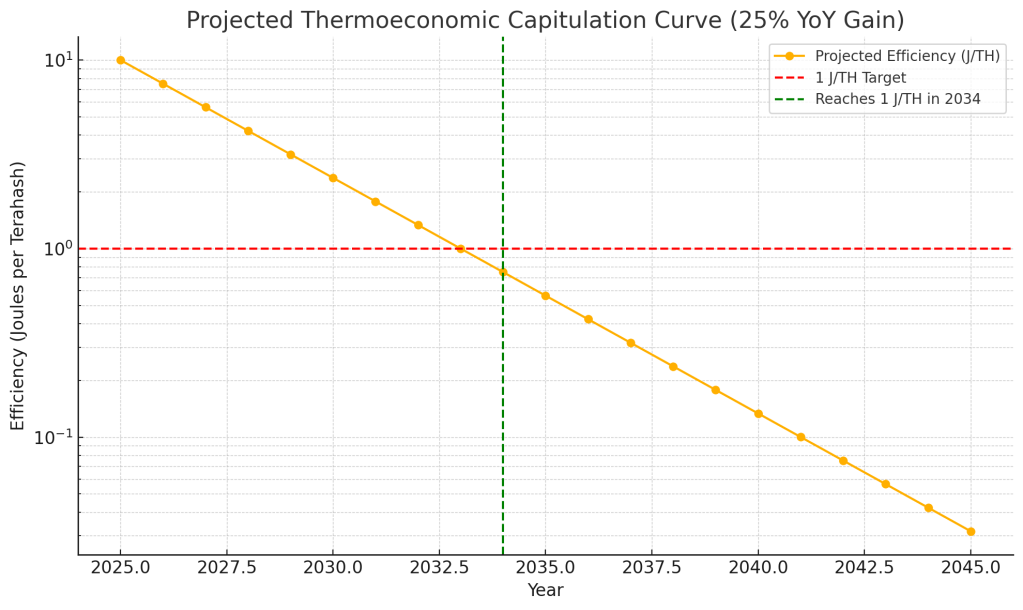

This is embodied in the Capitulation Curve* (See figure below) —a green line that starts with the A3 Sealminer in 2025 at 9.7 J/TH, passes through projected ASICs in 2027 (5.45 J/TH) and 2030 (2.30 J/TH), and converges at the 1 J/TH threshold in the heart of the Singularity Window (2033–2036). The Capitulation Curve is a 25% year-over-year improvement in efficiency.

Proof of Work: The Thermoeconomic Capitulation Equation

The Thermoeconomic Capitulation (i.e. Power Efficiency) equation measures the rate at which we will reach the bitcoin mining singularity of 1 J/TH/s. This “thermoeconmic rate of capitulation” is expressed as:

J(t)= J0 X (1−r)t

or for more clarity:

EfficiencyYear = (J/TH/s) × (1−Rate)(Year−2025)

The equation provides a mathematical framework for understanding the pressured, non-linear path of Bitcoin mining efficiency. In this formula, E(t) represents the energy cost per terahash (J/TH) at year t, E0 is the starting efficiency (9.5 J/TH in 2025), r is the yearly improvement rate (for example, 25%, or 0.25), and t is the number of years since 2025.

So, our starting point at 9.5 Joules compounding at a 25% rate over the next 3 years looks like:

J/TH/s 2028 = 9.5 × (1 − 0.25) 2028−2025 = 9.5 × (0.75)3

This equation lets us estimate when that moment might happen, depending on how quickly hardware keeps improving.

Rather than depicting unchecked exponential growth, this model reflects a decelerating trajectory shaped by capital constraints, thermal resistance, and diminishing engineering yields.

As the gains compress toward the theoretical boundary of 1 J/TH, each additional unit of progress becomes more expensive and difficult—confirming the theory of Thermoeconomic Capitulation.

The equation not only aligns with hardware trends but also captures the broader reality: that Bitcoin mining efficiency is improving under constant resistance, resulting in a curve that arcs toward innovation but is weighted by the physics of space-time.

Figure 12: Projected Thermoeconomic Capitulation Curve: This chart visualizes the projected decline in Bitcoin mining energy consumption per terahash, starting from 10 J/TH in 2025 and approaching the theoretical “Bitcoin Mining Singularity” of 1 J/TH by 2034. It illustrates the compressed nature of progress described by the Theory of Thermoeconomic Capitulation, where technological gains are steady but constrained by economic resistance and physical limits. Rather than following a smooth exponential curve, the trajectory bends into a sigmoidal shape—highlighting the slowdown that occurs as efficiency nears the energy floor. This point of convergence is defined as the Bitcoin Mining Singularity.

As the gains compress toward the theoretical boundary of 1 J/TH, each additional unit of progress becomes more expensive and difficult—confirming the theory of Thermoeconomic Capitulation.

The equation not only aligns with hardware trends but also captures the broader reality: that Bitcoin mining efficiency is improving under constant resistance, resulting in a curve that arcs toward innovation but is weighted by the physics of heat, money, and time.

Hardware Doesn’t Lie: Further Evidence of Efficiency Returns Supporting Thermoeconomic Capitulation

The release data for Bitmain’s latest models—Antminer S21e XP Hyd (Jan 2025) and Antminer S23 Hyd (Jan 2026)—reveals a tangible year-over-year improvement in J/TH efficiency, from 13.0 J/TH down to 9.5 J/TH.

Figure 13. Efficiency and Profitability Comparison of Bitmain S21e XP vs. S23 Hyd ASIC Miners. This image compares two high-performance Bitcoin ASIC miners from Bitmain. The S23 Hyd 3U (2026) achieves a higher hashrate of 1.16 PH/s at 11,020 W, while the S21e XP (2025) delivers 860 TH/s at 11,180 W. Despite similar power consumption, the S23 demonstrates improved energy efficiency—reducing joules per terahash from 13.0 to 9.5—marking a 26.9% year-over-year gain. This supports the ongoing progression toward the 1 J/TH threshold forecasted in the Bitcoin Mining Singularity thesis.

This marks a 26.9% gain in energy efficiency within a single product cycle.

However, what distinguishes this singularity model from simplistic exponential optimism is the layer of resistance—a key insight from the Capitulation theory. Even as machines become more efficient, they do so under pressure: from manufacturing costs, power density challenges, heat dissipation, and constrained capital markets.

The S23’s performance is a triumph of engineering—but it also reflects several years of R&D, specialized chip design, and corporate consolidation.

That progress is not free. Every significant point in time that has been recorded by mankind has had to have some sort of significant cost.

The price of the S23 Hyd sits at $29,488, or roughly $25,421 per PH—a reminder that despite falling J/TH numbers, financial friction remains.

This dynamic illustrates the “capitulating” curve: not stagnant, not exponential, but pressured progress.

Proof of Work: Landauer’s Principle and The Absolute Limits of Bitcoin Mining Hardware Efficiency

Landauer’s Principle is a fundamental law of physics that establishes the minimum possible amount of energy required to irreversibly change or erase one bit of information in a computational process.

This principle is rooted in the second law of thermodynamics, which states that any logically irreversible operation, such as resetting a bit from one state to another, must dissipate a certain amount of heat to the environment. The minimum energy required for this operation is given by the equation:

Emin, bit = kT ln(2)

In the context of Bitcoin mining hardware, Landauer’s Principle sets the theoretical lower bound for the energy required to perform the massive number of bit operations involved in each SHA-256 hash.

When scaled to the level of one terahash, this limit defines the absolute physical minimum energy consumption that any hardware device, no matter how advanced, could ever achieve.

Landauer’s Principle therefore provides the foundation for the theoretical energy limit in Bitcoin mining hardware, making it essential for any rigorous analysis of long-term efficiency trends and absolute physical constraints.

The absolute limit of Bitcoin mining hardware is determined by the laws of physics, particularly Landauer’s Principle, which sets the minimum energy required to change a single bit of information. At typical room temperature, this minimum energy is about 2.8 × 10⁻²¹ joules per bit operation.

For Bitcoin mining, where one SHA-256 hash involves approximately ten thousand bit operations and one terahash equals one trillion hashes, the theoretical minimum energy required per terahash is 0.000028 joules. This value represents an absolute boundary that cannot be surpassed by any hardware, regardless of technological innovation.

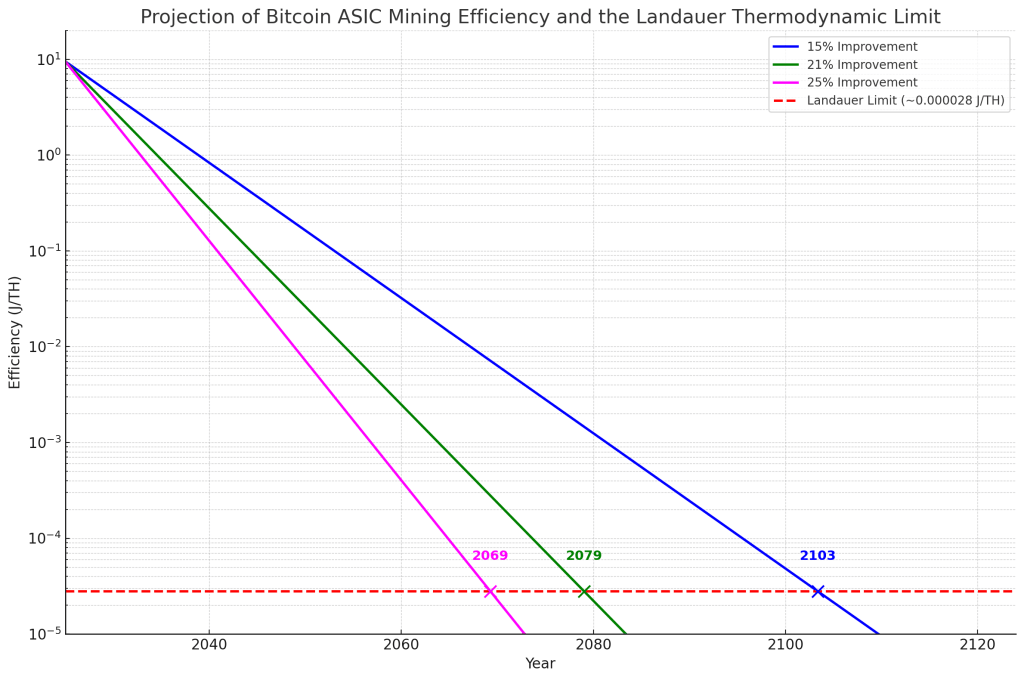

The Thermoeconomic Capitulation equation is used to model how quickly hardware efficiency improves over time, starting from a current benchmark of 9.5 joules per terahash.

This equation projects efficiency improvements based on annual rates of 15, 21, and 25 percent. According to these projections, hardware efficiency may approach but will never exceed the Landauer limit. Specifically, with an annual improvement rate of 25 percent, the theoretical minimum energy use per terahash would be reached in the year 2068. At an annual rate of 21 percent, the limit would be met in 2078, and at 15 percent per year, not until 2102.

The accompanying chart, shown in Figure 8, illustrates these scenarios by plotting each efficiency pathway—corresponding to 15, 21, and 25 percent improvement rates—alongside the Landauer limit as a horizontal reference line. All projected efficiency trends approach this physical boundary but do not cross it.

This analysis makes clear that although significant advances in mining efficiency are possible, every further improvement will become increasingly difficult as the physical limits imposed by thermodynamics are approached.

Understanding these limits through Landauer’s Principle and the Thermoeconomic Capitulation equation provides a practical and science-based framework for setting realistic expectations regarding the future of Bitcoin mining hardware.

Figure 14: Landauer’s Principle sets a theoretical lower bound on the energy needed to erase one bit of #information, meaning there is a minimum amount of energy that must be used to perform any computational task. In regards to bitcoin mining ASIC Efficiency, this translates to an absolute thermodynamic limit on how efficient a machine can be per terahash. This chart projects the anticipated improvement in bitcoin mining hardware efficiency by utilizing this principle under three different annual rates of progress: 15 percent (blue), 21 percent (green), and 25 percent (magenta). Each trajectory is calculated using the Thermoeconomic Capitulation equation, starting from a baseline efficiency of 9.5 joules per terahash (J/TH) in 2025. The horizontal red dashed line marks the thermodynamic limit, representing the absolute minimum energy required per terahash as dictated by Landauer’s Principle. For a 25 percent annual efficiency gain, the limit is projected to be reached in 2069; at 21 percent, in 2079; and at 15 percent, in 2103. Regardless of technological progress, all efficiency trajectories can theoretically approach but never surpass this fundamental physical boundary. Thermodynamic laws ultimately define the long-term limits of Bitcoin mining efficiency.

Financial Thermoeconomic Capitulation

Capitulation reveals a critical oversight in Kurzweil’s Law of Accelerating Returns: the assumption that all computing becomes cheaper over time.

In Bitcoin mining, the situation is more nuanced. While certain ASICs, such as Bitaxe solo miners, retail for as little as $50–$200, their cost-efficiency remains extremely low compared to industry grade ASIC Miners —often delivering just 1 terahash per second (TH/s) for $150 or more.

Most mainstream ASICs retail for $10 – $50 per Terrahash. This creates a paradox where devices become more affordable per unit, yet more expensive per unit of hashpower.

In other words, the dollar-per-terahash cost increases, forming a secondary curve of financial resistance that acts in opposition to pure efficiency gains.

This divergence introduces a new layer to Capitulation, suggesting that technological progress in Bitcoin mining is not just constrained by physics and thermodynamics, but also by capital allocation, manufacturing cost curves, and market pricing structures.

As such, financial capitulation emerges as a parallel and compounding force that defines the real-world limits of acceleration.

The chart below from the Hashrate Index illustrates this tension.

While ASIC prices have decreased over time, the dollar-per-terahash cost has followed a pressured path downward—oscillating with each economic cycle, ultimately revealing the real-world behavior of capitulation in the ASIC market.

Figure 15: The chart tracks ASIC market pricing in USD per TH/s (i.e. hashprice), showing a general decline over time with cyclical spikes driven by market demand. Despite momentary surges, the long-term trend reflects pressured progress toward lower cost-per-hashpower—consistent with the theory of Thermoeconomic Capitulation. Between 2018 and 2020, the ASIC price index chart reveals a sharp and rapid decline in the dollar-per-terahash ($/TH) cost, particularly evident in the pricing of older, less efficient machines. This period reflects the Law of Accelerating Returns, as manufacturers introduced increasingly efficient ASIC models at dramatically lower cost per unit of hashpower.

It marked the beginning of a climb toward the theoretical 1 J/TH mining singularity. However, from 2021 to 2022, the chart shows a distinct reversal.

The price per terahash surged across all efficiency tiers, driven by rising demand during Bitcoin’s bull market and exacerbated by global supply chain disruptions.

This upward movement, despite continued gains in ASIC efficiency, illustrates the onset of thermoeconomic tension. Here, capital constraints and material scarcity imposed a financial bottleneck, providing a real-world manifestation of the friction that defines the capitulation curve.

From 2023 to early 2025, the trend stabilizes, with ASIC prices falling back to historic lows, averaging between $10 and $20 per terahash for modern high-efficiency units.

Yet this decline is neither exponential nor free of resistance. Rather, it marks the characteristic shape of Capitulation: a sigmoidal pattern shaped by innovation, constrained by thermodynamic ceilings, and continuously moderated by capital expenditure, electricity pricing, and profitability thresholds.

Unlike the vertical trajectory predicted by Moore’s Law or the flatline of market stagnation, this curve reflects steady progress under continuous economic pressure.

The long-term projection toward 1 J/TH by the years 2033 to 2036 remains plausible when viewed through this lens. The chart acts as a lagging, real-world proxy of that thermoeconomic trend.

Despite periods of volatility, the directional momentum continues downward, though never without resistance. What emerges is not merely a trendline, but the visible trace of a deeper struggle—an ongoing negotiation between entropy and innovation, where cost, heat, and capital continually push back against technological advancement.

Ray Kurzweil’s, ‘Law Of Accelerating Returns’ further validates reasoning for Hydro-Cooled ASIC Hashrate Increases

In the worldview of Ray Kurzweil, technological progress accelerates so rapidly that linear expectations are rendered obsolete—so where does Bitcoin fit into that curve? In one key respect, Bitcoin materially validates the Kurzweilian vision of accelerating returns: the network’s total computational power, measured as hash rate, has been increasing at an exponential pace. As of the time of writing, the Bitcoin network is rapidly approaching, or may have already surpassed, one zettahash (1 ZH/s)—equivalent to one sextillion (10²¹) hashes per second.

Ray Kurzweil, in his Law of Accelerating Returns, asserts that the rate of technological progress increases exponentially over time. According to the law, each new generation of innovation builds upon the last, enabling faster and more powerful advancements in shorter time frames.

This compounding effect leads to accelerating developments, particularly in fields driven by information technology, such as computing, artificial intelligence, and biotechnology.

The theory suggests that technological change is not linear but grows at an exponential rate, potentially culminating in transformative shifts like the technological singularity.

This model supports the Bitcoin Mining Singularity by projecting nonlinear scaling in performance-per-watt, particularly under conditions of global demand and hardware competition.

If you apply this theory to bitcoin mining, it helps explain the dramatic reduction in energy consumption per terahash from 2016 to 2025. ASIC devices like the Antminer S9 (100 J/TH) gave way to the S21 XP (13.5 J/TH) and the Sealminer A3 (9.7 J/TH), reflecting a decade-long trend of exponential improvement in performance-per-watt.

Within this framing, the Bitcoin Mining Singularity—the point at which 1 joule yields 1 terahash per second—appears inevitable.

The trajectory toward 1 J/TH mimics Kurzweil’s curve, where each generation of ASIC builds on the architecture of the last, producing faster, denser, and more energy-efficient results.

Figure 6: The blue line represents total network hash rate (in terahashes per second), which has grown exponentially from near-zero in 2010 to over 1 zettahash by 2025. This trajectory visually affirms the Law of Accelerating Returns, as the computational power securing Bitcoin has scaled faster than linear models can explain. The black line shows Bitcoin’s market price in USD, which rises alongside hash rate but with far more volatility. Together, the chart reflects Bitcoin’s convergence with exponential computing trends—placing mining infrastructure at the forefront of a real-world singularity pathway. This scale of computation would have been inconceivable even a decade ago. It represents not just technological growth, but compounding energy-to-computation throughput that echoes Kurzweil’s claim: information technologies do not advance linearly, but exponentially. Unlike speculative examples used to illustrate the Singularity, Bitcoin mining is delivering this exponential output in the real world, measured in verifiable units and reinforced by competitive market forces. If the Singularity is defined by runaway computational power and recursively improving machines, then Bitcoin mining—at least in raw throughput—is already on that trajectory. Image Source: Blockchain.com

Anti-Acceleration: Where Kurzweil’s Accelerating Returns Break Down

Bitaxe Devices Highlight the Limits of Accelerating Returns

The inclusion of Bitaxe solo miners in 2024 and 2025 introduces a visible contradiction in the dollar-per-TH/s cost of bitcoin mining ASIC machines.

While mainstream ASICs reached an average of $6–$20/TH by 2025, the Bitaxe line enters the chart much higher—starting at $200/TH in 2024 and only decreasing to about $150/TH by 2025.

The contrast highlights that not all computing follows the same cost curve, particularly in the context of decentralized or hobbyist-level hardware.

Figure 16: This chart illustrates the declining cost per terahash ($/TH) of mainstream ASIC miners from 2018 to 2025, contrasted with Bitaxe Solo Miner economics. While Ray Kurzweil’s Law of Accelerating Returns predicts exponential cost-efficiency returns, the data reveals a flattening curve—highlighting diminishing returns in dollar-per-hash reduction. Bitaxe devices, though affordable per unit, remain costly per TH ($150/TH), revealing a contradiction in acceleration theory. Thermoeconomic Capitulation explains this resistance: as hashpower becomes cheaper, economic and physical constraints make each new gain incrementally harder and more expensive.

Bitaxe miners are open-source, DIY-oriented solo mining devices designed more for experimentation.

Despite the technological innovation, their cost per terahash remains orders of magnitude higher than industrial ASICs.

This contradicts Kurzweil’s Law of Accelerating returns because while the unit price of a Bitaxe device may decline, its dollar-per-terahash ratio—the metric that truly matters for mining economics—remains inefficient.

If acceleration models hold true, it would suggest that in another 10 years, a well-optimized bitaxe should cost about $10-$20/TH (per unit).

But that would require Bitaxe designs to keep pace with industrial breakthroughs in chip design, manufacturing scale, and thermal engineering—something that isn’t guaranteed due to their capital and hardware limitations.

This contrast reveals the nature of thermoeconomic capitulation. While mainstream miners push toward the theoretical 1 J/TH singularity with increasing affordability, devices like the Bitaxe stall behind, pressured by low hashpower and high per-unit cost.

It is a clear instance where capital efficiency does not scale equally across all forms of computing, and thus not all hardware benefits equally from the accelerating returns described by Kurzweil.

In Bitcoin mining, the dollar-per-terahash curve is not just a function of time—it’s a function of scale, and production economics.

In this way, the Bitaxe’s trajectory visualizes the financial resistance embedded in the Theory of Capitulating Returns.

While technology progresses, the reality of cost-per-hashpower improvement is not uniform, exposing the very limits of generalized acceleration models when applied to physical mining infrastructure.

The accelerating model alone does not account for the resistance ASIC efficiency improvements encounter in physical and economic reality.

In Bitcoin mining, this breakdown is most visible in two areas: the “diminishing efficiency” of J/TH efficiency in ASIC chips and the reduced year over year hashrate growth in air cooled machines.

While hydro cooled systems continue to post order of magnitude gains, air cooled hardware now advances at only 27 to 43 percent annually, which is a fraction of its early growth pace and far too slow to sustain Kurzweil’s steep curve.

Furthermore, J/TH efficiency gains, which once exceeded 60 percent per year in early ASIC generations, have compressed to the 15 to 25 percent range, with each new percentage point requiring disproportionately more engineering effort, cost, and thermal management.

Capital expenditures, manufacturing constraints, heat dissipation, and supply chain bottlenecks introduce drag into the curve.

Reports like those from Blockware Intelligence have noted this flattening: efficiency returns from chip compression or architectural tweaks are now harder to achieve than during the early leaps.

Moreover, financial bottlenecks, especially during bull runs or chip shortages—create friction even when technological capability exists.

The inaccuracy from Kurzweil’s optimistic slope signals the need for a new explanatory layer: one that reflects real-world thermoeconomic conditions and capital limitations.

Power Efficiency Theory: A Simplified Analytical Analogy

To make Power Efficiency Theory easy to understand for people who are not well versed in #bitcoin mining energy analytics, it helps to translate the concept into something familiar like cars.

Most people already understand miles per gallon (MPG) and miles per hour (MPH).

MPG is an efficiency metric. It tells you how far you can go using one unit of fuel.

MPH is a performance metric. It tells you how much travel output you get per unit of time.

The average (new) gas powered vehicle today costs roughly $50,000, achieves about 25 miles per gallon, and operates at an average speed of around 60 miles per hour.

So, as an amusing thought experiment, imagine a world where cars experience an order of magnitude improvement, similar to a major generational leap in ASIC mining chip performance.

Over a 10 year period, it improves by ten times in the two metrics people immediately recognize (MPH and MPG).

So, the average rate of efficiency goes from 25 MPG to 250 MPG.

And The average rate of speed goes from 60 MPH to 600 MPH.

That’s 10x gain in efficiency and a 10x gain in speed.

Ten times more efficient multiplied by ten times faster becomes a 100x improvement in the combined performance score.

If the market priced the average vehicle in proportion to that combined improvement, then a $50,000 car multiplied by a 100x capability jump implies a market value of $5,000,000.

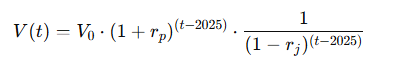

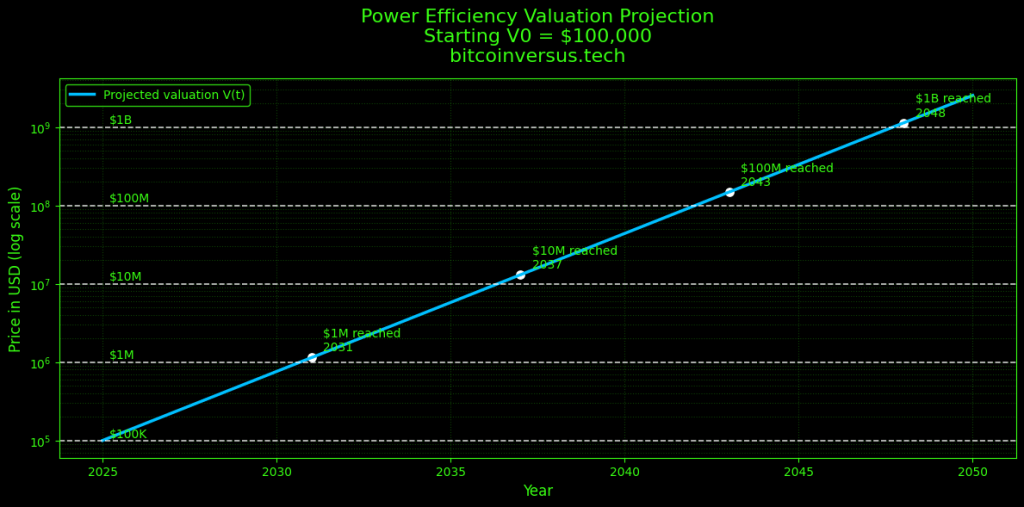

Alternate Power Efficiency Equation: The future value V(t) equals the starting value V₀ multiplied by a compounded multiplier, where that multiplier is the performance growth factor per year divided by the remaining energy cost factor per year, all raised to the number of years after 2025. it is divided by one minus the efficiency improvement rate, because represents a yearly reduction in the cost metric (like J/TH output).

In a world where a mainstream car can reliably cruise at 600 mph while also achieving 250 MPG, the product is no longer competing with normal cars.

It starts competing with airplanes, high speed rail, and premium transport services.

Under that reality, a $5,000,000 price is a plausible reflection of how markets tend to value an overall improvement in performance (when it is real, safe, legal, and usable at scale).

When performance improves by an order of magnitude in multiple dimensions, it stops feeling like a normal product upgrade and starts behaving like a totally different class of technology.

The same concept applies when you talk about Bitcoin mining hardware with joules per terahash (J/TH) and also the computational power – terahash per second (TH/s).

When you apply (performance) efficiency theory in ASIC mining, you are not saying a machine is slightly better.

You are describing compounding jumps in how efficiently energy can perform computational work.

When a machine gets dramatically more efficient, it completely changes the economics of operation. It changes operational variables, like how much hash (or how many machines) can be deployed per megawatt.

The vehicle efficiency analogy is a way to help people understand why efficiency can reshape what something is worth.

J/TH and TH/s are simply the mining industry’s version of measuring computational efficiency and power, respectively.

Determining Price Evaluation Using Power Efficiency Theory: How does Bitcoin actually get to $1,000,000 USD per coin?

The fourth and final pillar of my research is that the price of bitcoin should actually coincide with the energy efficiency improvements as well as the computational power (hashrate) of the ASIC (Application Specific Integrated Circuit) machine itself.

If we anticipate that bitcoin mining ASIC chip J/TH (joule per terahash) efficiency is going to reach 1 J/TH in between the years of 2033-2039 (that’s a 10x in energy efficiency),

and if we also expect the computational power of the best performing machine to be at least 10x more powerful in the same timeframe (10 PH/s),

then the market valuation of bitcoin should also be an order of magnitude greater than what it is today during that relative time frame as well.

One caveat here is that the price of bitcoin usually lags the actual physical improvement of the bitcoin protocol’s infrastructure.

Nevertheless, I anticipate that the price of bitcoin will be $1,000,000 USD in between the years of *2035-2040*.

Final Considerations

The Bitcoin Mining Singularity—defined as the moment one joule of energy produces one terahash per second—remains a calculable and highly probable milestone based on over a decade of hardware progression.

Historical efficiency returns between 15 and 25 percent annually place the singularity window between 2033 and 2039, with hydro-cooled ASICs driving the most accelerated trajectory.

These hydro-cooled systems, advancing at 233 to 367 percent YoY in hashrate growth, are on track to achieve exahash-scale performance per device within the next decade, while air-cooled counterparts lag by at least a generation.

Yet the advance is not unbounded; the “Power Efficiency” models how exponential gains meet resistance from physical ceilings such as Landauer’s limit and from persistent financial friction in manufacturing, deployment, and market pricing.

This duality produces a measurable capitulation curve rather than unchecked exponential growth, with the climb from 1 J/TH to the thermodynamic minimum of 0.000028 J/TH projected to take until 2068–2103 depending on improvement rates.

In this light, Bitcoin mining emerges as a thermoeconomic constant—its trajectory shaped as much by cooling innovation, materials science, and economic structure as by chip scaling itself.

The singularity’s arrival will mark not only a technological milestone but also a redefinition of the balance between energy, computation, and value in the global digital economy.

Cited Sources:

- https://www.asicminervalue.com/miners/bitmain/antminer-s23-hydro-u3-1160th

- https://www.asicminervalue.com/miners/bitmain/antminer-s21e-xp-hydro-860th

- https://www.blockchain.com/explorer/charts/hash-rate

- https://data.hashrateindex.com/asic-index-data/price-index

- https://bitcoinversus.tech/2025/01/07/blockware-report-highlights-reduced-efficiency-gains-in-bitcoin-mining/

- https://en.wikipedia.org/wiki/Landauer%27s_principle

- https://chat.deepseek.com/

- https://x.com/i/grok?conversation

- chatgpt.com

- https://dspace.mit.edu/handle/1721.1/153030

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True. If you would like to support to help further secure the integrity of our research initiatives, please donate here

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment