Power Efficiency Theory could also be used to measure the “physical intrinsic value” of products across different markets.

When a well-off individual says something like a market asset would “fall to its utility value”, they are implying that the asset has been miscalculated due to superficial or artificial or non-physical factors that sometimes enter the market.

So I suppose I should also cite Einstein because what we’re actually measuring is the energy of the product that somebody wants to sell. Energy is equal to mass multiplied by the speed of light. It’s a constant.

Similarly (and more specifically) The Power efficiency of the product that you’re selling should also equal some sort of equivalent to the mass and/or the speed of that product along with its physical progression, stagnation, or decline.

Putting a valuation point on a system at its physically intrinsic value could be a foundational constant in valuing new and emerging technological systems at the very least.

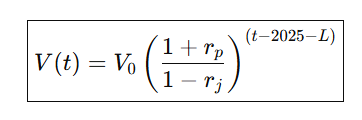

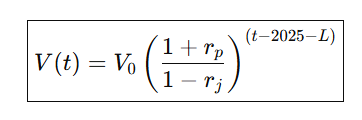

So, at this point, we have the chart here but the equation is missing one crucial point – it’s (supposed to be) a conservative chart in that we must also assume the lowest point within the 4 year lag of the price prediction… so perhaps we can represent that and express it properly within the equation.

Because we’re trying to somehow account for uneventful events in the future that we can’t actually account for, like a recession or natural disaster, if that makes sense.

BitcoinVersus.Tech Editor’s Note:

We volunteer daily to ensure the credibility of the information on this platform is Verifiably True. I

If you would like to support to help further secure the integrity of our research initiatives, please donate here: 3C9o19EH5HSiwEPyCTmEKzxhNCbo2X6TTb

Leave a comment