finance

-

In a remarkable turn of events, Changpeng Zhao, known as CZ, the founder of Binance, has returned to the public eye after serving a four-month sentence in a U.S. federal prison for Anti-Money Laundering (AML) violations. Released on September 27, CZ’s brief incarceration marks him as the wealthiest person ever to serve time in a…

-

Emory University has made headlines with its investment of approximately $15.8 million in the Grayscale Bitcoin Mini Trust (BTC). This significant move places Emory among the pioneering higher education institutions to include Bitcoin ETF holdings in their endowment strategies. The university’s recent SEC filing highlights ownership of about 2.7 million shares in the trust, showcasing…

-

Bitcoin surged to a new all-time high of $77,000 on Friday, reflecting heightened investor enthusiasm following Donald Trump‘s recent election victory and his commitment to fostering a more cryptocurrency-friendly administration. The influx of capital into spot Bitcoin exchange-traded funds (ETFs) on Wednesday and Thursday significantly contributed to this price escalation. These ETFs, which directly hold…

-

-

BlackRock Inc. recently reported holding a 5.2% stake in MicroStrategy Inc. (MSTR) through its latest SEC Schedule 13G/A filing. The holding reflects a significant investment in the business intelligence firm, notable for its extensive Bitcoin reserves and its alignment with the broader Bitcoin strategy spearheaded by CEO Michael Saylor. BlackRock’s stake highlights the institutional interest…

-

Prominent figures in the financial and cryptocurrency sectors have made ambitious predictions regarding Bitcoin’s future value, reflecting their perspectives on its potential role in the global economy. Cathie Wood, CEO of Ark Invest, projects Bitcoin reaching $1 million by 2030. Her optimistic outlook is based on anticipated widespread adoption and Bitcoin’s potential to become a…

-

NVIDIA has surpassed Apple Inc. to become the world’s most valuable company, with a market capitalization exceeding $3.5 trillion. This milestone reflects the growing influence of artificial intelligence (AI) in the technology sector. NVIDIA’s stock has surged over 850% since the end of 2022, driven by high demand for its AI-capable chips. Major tech companies,…

-

MicroStrategy, the largest corporate holder of Bitcoin, has recently unveiled a grand plan to enhance its Bitcoin reserves by committing an unprecedented $42 billion over the next three years. This initiative, known as the “21/21 Plan,” is designed to equally balance the acquisition of $21 billion in equity and $21 billion in fixed-income securities. This…

-

The Central Bank of Argentina (BCRA) made history by becoming the first central bank globally to host a live Bitcoin mining exhibit as part of an art display. The exhibition, titled Art, Artificial Intelligence, and the Future of the Economy, features real crypto mining rigs and installations by artist Alberto Echegaray, including the notable “Moneyballs”—spheres…

-

VanEck’s head of digital assets research, Matthew Sigel, expressed optimism regarding Bitcoin’s potential in the lead-up to the upcoming U.S. presidential election. During an interview on CNBC’s Squawk Box, Sigel highlighted market trends that suggest an advantageous position for the cryptocurrency. Sigel pointed out that Bitcoin’s current setup may pave the way for significant gains…

-

Fidelity’s Wise Origin Bitcoin Fund (FBTC) continues to grow its assets, now holding 184,219 Bitcoin, valued at over $12 billion as of October 2024. Fidelity’s move into the cryptocurrency space with a dedicated Bitcoin exchange-traded product (ETP) demonstrates how traditional finance is bridging the gap to digital assets, offering investors a safer way to access…

-

Michael Saylor’s recent comments on Bitcoin self-custody have sparked considerable debate within the cryptocurrency community. In an interview, Saylor suggested that relying on large financial institutions—often referred to as “too big to fail” banks—could be a safer option than individual self-custody, which he argued increases seizure risks, particularly when managed by non-regulated entities. He referred…

-

MicroStrategy has revealed an ambitious capital gameplan, aiming to raise $42 billion, split between an at-the-market (ATM) equity offering and fixed-income securities. The company plans to secure $21 billion through each channel, allowing it to expand its Bitcoin holdings while supporting its business intelligence operations. The announcement underscores MicroStrategy’s enduring commitment to Bitcoin as a…

-

The U.S. Treasury has identified a notable trend in which the rising use of stablecoins is significantly increasing the demand for U.S. Treasury bills. Treasury reports reveal that stablecoin assets now leverage approximately $120 billion in collateral tied up in T-bills and Treasury-backed repo transactions. This shift has resulted from stablecoins’ reliance on liquid, short-term…

-

Former President Donald Trump recently voiced his concerns regarding the tax treatment of Bitcoin and cryptocurrencies. In remarks during his campaign, Trump questioned the fairness of capital gains taxes on Bitcoin, arguing that users should not incur tax liabilities when using Bitcoin for everyday purchases, such as coffee. This perspective marks a notable shift in…

-

NBA legend Scottie Pippen recently made waves in the cryptocurrency community by predicting a significant rise in Bitcoin’s price. In a post shared on X (formerly Twitter), Pippen claimed that Bitcoin’s anonymous creator, Satoshi Nakamoto, appeared to him in a dream, forecasting that Bitcoin would hit $84,650 on November 5, 2024. His tweet quickly sparked…

-

A Moscow court has imposed an unprecedented $20 decillion fine on Google for allegedly blocking Russian pro-Kremlin YouTube channels. This fine—a number almost inconceivably large—exceeds the global economy’s worth. The lawsuit, driven by various Russian broadcasters, stemmed from Google’s removal of Russian state media channels under Western sanctions, intensifying legal tensions between the tech giant…

-

Charlie Munger, who passed away recently, has long been a significant figure in the financial world, known for his outspoken criticism of Bitcoin. Despite his passing, Munger’s harsh views on the cryptocurrency continue to be referenced in discussions about Bitcoin’s future. The Daily Hodl recently highlighted Munger’s strong stance against Bitcoin, using his critiques to…

-

Jack Mallers, CEO of Strike, made a compelling point during a recent debate with Peter Schiff, emphasizing Bitcoin’s ability to achieve transaction finality without reliance on government or central authority. Mallers argued that gold, while historically valuable, is limited by its dependence on centralized institutions for verification and settlement. He highlighted that without a government…

-

Billionaire investor Tim Draper has spearheaded a $2.5 million pre-seed funding round for Ark Labs, a promising startup focused on advancing Bitcoin transactions by making them faster and more cost-effective. Ark Labs, is working on a protocol designed to simplify Bitcoin payments, making the cryptocurrency more accessible for everyday global commerce. Draper, known for his…

-

The European Central Bank recently renewed its critical stance against Bitcoin, asserting that the cryptocurrency’s true value is zero. In a report co-authored by Ulrich Bindseil and Jürgen Schaaf, ECB officials argue that Bitcoin has failed to deliver on its original promise of becoming a global payment system, instead evolving into a speculative investment asset…

-

In a recent report titled Bitcoin’s Protection under the First Amendment, Ross Stevens, the founder of NYDIG, argues that Bitcoin qualifies as “speech” under U.S. constitutional law. According to the report, Bitcoin’s decentralized structure and the freedom it provides from government-controlled money make it an inherently political tool. Stevens suggests that Bitcoin’s core functions, such…

-

The Italian government has announced plans to significantly increase its capital gains tax on Bitcoin and other cryptocurrencies from 26% to 42%. This move, part of the country’s 2025 budget plan, aims to generate additional revenue to fund public services and address fiscal shortfalls. Deputy Economy Minister Maurizio Leo confirmed the proposed hike during a…

-

In a recent interview with “Scarce Assets,” Michael Saylor emphasized Bitcoin’s critical role in revitalizing struggling companies. During the discussion, Saylor argued that Bitcoin is the “universal merger partner” and a key solution for “zombie companies” in the Russell 2000. His recommendation? Recapitalize these businesses using Bitcoin to ensure their survival. According to Saylor, Bitcoin…

-

Bitcoin continues to track global M2 money supply trends, and analysts are forecasting a potential surge in its price to $90,000 by the end of 2024. The M2 money supply, which measures cash and short-term bank deposits, has been a key indicator of Bitcoin’s performance in past cycles. As liquidity accelerates, Bitcoin is poised to…

-

Davinci Jeremie, a well-known figure in the cryptocurrency world, recently made a bold statement on social media: owning just one Bitcoin could be enough to secure early retirement within a decade. In a post on X (formerly Twitter), Jeremie urged followers to work hard until they acquire at least one Bitcoin, as the cryptocurrency’s future…

-

Ethereum co-founder Vitalik Buterin has publicly criticized MicroStrategy’s Michael Saylor for advocating that crypto assets, such as Bitcoin, should be held by large financial institutions like BlackRock and Fidelity. Buterin referred to Saylor’s approach as “batshit insane,” arguing that crypto’s foundational value lies in decentralization, not institutional control. Buterin emphasized that a regulatory capture strategy,…

-

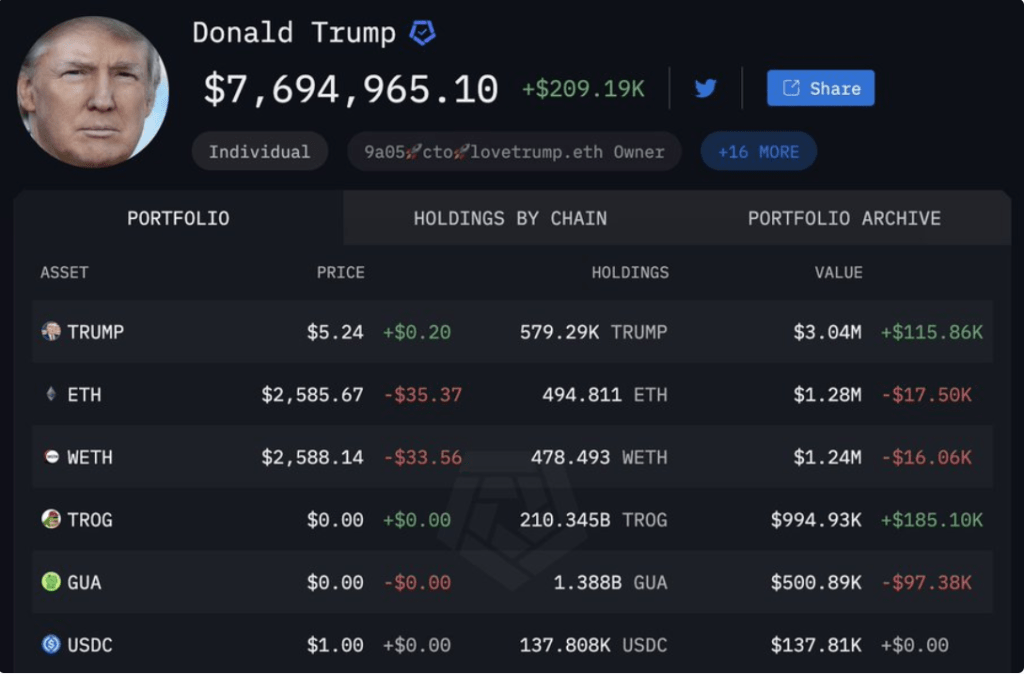

Presidential candidate Donald Trump has seen a significant rise in his cryptocurrency holdings in 2024, with a total increase of $6.1 million since the start of the year. This surge has largely been driven by his investment in meme coins, which now make up over 65% of his portfolio. Among his most prominent holdings is…

-

OpenAI, the artificial intelligence powerhouse, recently secured $6.6 billion in fresh capital from a mix of high-profile investors, including Citi and JPMorgan Chase. This funding round pushed OpenAI’s valuation to an impressive $157 billion. As AI demand surges, OpenAI’s services are projected to generate $3.7 billion in revenue for 2024 and are expected to grow…

-

Marathon Digital Holdings (MARA) recently announced securing a $200 million credit line, utilizing its substantial Bitcoin holdings as collateral. The funds aim to provide the company with enhanced liquidity and flexibility to pursue strategic growth opportunities, including expanding its mining operations and capitalizing on other corporate initiatives. MARA’s decision reflects its confidence in leveraging Bitcoin’s…

-

The Bitcoin Power Law model is primarily a form of quantitative analysis, applying mathematical principles to predict Bitcoin’s long-term price trends. It uses logarithmic transformations and regression analysis to define support and resistance levels, offering a structured approach to forecasting. While it overlaps with technical analysis, the model’s foundation in physics-based principles places it firmly…

-

Michael Burry, famed for his prescient bets against the housing market in 2008, shocked investors by tweeting a single word: “Sell.” At the time, the S&P 500 was trading around 4,076 points, and many feared a significant market downturn. However, the stock market defied expectations, with the S&P 500 soaring by 41% since ts, indicating…

-

Donald Trump’s latest venture into the cryptocurrency space, the World Liberty Financial (WLFI) token sale, encountered significant obstacles during its October 15 launch. Despite heavy promotion and Trump’s personal endorsement, the sale saw only 3-4% of its goal achieved, raising approximately $9-10 million out of the expected $300 million. Technical difficulties, including multiple website crashes,…

-

Bitcoin traders are carefully monitoring the market as Pledditor (@Pledditor) posted that Gareth Soloway, a well-known technical analyst, has entered another short position on Bitcoin at $68,000. Soloway’s bearish stance reflects his prediction that the cryptocurrency could face significant resistance at this price level, leading some investors to brace for a potential downturn. Bitcoin has…

-

A recent U.S. government filing has revealed that cryptocurrency exchange Bitfinex may be the only entity eligible for restitution following the infamous 2016 hack, in which approximately 120,000 Bitcoin (BTC) were stolen. The Bitcoin, valued at $72 million at the time, is now worth around $7.4 billion, reflecting the significant appreciation of the cryptocurrency. The…

-

BlackRock made headlines at the 2024 Digital Assets Conference in Brazil by showcasing the increasing importance of Bitcoin in modern investment portfolios. Jay Jacobs, BlackRock’s U.S. Head of Thematic and Active ETFs, emphasized that Bitcoin adoption is outpacing the growth of other major technologies. He highlighted how digital currencies are rapidly emerging as a monetary…

-

Morgan Stanley has disclosed that it has invested over $272 million in Bitcoin exchange-traded funds (ETFs), reflecting a growing confidence in cryptocurrency among traditional financial institutions. The investment is seen as part of a broader institutional shift toward Bitcoin, with firms like BlackRock and Fidelity also heavily involved in the Bitcoin ETF space. This significant…

-

South Korea’s Financial Services Commission (FSC) has taken a significant step towards approving spot cryptocurrency exchange-traded funds (ETFs), officially announcing the formation of a Virtual Asset Committee on October 10, 2024. The committee, composed of public and private sector experts, will act as an advisory body to review and approve Bitcoin and Ethereum spot ETFs,…

-

BlackRock has solidified its position as one of the largest institutional holders of Bitcoin, currently controlling 369,643 BTC worth approximately $29.6 billion. Over the past 10 months, BlackRock has acquired 1.76% of the total Bitcoin supply, showcasing its growing commitment to cryptocurrency investment strategies. This acquisition is not just a short-term play but a reflection…

-

Metaplanet, a Japanese publicly traded company, has acquired an additional ¥500 million worth of Bitcoin, bringing its total holdings to 360.368 bitcoins. This investment aligns with the company’s strategy to increase its Bitcoin reserves, following a ¥1 billion loan secured for this purpose, totaling ¥3.45 billion. This reflects the trend of public companies using Bitcoin…

-

In a recent interview with CNBC, Michael Novogratz, CEO of Galaxy Digital, predicted a transformative boost for Bitcoin driven by the launch of options trading on Bitcoin ETFs. Novogratz emphasized that while the rollout of these options has been slower than expected, they will act as a significant catalyst for the cryptocurrency market. “The next…

-

Italy’s Banca Sella, one of the oldest financial institutions in the country, has officially introduced Bitcoin trading services through its mobile banking platform, Hype. This move marks a significant milestone in the integration of traditional banking with cryptocurrency, providing more than 1.3 million customers direct access to Bitcoin trading without needing external exchanges. The service…

-

The U.S. stock market is seeing a unique “Goldilocks” moment, where economic conditions are neither too hot nor too cold, providing an ideal environment for equity growth. Bank of America’s head of U.S. equity strategy, Savita Subramanian, has highlighted that recent data, including stronger-than-expected job growth, has created this balanced situation. The term “Goldilocks” refers…

-

XRP experienced a sharp drop, losing over 10% of its value following the U.S. Securities and Exchange Commission’s (SEC) latest move to appeal a pivotal court ruling in its lawsuit against Ripple Labs. The legal battle between Ripple and the SEC has been ongoing since 2020, with the regulatory body asserting that XRP should be…

-

As of October 2024, Ross Stores, Inc. ($ROST) has surpassed MicroStrategy ($MSTR) in market capitalization, showcasing the strength of the retail giant against the tech-focused company. Ross Stores, a major player in the retail space, now boasts a market cap of $49.01 billion, driven by its strong presence in the discount retail sector. The company’s…

-

-

Ardizor, a self-proclaimed “research wizard,” predicts Bitcoin’s bull market will start in October 2024, following historical price cycles related to halving events. He suggests that post-halving, Bitcoin typically sees significant price increases, potentially attracting more mainstream participants and interest in the crypto market.

-

On August 15, 2024, Defiance ETFs introduced the first-ever leveraged ETF focused on MicroStrategy, known as the Defiance Daily Target 1.75X Long MSTR ETF (MSTX). This ETF is designed to offer investors 1.75 times the daily percentage change in MicroStrategy’s stock price. Given MicroStrategy’s substantial Bitcoin holdings, this ETF provides a unique opportunity for investors…

-

-

-

As the Federal Reserve approaches its September 18th meeting, market sentiment has shifted, with traders now predicting a 50 basis point (bp) rate cut. The shift in expectations follows economic data suggesting that the central bank may need to ease monetary policy to manage inflation and stimulate growth. Currently, the Fed’s target interest rate stands…

-

MicroStrategy has announced plans to offer $700 million in convertible senior notes due 2028. This private offering will be available to qualified institutional buyers under Rule 144A of the Securities Act. The proceeds will be primarily used to redeem $500 million in existing Senior Secured Notes, which carry a 6.125% interest rate, maturing in 2028.…

-

Former President Donald Trump is stepping into the decentralized finance (DeFi) space with the launch of World Liberty Financial, a new cryptocurrency project. Trump made the announcement on X (formerly Twitter), stating that the project will officially launch next Monday at 8 p.m. during a Space hosted on the platform. The former president’s pivot towards…

-

The 1000-day Bitcoin trading strategy aims to capitalize on Bitcoin’s cyclical price movements around halving events. It involves accumulating Bitcoin approximately 500 days before halving to benefit from lower prices and holding through the subsequent 500 days of potential price increases. Historical data supports its effectiveness, but caution and research are crucial due to inherent…

-

-

-

The U.S. dollar has significantly depreciated compared to real estate values and Bitcoin over the past eight years. The median home price in the United States has increased from $288,400 in 2016 to $434,700 in 2024, while the amount of Bitcoin needed to purchase the same home has decreased from 664 BTC to just 6.6…

-

-

Mastercard introduces Crypto Credential service, simplifying cryptocurrency transactions with user aliases instead of complex addresses. This enhances user experience and minimizes errors. The service ensures secure transactions by verifying user identities and recipient wallet compatibility. Initially available in select countries, it will expand globally, catering to over seven million users and extending to various applications…

-

-

-

Jennifer Lopez’s engagement ring collection, estimated at $17 million, stands as one of the most impressive in Hollywood. With the current price of Bitcoin at approximately $64,000 per coin, her collection is equivalent to about 265 BTC. This glamorous assortment includes six rings from five different partners, each symbolizing significant moments in her life. The…

-

Federal Reserve Chair Jerome Powell announced that the time has come for policy adjustments, indicating a shift towards cutting interest rates. Speaking at the Jackson Hole Economic Symposium, Powell emphasized that while inflation has been a challenge, recent data shows progress toward price stability. The Federal Reserve’s key rate, currently at its highest in 25…

-

The Michigan Retirement System has invested $6.6 million in ARK 21Shares Bitcoin ETFs, making it the third U.S. state pension fund to include Bitcoin ETFs. This follows a trend of public pension funds exploring digital asset investments. The SEC’s approval of Bitcoin ETFs has encouraged institutional adoption, with more funds considering similar investments.

-

-

Michael Saylor, the chairman and co-founder of MicroStrategy, has once again taken to social media to advocate for Bitcoin during a pivotal moment in the global financial landscape. In his latest statement, Saylor declared, “There is a revolution taking place in global capital markets amid a digital transformation in finance. TradFi is a 2% solution;…

-

-

-

-

Bitcoin’s value dipped below $50,000 for the first time since February, reaching a low of $49,351 amid a broader market sell-off. This has contributed to a 17% reduction in the overall cryptocurrency market capitalization. Factors such as increasing interest rates, inflation concerns, and regulatory pressures on cryptocurrency exchanges have influenced this downturn. Market analysts are…

-

-

Senator Cynthia Lummis proposed the BITCOIN Act, aiming to establish a federal Bitcoin reserve to stabilize the U.S. dollar and manage national debt. The bill aims to acquire 1 million Bitcoin over time, with bipartisan support emphasizing Bitcoin’s growing importance. The initiative reflects broader political interest in adopting Bitcoin as a key financial instrument.

-

Morgan Stanley, a leading Wall Street bank, has announced it will be the first major U.S. bank to offer Bitcoin exchange-traded funds (ETFs) to its wealth management clients. Starting this month, Morgan Stanley’s financial advisors will have the option to sell shares of BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC)…

-

-

-

Cantor Fitzgerald, a global financial services group, launches a $2 billion Bitcoin financing business with plans for additional increments. The CEO emphasizes Bitcoin’s potential as a universally recognized asset. This move reflects the firm’s commitment to expanding in the cryptocurrency market and is expected to create new opportunities for Bitcoin investors.

-

Larry Fink, CEO of BlackRock, has significantly shifted his view on Bitcoin, now praising it as a potential revolutionary force in finance. Initially skeptical, Fink admitted, “I was a proud skeptic… I studied it, learned about it, and I came away saying my opinion was wrong.” He acknowledged Bitcoin’s role in protecting against currency debasement,…

-

-

-

Fidelity’s Wise Origin Bitcoin Fund (FBTC) holds 34,126 BTC valued at $1.37 billion as of January 22, 2024. This significant investment reflects Fidelity’s long-term commitment to Bitcoin and its belief in digital assets’ potential. The SEC’s approval of Bitcoin-focused ETFs has further boosted Fidelity’s position in the market, signaling increasing acceptance of cryptocurrencies in traditional…

-

-

-

-

Bitwise, Fidelity, and BlackRock Lead Historic Inflows into Bitcoin ETFs BITB by Bitwise led all new Spot Bitcoin ETFs with the highest net inflow on its first day of trading, amounting to $237.9 million. This remarkable performance can be attributed to its competitive pricing structure, offering the lowest fee among spot Bitcoin ETFs at 0.20%,…

-

-

-

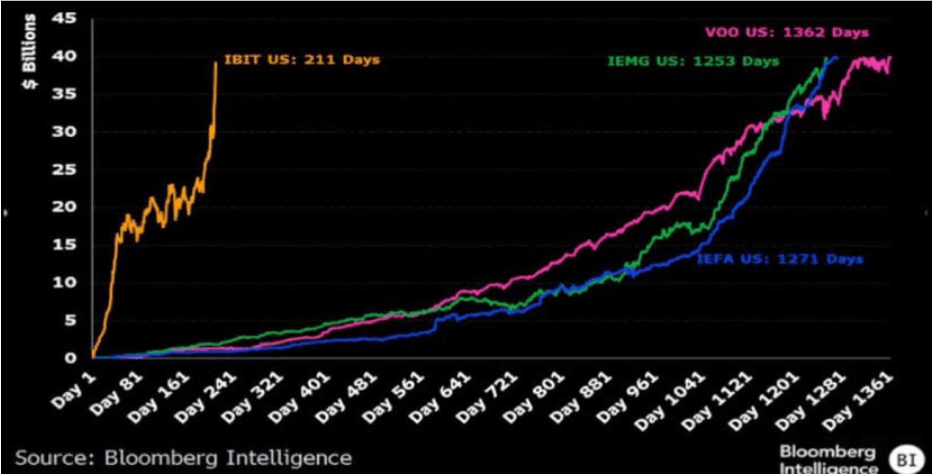

BlackRock’s iShares Bitcoin Trust (IBIT) has achieved unprecedented success, amassing $40 billion in assets under management (AUM) within 211 days of its January 2024 launch. This rapid growth positions the Bitcoin ETF among the top 1% of all exchange-traded funds by size, surpassing all ETFs introduced in the past decade. The surge in IBIT’s AUM…

-

-

-

-

-