In the previous attempt to predict the future Hashrate for ASIC machines, the equation and the numbers were in fat mathematically correct, but we needed to get the most efficient data possible instead of just picking out numbers that were merely anticipated and had no mathematical basis.

For the math to make sense, we need to know why it was actually used for the ASIC machine hashrate prediction model.

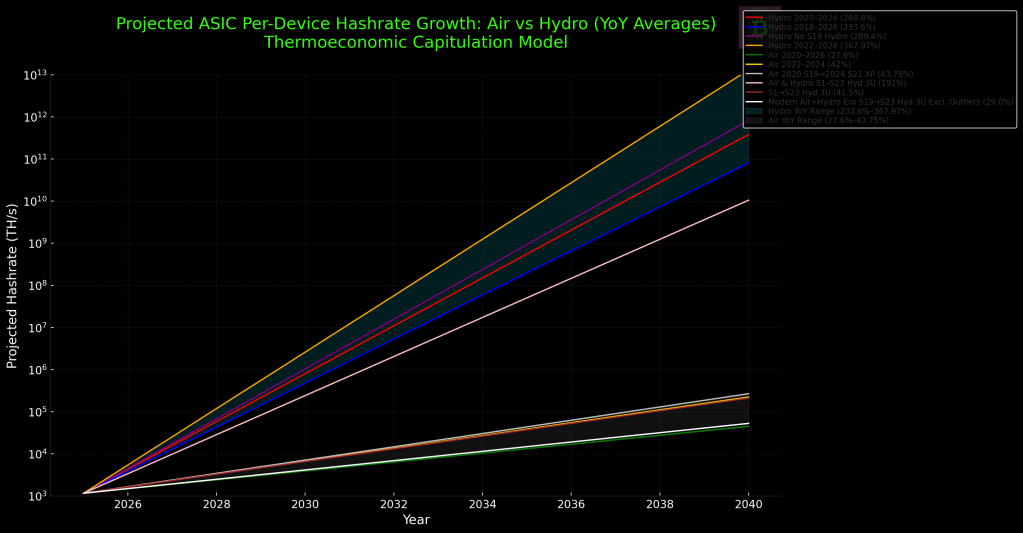

In order to make the Hashrate prediction chart more mathematically realistic, we extracted the year-over-year averages of Air cooled and Hydro – Cooled machines separately, rather than combining the two coolant methods annual average percentage gains.

However, we did add a an all-inclusive average for air cooled and hydro-cooled machines to show more potential rates of growth for individual machine hashpower.

Analysis of the average year-over-year (YoY) hashrate growth rates shows a dramatic divergence between hydro-cooled and air-cooled ASICs.

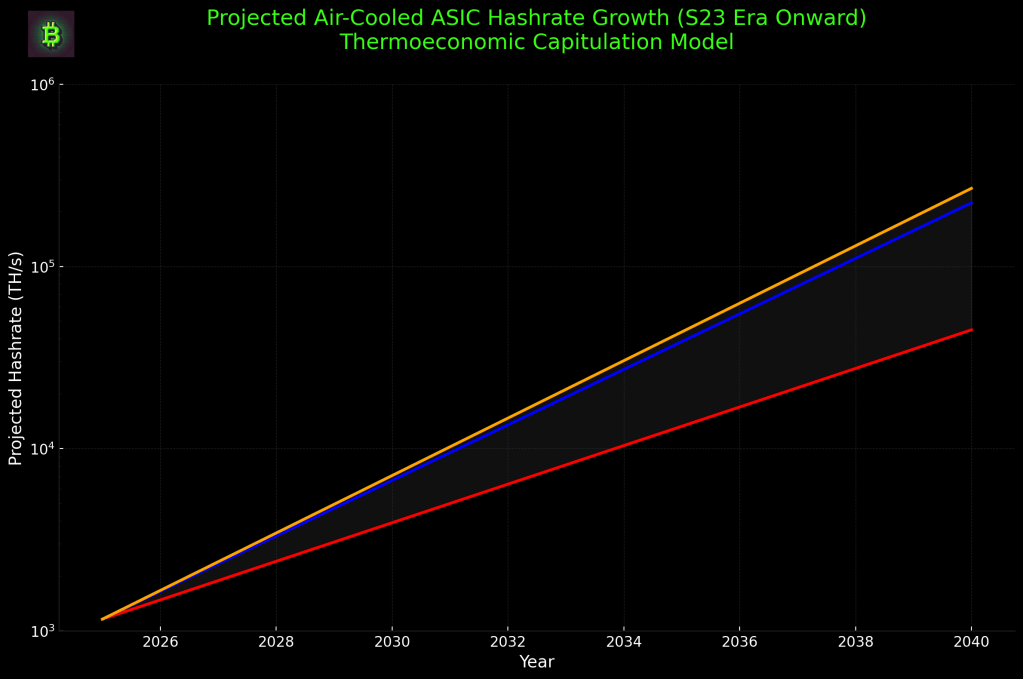

Air-Cooled ASIC Hashrate Growth Projections

The projected growth trajectories for air-cooled Bitcoin mining ASICs reveal a steady but ultimately limiting pattern of technological advancement. The model evaluates three representative year-over-year (YoY) growth rates based on observed release cycles for flagship air-cooled machines since 2020: a conservative 27.6% (red), a middle-range 42% (blue), and an aggressive 43.75% (orange), the latter two reflecting peak annualized improvements between the S19 and S21 XP series.

In terms of orders of magnitude, the growth profiles demonstrate clear milestones, but is still an order of magnitude slower than hydro-cooled machines.

The conservative 27.6% line crosses 10,000 TH/s (10 PH/s) in 2035 and approaches 100,000 TH/s (100 PH/s) near the end of the modeled period, around 2046. It does not reach 1,000,000 TH/s (1 EH/s) before 2040.

The middle-range (42%) and aggressive (43.75%) curves both surpass 10,000 TH/s by approximately 2033, reach 100,000 TH/s between 2039 and 2040, and, even under optimal conditions, do not attain the 1 EH/s (10^6 TH/s) milestone within the 2025–2040 window.

The data makes it clear that air-cooled ASICs are facing real barriers to faster progress. While hydro-cooled machines routinely post dramatic year-over-year gains, air-cooled models are now advancing at a far more measured pace. This growth is steady and reliable—much like the trend once seen with Moore’s Law—but each step forward is smaller than the last, and the limits of air cooling are becoming more obvious.

For air-cooled systems, moving from 10 PH/s to 100 PH/s is projected to take well over a decade. Reaching the 1 EH/s mark is not expected within the next 15 years unless there’s a significant leap in cooling technology or chip efficiency. The timeline for hitting each new order of magnitude keeps stretching out, underscoring the reality that traditional air cooling is reaching its practical ceiling.

In summary, while air-cooled ASICs will likely continue to improve, the rate of those improvements is slowing, making it increasingly difficult to achieve the kind of rapid progress seen in the early years of Bitcoin mining. Unless there’s a disruptive breakthrough, air-cooled hardware may become less competitive as new generations of miners demand much higher hashrates and greater efficiency

Hydro-Cooled ASIC Hashrate Growth Projections

Hydro-cooled machines are progressing approximately 10 times faster than air-cooled models, as demonstrated by mean YoY growth rates of 269.8%–367.97% for hydro versus 27.6%–43.75% for air.

This means that, for every doubling of hashrate achieved by air-cooled machines, hydro-cooled systems increase by an order of magnitude or more.

For every doubling achieved by air cooling, hydro-cooled hardware is posting an order-of-magnitude gain or more.

Even at the higher end for air-cooled (43.75% YoY), the 10 PH/s milestone is not reached until 2033, with 100 PH/s projected around 2040. In contrast, all hydro-cooled growth scenarios reach each new order of magnitude years earlier, emphasizing the scale of the technological gap.

Historical Blended Average Explained

The pink line (the line in between both shaded areas) is a historic blended average—showing that, while hydro-cooled machines have set new speed records, even the full-market mean rate of 191% YoY would have been considered extraordinary by air-cooled standards, but is still a conservative projection compared to the current elusively hydro-surge.

The blue line in the chart represents the lower bound of hydro-cooled ASIC growth, with an average year-over-year hashrate increase of 233.6%.

This conservative projection is significant because it illustrates that, even at the slowest observed hydro-cooled progression, the expected rate of performance improvement outpaces the most optimistic air-cooled trajectories by a wide margin.

Based on the latest performance data, it is reasonable to expect hydro-cooled ASICs to sustain at least a 100% YoY hashrate improvement over the next cycle—meaning performance should double annually from the S23 Hydro 3U benchmark onward. This conservative scenario projects a 10 PH/s hydro machine emerging between 2028 and 2029.

The data reinforces that, even at lower hydro-cooled YoY rates, technological progress dramatically outpaces air-cooled innovation, and the time to each hashrate milestone shrinks to a single product generation.

Analysis for the (Conservative?) Blue Line:

Rapid milestone achievement: Even at this conservative growth rate, hydro-cooled machines are expected to reach 10 PH/s by 2026, 100 PH/s by 2027, and 1 EH/s by 2028—each milestone reached years ahead of the best-case scenario for air-cooled hardware.

Sustained exponential advantage: The slope of the blue line demonstrates that exponential gains in hydro-cooled ASIC performance are not limited to extreme, short-term periods, but persist across multiple generations of mining hardware.

Practical lower bound: The blue line acts as a practical minimum for what can be expected from next-generation hydro-cooled mining machines, highlighting the inevitability of hydro’s dominance in future hashrate scaling, unless a disruptive innovation occurs in air cooling or chip design.

To further contextualize the hashrate growth scenario, we plotted the median year-over-year growth rate within each shaded band—yielding 300.8% for hydro-cooled ASICs and 35.7% for air-cooled models.

The median lines provide a central tendency for expected hashrate advancement between the most conservative and most aggressive projections, serving as a practical benchmark for hardware progress under each cooling regime.

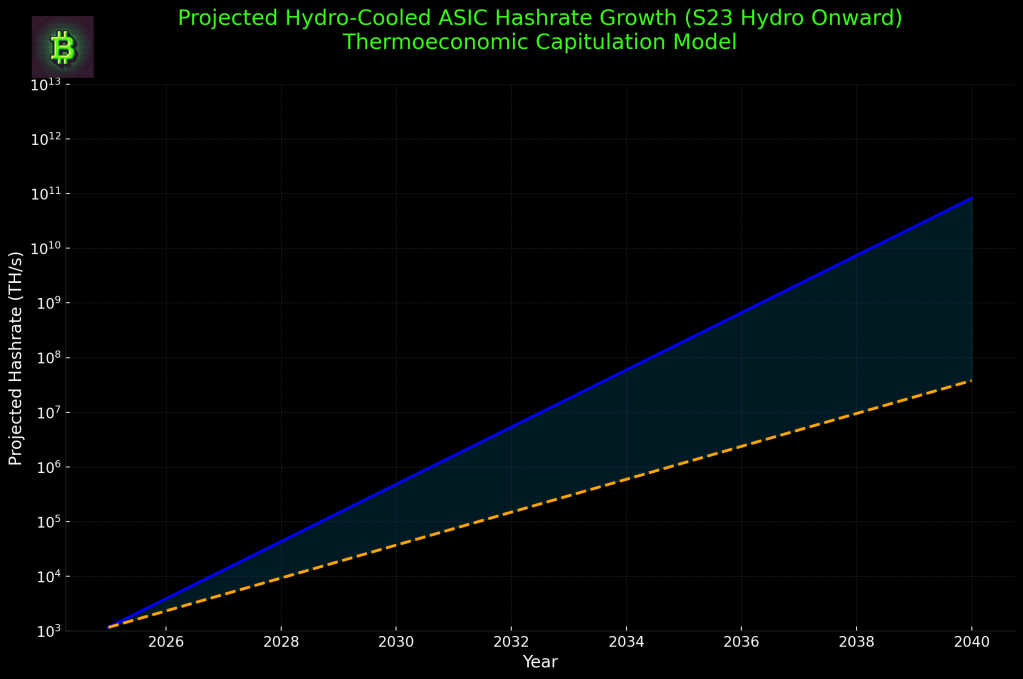

Hydro-Cooled ASIC Projected Hashrate Growth (S23 Hydro Onward)

The chart below models the projected hashrate growth of top-tier hydro-cooled Bitcoin ASICs from 2025 to 2040. The analysis uses the S23 Hydro as a baseline, incorporating both observed and hypothetical year-over-year (YoY) growth rates to illustrate the full spectrum of possible performance outcomes for next-generation hardware.

Blue Line (233.6% YoY, Conservative Hydro):

This curve represents the conservative scenario, derived from actual industry data—specifically, the average YoY hashrate growth of hydro-cooled Bitmain machines since their introduction. W

ith a growth rate of 233.6%, the blue line reflects the historic performance of the sector, and is consistent with observed leaps in efficiency and throughput delivered by hydro-cooled ASICs. This trend demonstrates just how rapidly hydro-based cooling has transformed mining hardware, allowing for orders of magnitude improvements in a few product generations.

The orange-gold dashed line marks a scenario where each new generation of hydro-cooled ASIC doubles the hashrate of its predecessor every year—a 100% YoY increase. This is not a hypothetical stretch.

In fact, given the data from recent hydro-cooled ASIC releases, where average annual gains have ranged between 233% and 367% (as shown in your previous air-vs-hydro comparison chart), this 100% trajectory is highly plausible and may even be conservative relative to the sector’s demonstrated pace.

Given the current state of hydro-cooled ASIC technology and the ongoing trend of rapidly accelerating hashrate growth, it is entirely possible for the next generation of machines to achieve a full doubling of per-device hashrate ahead of the next Bitcoin halving.

If the sector maintains even a fraction of the historic 233–367% YoY gains, the industry could see the 100% increase line not only met but exceeded before 2028.

The blue-to-yellow shaded region between these two lines represents the realistic range for future hydro-cooled ASIC performance, bounded by the conservative 233.6% historical growth and a more measured—but still dramatic—doubling scenario. This envelope visualizes the plausible improvement space for upcoming hardware, emphasizing the upside potential if innovation continues to compound.

Ultimately, Hydro-cooled ASICs are advancing at a pace that far outstrips both their air-cooled predecessors and most expectations, with 100% YoY gains being a realistic scenario given current industry dynamics. This makes a compelling case for hydro-cooled solutions as the primary driver of hashrate and efficiency improvements over the next cycle, with the 100% line serving as a practical target—rather than an optimistic ceiling—for miners and manufacturers alike.

What the Data Ultimately Reveals

Hydro-Cooled Progression is Exponential:

Hydro-cooled systems are not just advancing rapidly—they are accelerating at a rate that compounds generationally, moving from terahash to petahash and eventually exahash performance per machine within a single decade. This explosive growth rate means that hydro is redefining what is technologically possible in Bitcoin mining hardware.

Hydro as the Future of Mining Sustainability:

The sustained, rapid YoY growth in hydro-cooled hardware highlights its superior ability to manage heat and power density, which are the primary bottlenecks in ASIC design. For operators aiming at long-term viability and infrastructure efficiency, hydro cooling represents the most future-proof investment.

Air-Cooled: Steady but Outpaced:

Air-cooled ASICs display incremental, steady growth closely following a trajectory comparable to Moore’s Law. However, the gap between air and hydro is widening, with air-cooled models projected to reach the next order of magnitude a decade later than their hydro-cooled counterparts.

The Central Role of Cooling Technology:

The next major performance breakthroughs may not come from new chip architectures but from radical improvements in cooling technology. As thermodynamic and physical limits of silicon approach, hydro and immersion cooling are likely to deliver the next leap in hashrate efficiency—pushing the industry closer to the “singularity” of 1 J/TH/s.

Hardware Lifecycles May be getting shorter:

The data also implies that operational lifespans of flagship machines will continue to compress. As hashrate grows exponentially, older models will become obsolete more quickly, further incentivizing ongoing upgrades to the latest cooling and hardware solutions.

Conclusion

The analysis of ASIC hashrate growth projections underscores a fundamental divergence in the evolution of Bitcoin mining hardware. Air-cooled machines, while still advancing, exhibit a decelerating trajectory constrained by thermal and physical limitations, with even the most optimistic projections failing to reach exahash-scale performance within the next 15 years.

In stark contrast, hydro-cooled ASICs are progressing at an exponential pace, routinely achieving order-of-magnitude improvements that render traditional air-cooled systems obsolete in terms of raw hashrate potential.

The data reveals that hydro-cooled machines are not merely incrementally better—they represent a paradigm shift in mining efficiency. With year-over-year growth rates between 233% and 367%, hydro-cooled ASICs are on track to reach 1 EH/s per machine by 2028, a milestone that air-cooled hardware may never achieve under current technological constraints.

This disparity highlights the growing necessity for miners to adopt advanced cooling solutions to remain competitive in an industry where hashrate growth is increasingly dominated by liquid-cooled systems.

Beyond raw performance, the implications of this shift are profound:

Sustainability & Efficiency: Hydro cooling’s superior thermal management allows for higher power densities and longer-term viability, reducing energy waste and operational costs.

Hardware Obsolescence: The accelerating pace of hydro-cooled advancements suggests shorter lifespans for older machines, incentivizing frequent upgrades to maintain profitability.

The Next Frontier in Mining: As chip efficiency approaches physical limits, future breakthroughs will likely come from cooling innovations rather than transistor scaling alone.

Hydro and immersion cooling are poised to drive the next wave of mining efficiency, potentially pushing toward the 1 J/TH benchmark.

Ultimately, the data makes an undeniable case: Hydro-cooled ASICs are the future of Bitcoin mining.

While air-cooled machines will continue to serve certain use cases, their diminishing returns in performance growth signal an industry-wide transition toward liquid-cooled solutions.

Miners who adapt early to this trend will secure a decisive advantage in the coming years, while those relying solely on air-cooled hardware risk falling behind in an increasingly competitive and efficiency-driven industry.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True. If you would like to support to help further secure the integrity of our research initiatives, please donate here

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment