Energy could be considered a form of currency.

But we’re (probably) not that far along, yet (as a society).

The closest thing we have is an electronic P2P payment system that requires energy to work.

It’s called bitcoin.

It’s a fascinating science experiment that has required us (humanity) to rethink the fundamentals of computer security, let alone the fundamentals of how we value stuff in relation to the protocol.

So, since it’s fundamentally changing stuff, we might as well, at the very least, consider how this new and emerging system might be valued fundamentally, right?

What if price isn’t the driving force of this new system?

What if the physical improvement and innovation behind the idea was the driving force of the price?

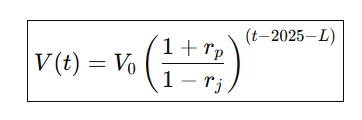

What if you could track the energy metrics of this system, and determine the value solely (or mostly) on the improvement of its physical properties – It’s power and efficiency – over time?

That’s basically what I’m trying to do with Power Efficiency Theory.

The problem is, there are several variables we have to account for and then (somehow) we also have to simultaneously account for unknown variables that will happen (like an uneventful global event, A.K.A a recession) even though we don’t actually know when exactly these unknown variables will happen.

So, basically, I have this idea, and if I’m right about the idea, it means we can (probably) use power and efficiency metrics to determine the value of new and emerging technologies.

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment