Power Efficiency Theory states that the value of a thing is determined by how fast its performance improves and how quickly its energy cost per unit output declines.

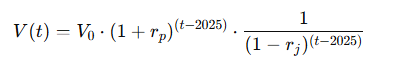

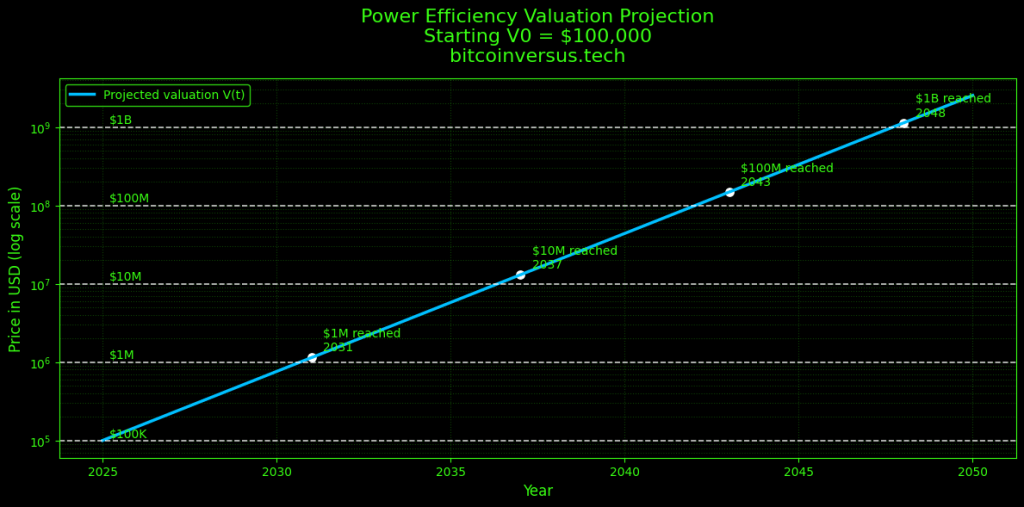

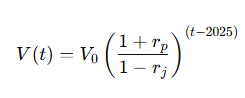

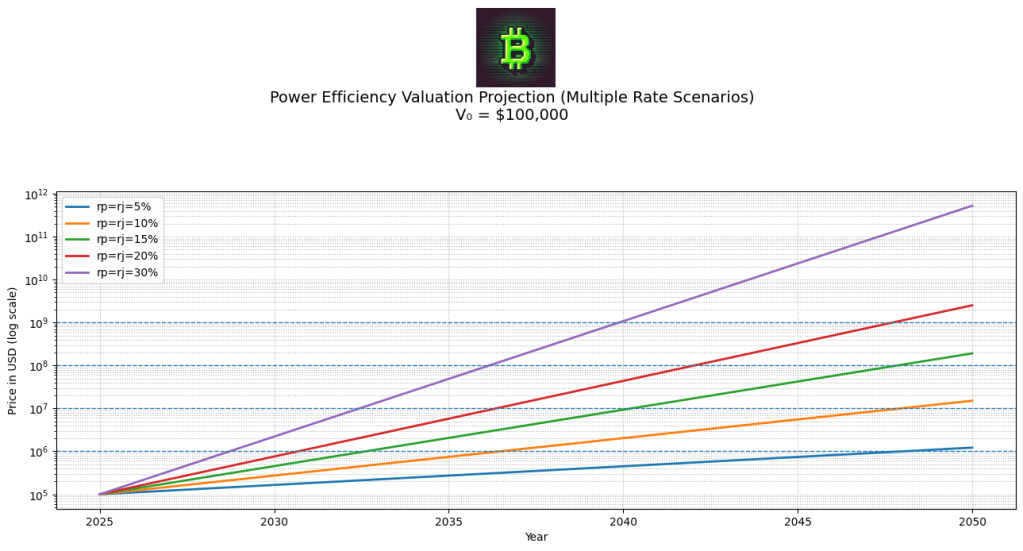

Starting from an initial value V₀, the value grows each year by the performance improvement factor (1 + rₚ) and is scaled upward by the inverse of the efficiency factor (1 − rⱼ), because lower energy required per unit of output (should increase) the value of the system.

So, the value of a system increases when the system produces more output per second and uses less energy to do it.

The longer those improvements continue, the higher the valuation becomes.

If a system does not increase its output per second and does not reduce the energy required per unit of output, then both improvement rates are zero.

So, if nothing improves within the system, the value of that system also should not increase.

This would also mean that, if a system’s output per second declines and its energy efficiency worsens, then its value should decrease accordingly.

Keep in mind that the valuations are in a vacuum.

The results of the equations are seemingly optimistic, and we should take evidential caution when analyzing any new and emerging system.

To make Power Efficiency Theory easy to understand for people who are not well versed in #bitcoin mining energy analytics, it helps to translate the concept into something familiar like cars.

Most people already understand miles per gallon (MPG) and miles per hour (MPH).

MPG is an efficiency metric. It tells you how far you can go using one unit of fuel.

MPH is a performance metric. It tells you how much travel output you get per unit of time.

The average (new) gas powered vehicle today costs roughly $50,000, achieves about 25 miles per gallon, and operates at an average speed of around 60 miles per hour.

So, as an amusing thought experiment, imagine a world where cars experience an order of magnitude improvement, similar to a major generational leap in ASIC mining chip performance.

Over a 10 year period, it improves by ten times in the two metrics people immediately recognize (MPH and MPG).

So, the average rate of efficiency goes from 25 MPG to 250 MPG.

And The average rate of speed goes from 60 MPH to 600 MPH.

That’s 10x gain in efficiency and a 10x gain in speed.

Ten times more efficient multiplied by ten times faster becomes a 100x improvement in the combined performance score.

If the market priced the average vehicle in proportion to that combined improvement, then a $50,000 car multiplied by a 100x capability jump implies a market value of $5,000,000.

In a world where a mainstream car can reliably cruise at 600 mph while also achieving 250 MPG, the product is no longer competing with normal cars.

It starts competing with airplanes, high speed rail, and premium transport services.

Under that reality, a $5,000,000 price is a plausible reflection of how markets tend to value an overall improvement in performance (when it is real, safe, legal, and usable at scale).

When performance improves by an order of magnitude in multiple dimensions, it stops feeling like a normal product upgrade and starts behaving like a totally different class of technology.

The same concept applies when you talk about Bitcoin mining hardware with joules per terahash (J/TH) and also the computational power – terahash per second (TH/s).

When you apply (performance) efficiency theory in ASIC mining, you are not saying a machine is slightly better.

You are describing compounding jumps in how efficiently energy can perform computational work.

When a machine gets dramatically more efficient, it completely changes the economics of operation. It changes operational variables, like how much hash (or how many machines) can be deployed per megawatt.

The vehicle power efficiency analogy is a way to help people understand why power and/or efficiency can reshape what something is worth.

J/TH and TH/s are simply the mining industry’s version of measuring computational efficiency and power, respectively.

Disclaimer: I’m not a financial advisor. This is comprehensive technical advice on a new and emerging technology. I report on financial subjects purely for informational purposes.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True.

If you would like to support to help further secure the integrity of our research initiatives, please donate here: bc1q5qgtq8szqa6yy38tqpsyuk3hynq8zy3xvqhsvzecj8lnryrnzhmqsfmwhh

Leave a comment