Bitcoin mining hardware exhibits a relentless pace of technological advancement, where successive generations achieve hashrate increases previously considered unattainable.

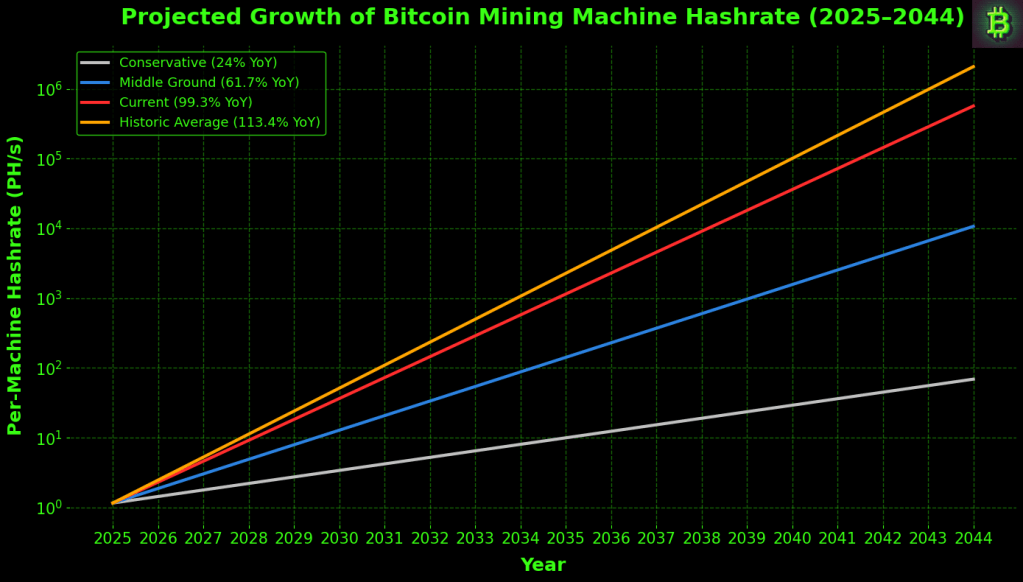

The chart models four mathematically grounded growth trajectories, demonstrating how rapidly contemporary petahash-scale systems may be superseded. Projections underscore that even conservative pathways suggest today’s performance benchmarks will soon be eclipsed.

To quantify the range of outcomes for next-generation bitcoin mining ASIC performance, the chart plots four exponential curves that reflect distinct growth regimes derived from recent machine upgrades

Growth Trajectories and Scenarios

The accompanying chart projects per-machine hashrate from 2025 to 2044 using four data-driven year-over-year rates—24.0 %, 61.7 %, 99.3 %, and 113.4 %.

Analyzing these four growth scenarios side-by-side clarifies the likely timeline for when next-generation machines may surpass major hashrate milestones. Under the conservative 24% growth scenario, a 10 PH/s machine could emerge by 2033, with 100 PH/s projected around 2042, while reaching 1 EH/s would likely extend beyond the current forecast period.

Using the middle-ground 61.7% annual growth, the 10 PH/s threshold arrives by 2029, 100 PH/s by 2033, and 1 EH/s by 2040. If the industry sustains its aggressive 99.3% trend, miners can expect to see 10 PH/s by 2028, 100 PH/s by 2031, and 1 EH/s as early as 2034.

At the historical average of 113.4% growth, these milestones could fall to 2028 for 10 PH/s, 2031 for 100 PH/s, and 2034 for 1 EH/s.

These models illustrate just how sensitive the timeline is to annual gains, making clear that even incremental shifts in the rate of progress can advance or delay the next era of mining technology by several years.

Each line begins at the 1.16 PH/s baseline of the 2025 S23 XP Hyd 3U and applies its respective exponential function to illustrate how quickly the industry could progress from tens to hundreds (and eventually thousands) of petahashes per second under different technological and economic conditions.

The chart visualizes projected growth scenarios for the per-machine hashrate of Bitcoin mining hardware from 2025 to 2044. Each trajectory is modeled with exponential growth equations based on distinct year-over-year (YoY) percentage rates, selected to reflect both historical industry performance and plausible future improvements.

Projection Methodology

The starting point is set at 1.16 PH/s, corresponding to the top-end machine performance of the Bitmain S23 XP Hyd 3U, released in 2025 (officially released in 2026). All projections employ the formula:

H(t) = H0 ⋅ (1+r) (t−2025)

Expressed as:

Hashrateyear = 1160 × (1+r)(year−2025)

This formula allows us to estimate the expected hashrate of a top-tier mining machine in any given future year, starting from 1160 TH/s in 2025, by multiplying by (1 + r) raised to the number of years since 2025, where r is the assumed annual percentage growth rate.

Four growth scenarios are presented: a conservative case (24.0% YoY), a middle ground (61.7% YoY), a current aggressive trend (99.3% YoY), and a historic industry average (113.4% YoY).

The conservative estimate is derived from the compound annual growth rate between 2020’s S19 Pro and the S23 XP Hyd 3U, representing gradual progress consistent with earlier hardware cycles.

The middle ground is the average of the conservative and aggressive rates, capturing a balanced perspective between steady and rapid growth.

To quantify likely growth paths for next-generation ASICs, the chart traces four exponential curves, each anchored to a data-backed year-over-year rate. All lines start at today’s 1.16 PH/s flagship.

The conservative 24 % CAGR comes from the compound pace between the S19 Pro’s launch in 2020 and the S23-class machine in 2025. The middle-ground 61.7 % rate is simply the arithmetic mean of that conservative 24 % and the aggressive 99.3 % CAGR, the latter calculated from every model released since the S19 debuted in 2020.

Finally, the historic average line (113.4 %) reflects the long-run CAGR across all major Bitmain releases back to the original S1 in 2013.

Implications for the Industry

Viewing these four scenarios side-by-side reveals how quickly single miners could pass the 10 PH/s, 100 PH/s, and even 1 EH/s milestones, depending on which trajectory the industry ultimately follows.

Collectively, these projections indicate that current-generation mining hardware will likely succumb to dramatically shortened operational lifespans. Even under conservative growth models, empirical trendlines suggest today’s petahash-scale performance benchmarks will transition to obsolescence within 3–5 years.

This acceleration underscores the critical need for continuous infrastructure reinvestment to maintain relevance in the bitcoin mining industry

The analysis confirms that per-device hashrate scaling operates nonlinearly, compressing historical multi-decade advancement rates into single product generations. Consequently, operational longevity hinges not merely on initial throughput but on anticipating inflection points in efficiency curves.

Across all modeled scenarios, the projected trajectories converge on a singular outcome: exponential hashrate growth will systematically erode the relevance of existing mining architectures.

This necessitates strategic pivots toward modular upgradability and dynamic power optimization to mitigate premature capital depreciation in rapidly evolving technological landscapes.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True. If you would like to support to help further secure the integrity of our research initiatives, please donate here

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment