Bitcoin is (probably) for everyone.

But, from an account of comprehensive independent research, deploying and managing thousands of ASIC Mining servers in below-freezing temperature in the middle of nowhere is (probably) not for everyone.

The operation of a network like this is physically expensive, to say the least.

But this extreme physical cost in security is also why the network is so valuable.

Space, Time, and Energy along with dollars are exchanged to increase the physical energy capacity and thus, strengthen the security of the network.

This increase of physical improvement also increases the cost of attack (security) while it simultaneously weakens the benefit of attack (J.P. Lowery, Softwar). This would make the protocol more strategically secure, at the very least.

The cost of security is so high at this point, that the protocol can’t possibly be invaluable, from a utility standpoint at the very least.

Imagine a stronger local grid and a flexible controllable load resource for your power district. The potential use of constant or intermittent energy is valuable, in and of itself.

So there is a consensus that it has some sort of physical value.

The question is how does one measure the progress of that physical value.

And how does one value the progress of that entire system in relation to its physical improvement over time.

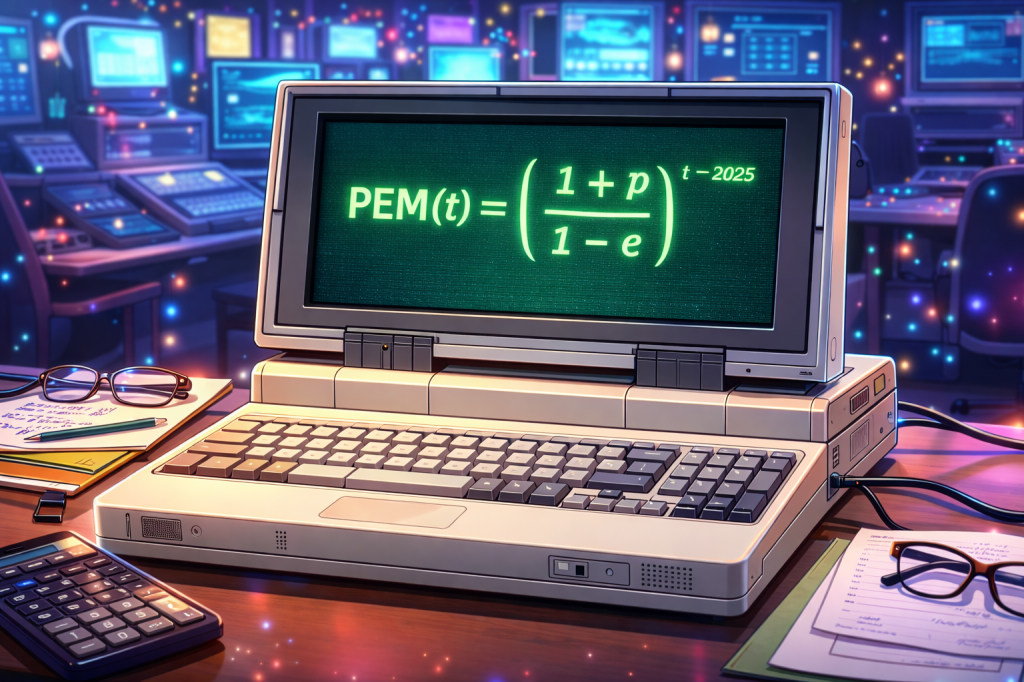

Power Efficiency Theory aims to measure the value of the improvement within that physical system over time through a mathematical analysis of the energy metrics (TH/s and J/TH/s) of the machines that secure and verify the transactions on that network.

Furthermore, Power Efficiency Theory could also be used to measure the “physical intrinsic value” of products across different markets. When a well-off individual says something like a market asset would “fall to its utility value”, they are implying that the asset has been miscalculated due to superficial or artificial or non-physical factors that sometimes enter the market.

So, I suppose I should also site Einstein because what we’re actually measuring is the energy of the product that somebody wants to sell. Energy is equal to mass multiplied by the speed of light. It’s a constant.

Similarly (and more specifically) The Power efficiency of the product that you’re selling should also be equal to some sort of equivalent to the mass and/or the speed of that product along with its physical progression, stagnation, or decline.

Putting a valuation point on a system at its physically intrinsic value could be a foundational constant in valuing new and emerging technological systems at the very least.

If my hypothesis is correct, then a consistent increase in improvement of the Power Efficiency variables within the bitcoin protocol, whether in computational power (hashrate) or in joule per terahash efficiency, should be the main factor in the increase of the value of that entire system over time.

Ultimately, I believe that, at the very least, new and emerging technologies will be valued more by their intrinsic, physical, energetic properties, and less by artificial indicators like “market sentiment.”

I will admit that the results of the equations are optimistic.

The physical prediction of a 20% increase in Power/Efficiency is fairly realistic, but the simultaneous valuation prediction is likely a decade or more early, as we seemingly have to account for moments in time that we can’t precisely account for (like 5-year and 10-year global market contractions for whatever uneventful reason).

So, while the equations are optimistic, the actual valuation point will likely lag the physical improvements of that the bitcoin protocol by as much as 5 years or 10 years or even more.

Disclaimer: This is not financial advice. This is comprehensive technical analysis on a new and emerging technology. Do your own research and/or contact a professional advisor before making any investment decisions.

Leave a comment