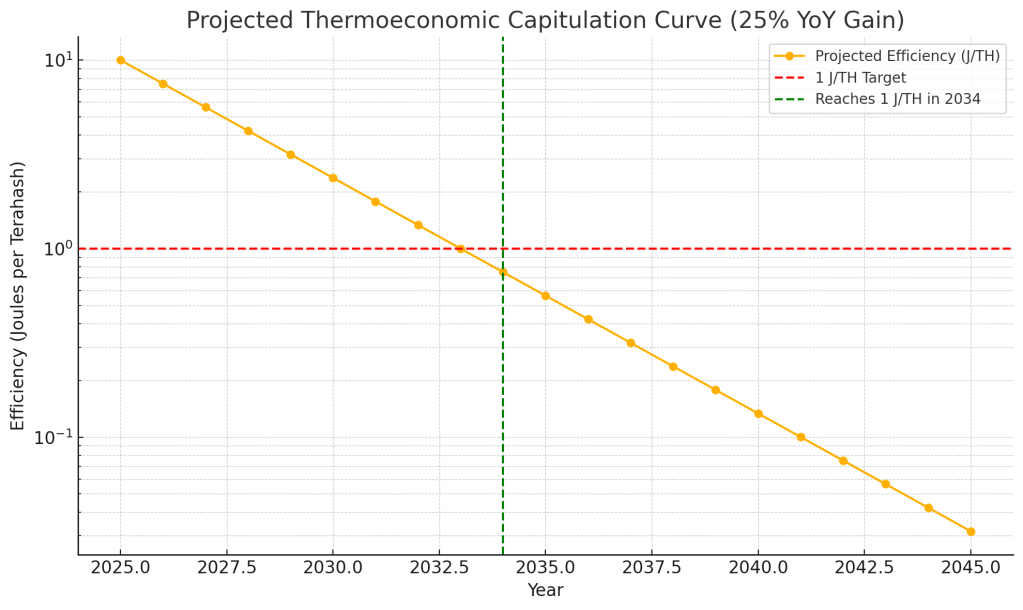

In The Bitcoin Mining Singularity, I introduced a theoretical convergence point — 1 joule of energy producing 1 terahash per second (1 J/TH) — as a future milestone in Bitcoin mining hardware.

The prediction was built on data from real ASIC models, beginning with the Antminer S9 in 2016 (100 J/TH) and accelerating to the Sealminer A3 in 2025 (9.7 J/TH). Given historical trends and forecasted annual efficiency gains of 25–30%, the singularity was projected to occur between 2033 and 2036.

This range defines a Singularity Window—a critical period in which ASIC mining hardware will reach its most efficient form to date, redefining the economic and physical constraints of digital labor.

Thermoeconomic Capitulation is A New Model for Bitcoin Mining Efficiency Progression

Thermoeconomic Capitulation is the ongoing interaction between the Law of Accelerating Returns and Diminishing Efficiency Returns. It essentially defines the rate at which we approach the 1 J/TH singularity.

It describes how technological progress—such as better ASIC performance—continues, but is constantly slowed by practical limits like cost, heat, and complexity.

Instead of one law replacing the other, both operate at the same time: breakthroughs push efficiency forward, while physical and economic constraints (Diminishing efficiency) hold it back.

Capitulation captures this push-pull dynamic, showing how mining efficiency improves steadily, but always under pressure from opposing forces.

The chart accompanying this report introduces a new scientific concept: The Law of Capitulating Returns.

This law posits that technological acceleration and diminishing returns are not opposing endpoints but interacting forces. They do not cancel one another out—they capitulate to each other.

That is, exponential growth pushes forward until it is met by a wall of cost, physics, and diminishing improvement, and in doing so, bends or reroutes—but does not vanish.

This is embodied in the Capitulation Curve* (See figure below) — a green line that starts with the A3 Sealminer in 2025 at 9.7 J/TH, passes through projected ASICs in 2027 (5.45 J/TH) and 2030 (2.30 J/TH), and converges at the 1 J/TH threshold in the heart of the Singularity Window (2033–2036). The Capitulation Curve is a 25% year-over-year improvement in efficiency.

The chart is built on a descending scale, showing the shrinking energy requirements per terahash. Each “x” on the chart marks a real ASIC release, beginning with the Antminer S5 in 2014 with over 500 J/TH and continuing through to modern models like the S21 and M30S++.

The white dashed line indicates the 1 J/TH threshold, and the orange window visualizes the projected convergence zone. Together, they frame the environment in which the law of Capitulating Returns operates.

Proof of Work: Thermoeconomic Capitulation as a Mathematical Model

The Thermoeconomic Capitulation equation is expressed as:

E(t)=E0 x (1−r)t

The equation provides a framework for understanding the pressured, non-linear path of Bitcoin mining efficiency. In this formula, E(t) represents the energy cost per terahash (J/TH) at year t, E0 is the starting efficiency (10 J/TH in 2025), r is the yearly improvement rate (25%, or 0.25), and t is the number of years since 2025.

Rather than depicting unchecked exponential growth, this equation reflects a decelerating trajectory shaped by capital constraints, thermal resistance, and diminishing engineering yields.

As the gains compress toward the theoretical boundary of 1 J/TH, each additional unit of progress becomes more expensive and difficult—confirming the theory of Thermoeconomic Capitulation.

The equation not only aligns with hardware trends but also captures the broader reality: that Bitcoin mining efficiency is improving under constant resistance, resulting in a curve that arcs toward innovation but is weighted by the physics of heat, money, and time.

Furthrer Evidence of Efficiency Gains Supporting Thermoeconomic Capitulation

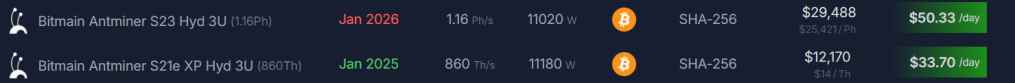

The release data for Bitmain’s latest models—Antminer S21e XP Hyd (Jan 2025) and Antminer S23 Hyd (Jan 2026)—reveals a tangible year-over-year improvement in power efficiency, from 13.0 J/TH down to 9.5 J/TH.

This marks a 26.9% gain in energy efficiency within a single product cycle. with this data in mind as well as the data procured from the Seal A3 miner, The speed of Thermoeconomic Capitulation currently averages roughly 25% year-over-year gain in efficiency, as evidenced by recent advancements such as the Bitmain Hydro project between 2025 and 2026.

However, what distinguishes this singularity model from simplistic exponential optimism is the layer of resistance—a key insight from the Capitulation theory. Even as machines become more efficient, they do so under pressure: from manufacturing costs, power density challenges, heat dissipation, and constrained capital markets.

The S23’s performance is a triumph of engineering—but it also reflects several years of R&D, specialized chip design, and corporate consolidation.

That progress is not free. Every significant point in time that has been recorded by mankind has had to have some sort of significant cost.

The price of the S23 Hyd sits at $29,488, or roughly $25,421 per PH—a reminder that despite falling J/TH numbers, financial friction remains.

This dynamic illustrates the “capitulating” curve: not stagnant, not exponential, but pressured progress.

Financial Thermoeconomic Capitulation

Capitulation reveals a critical oversight in Kurzweil’s Law of Accelerating Returns: the assumption that all computing becomes cheaper over time.

In Bitcoin mining, the situation is more nuanced. While certain ASICs, such as Bitaxe solo miners, retail for as little as $50–$200, their cost-efficiency remains extremely low compared to industry grade ASIC Miners —often delivering just 1 terahash per second (TH/s) for $150 or more.

Most mainstream ASICs retail for $10 – $50 per Terrahash. This creates a paradox where devices become more affordable per unit, yet more expensive per unit of hashpower.

In other words, the dollar-per-terahash cost increases, forming a secondary curve of financial resistance that acts in opposition to pure efficiency gains.

This divergence introduces a new layer to Capitulation, suggesting that technological progress in Bitcoin mining is not just constrained by physics and thermodynamics, but also by capital allocation, manufacturing cost curves, and market pricing structures.

As such, financial capitulation emerges as a parallel and compounding force that defines the real-world limits of acceleration.

The chart below from the Hashrate Index illustrates this tension.

While ASIC prices have decreased over time, the dollar-per-terahash cost has followed a pressured path downward—oscillating with each economic cycle, ultimately revealing the real-world behavior of capitulation in the ASIC market.

Between 2018 and 2020, the ASIC price index chart reveals a sharp and rapid decline in the dollar-per-terahash ($/TH) cost, particularly evident in the pricing of older, less efficient machines. This period reflects the Law of Accelerating Returns, as manufacturers introduced increasingly efficient ASIC models at dramatically lower cost per unit of hashpower.

It marked the beginning of a climb toward the theoretical 1 J/TH mining singularity. However, from 2021 to 2022, the chart shows a distinct reversal.

The price per terahash surged across all efficiency tiers, driven by rising demand during Bitcoin’s bull market and exacerbated by global supply chain disruptions.

This upward movement, despite continued gains in ASIC efficiency, illustrates the onset of thermoeconomic tension. Here, capital constraints and material scarcity imposed a financial bottleneck, providing a real-world manifestation of the friction that defines the capitulation curve.

From 2023 to early 2025, the trend stabilizes, with ASIC prices falling back to historic lows, averaging between $10 and $20 per terahash for modern high-efficiency units.

Yet this decline is neither exponential nor free of resistance. Rather, it marks the characteristic shape of Capitulation: a sigmoidal pattern shaped by innovation, constrained by thermodynamic ceilings, and continuously moderated by capital expenditure, electricity pricing, and profitability thresholds.

Unlike the vertical trajectory predicted by Moore’s Law or the flatline of market stagnation, this curve reflects steady progress under continuous economic pressure.

The long-term projection toward 1 J/TH by the years 2033 to 2036 remains plausible when viewed through this lens. The chart acts as a lagging, real-world proxy of that thermoeconomic trend.

Despite periods of volatility, the directional momentum continues downward, though never without resistance. What emerges is not merely a trendline, but the visible trace of a deeper struggle—an ongoing negotiation between entropy and innovation, where cost, heat, and capital continually push back against technological advancement.

Bitaxe Devices Highlight the Limits of Accelerating Returns

The inclusion of Bitaxe miners in 2024 and 2025 introduces a visible contradiction. While mainstream ASICs reached an average of $15–$20/TH by 2025, the Bitaxe line enters the chart much higher—starting at $200/TH in 2024 and only decreasing to about $150/TH by 2025.

This stark contrast underscores a critical point: not all computing follows the same cost curve, particularly in the context of decentralized or hobbyist-level hardware.

Bitaxe miners are open-source, DIY-oriented solo mining devices designed more for experimentation and education than for high-efficiency performance.

Despite technological improvement, their cost per terahash remains orders of magnitude higher than industrial ASICs.

This contradicts Kurzweil’s generalization because while the unit price of a Bitaxe device may decline, its dollar-per-terahash ratio — the metric that truly matters for mining economics — at the time of writing remains inefficient.

If we attempted to extrapolate the mainstream trend forward linearly (or even modestly exponentially), it would suggest that in another 10 years, a well-optimized ASIC should cost between $5 and $10/TH, or even less.

If Bitaxe followed that same curve, we would expect its cost-per-terahash to fall from $150 in 2025 to roughly $15–$25 by 2035.

But that would require Bitaxe designs to keep pace with industrial breakthroughs in chip design, manufacturing scale, and thermal engineering—something that isn’t guaranteed due to their niche use case and hardware limitations.

This contrast reveals the nature of thermoeconomic capitulation. While mainstream miners push toward the theoretical 1 J/TH singularity with increasing affordability, devices like the Bitaxe stall behind, pressured by low hashpower and high per-unit cost.

It is a clear instance where capital efficiency does not scale equally across all forms of computing, and thus not all hardware benefits equally from the accelerating returns described by Kurzweil.

In Bitcoin mining, the dollar-per-terahash curve is not just a function of time; it’s a function of scale, energy efficiency returns. and production economics.

In this way, the Bitaxe’s trajectory visualizes the financial resistance embedded in the Law of Capitulating Returns. While technology progresses, the reality of cost-per-hashpower improvement is not uniform, exposing the very limits of generalized acceleration models when applied to physical mining infrastructure.

Final Thoughts

In finality, The Bitcoin Mining Singularity represents more than a technological endpoint—it is a thermoeconomic threshold where energy and information converge into a unified, quantifiable exchange rate: one joule of energy for one terahash of proof-of-work.

What this dissertation proposes is not a law, but a theory rooted in measurable engineering trends and shaped by real-world economic resistance.

The Theory of Thermoeconomic Capitulation helps explain why exponential efficiency gains are not frictionless, but instead evolve along a pressured curve defined by material limits, heat dissipation, capital bottlenecks, and diminishing returns.

From 2016’s 100 J/TH to 2025’s 9.7 J/TH, and on toward the projected 1 J/TH milestone by 2033–2036, the convergence is visible—but nonlinear. It accelerates, then resists.

There’s a constant oscillation of progress and stagnation. It is within this dynamic that the Capitulation Curve emerges—not as failure, but as structure. Not as slowdown, but as reality. In Bitcoin mining, progress is no longer merely exponential—it is negotiated.

One thing is certain: We are not accelerating toward the future unopposed. In bitcoin mining, engineering challenges are the standard, not the exception. We are advancing toward The Bitcoin Mining Singularity under tension, guided by engineering, constrained by thermodynamics and entropy.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True. If you would like to support to help further secure the integrity of our research initiatives, please donate here

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment