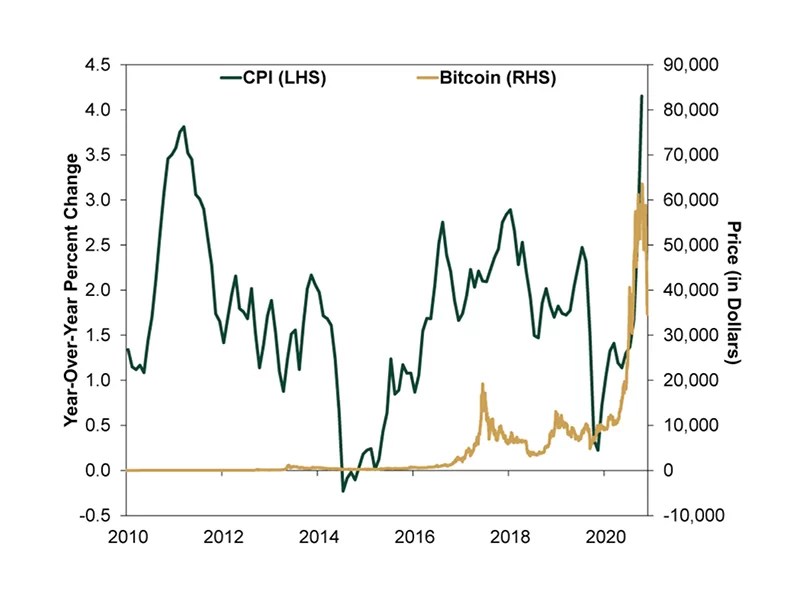

The CPI-Bitcoin Connection

For Bitcoin aficionados, inflation has often been perceived as a favorable factor. Historical data underscores this sentiment, showcasing two of Bitcoin’s all-time highs of $65,000 and $69,000 during a phase of robust monetary expansion and escalating inflation in 2021. Furthermore, as governments and colossal institutional investors warm up to Bitcoin, the monthly CPI data’s impact on BTC prices becomes more evident. To underscore this, a mere 48 hours post the last CPI release on July 12 led to a 4% surge in Bitcoin’s price, establishing a new zenith for 2023 at $31,500.

CPI in Relation to Bitcoin. Source: Skrill.com

The Ripple Effect on Disposable Income

An inverse relationship exists between consumer prices and Bitcoin’s price. When consumer prices soar, Bitcoin tends to see a downturn. This pattern isn’t isolated to Bitcoin alone but spans the entirety of the digital asset spectrum. Simplified, rising prices on essentials like food and utilities leave consumers with less disposable income. Since priorities like sustenance and utility bills supersede investment in Bitcoin and other cryptocurrencies, there’s a palpable reduction in expenditure on digital assets.

Crypto’s Affinity with Monetary Inflation

Monetary inflation, characterized by the swelling money supply, usually results in a corresponding climb in the CPI. However, it’s crucial to delineate between monetary inflation and the prices consumers and manufacturers deal with. The former encapsulates the volume of money in circulation.

Consumer Price Index for the Rest of 2023 Source: U.S. Government

A noticeable trend is that when the M2 money supply augments, Bitcoin and the crypto realm bask in substantial gains. Conversely, when the M2 contracts, the digital assets realm grapples. Drawing parallels with historical graphs, it becomes apparent that the M2 growth rate began its descent towards the end of 2021 and the commencement of 2022. This dovetailed with the apex of the crypto market the preceding year, suggesting that this wasn’t a mere coincidence.

Bitcoin: The Monetary Inflation Hedge

Time and again, history has spotlighted Bitcoin’s market cap evolution in tandem with the M2 supply’s growth, making it evident that cryptocurrency stands as a bulwark against monetary inflation. Thus, with the anticipation of the money supply burgeoning anew, the crypto market cap is likely to emulate its trajectory.

Leave a reply to Prediction: Bitcoin Hashrate to Hit New All-Time Highs by Year-End – Bitcoin Versus Cancel reply