Employees’ Pay Lags as Bitcoin’s Worth Continues Its Ascendancy.

The unstoppable growth of Bitcoin is making headlines, often eclipsing the rate at which employees receive pay raises. As the U.S. dollar’s strength diminishes over time, Bitcoin’s consistent appreciation highlights an essential financial trend. With the increasing value of Bitcoin, acquiring even one becomes a distant dream for many. This dynamic shift encourages experts to opine, “In a world where the dollar’s value wanes, diversifying savings into Bitcoin seems not just wise but almost essential.”

Workers’ Share of Economic Pie Shrinks

While most of the 20th century saw employee compensation and corporate profits moving in tandem, the recent decades paint a different picture. Since the dawn of the new millennium, while employee compensation has grown by a mere 28% after adjusting for inflation, corporate profits have more than doubled, marking a 107% increase. This widening chasm became glaringly apparent in 2021. Corporate coffers swelled by 25% while middle-income worker wages took a hit, dropping by 2%.

Corporate Profits and Employee Compensation: A Tale of Two Metrics

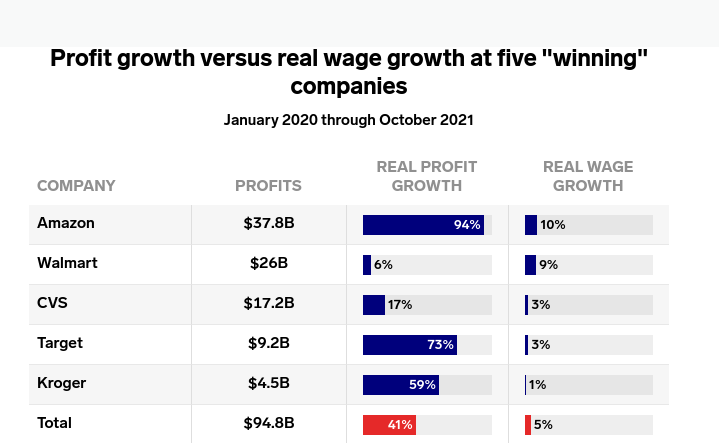

The disparities between corporate profits and employee compensation in 2021 stand out. Profits for five major companies shot up by 41% as wages lagged behind with a 5% increment. Interestingly, while worker pay saw an gain of $27 million, these companies channeled a massive $800 million towards stock buybacks. By the third quarter, the national income composition had employee compensation making up 64.1% and corporate profits at 11.5%. Corporate profits, calculated after accounting for wages, inventory adjustments, and capital consumption, have been buoyed by price hikes, despite a drop in some business costs.

Wages in 2023: A Snapshot

September 2023 witnessed a wage increase of 5.31% from the previous year. Historical data spanning from 1960 to 2023 reveals a wage growth averaging 6.19%. The year ending June 2023 marked a 4.6% surge in wages and salaries. Come 2022, the average annual raise across the US stood at 7.6%. Individuals switching jobs enjoyed a salary boost of 14.8%, in stark contrast to the 5.8% wage growth for those who stayed put. However, employers seem optimistic, forecasting an average salary change of 4.6% for 2023. Yet, with the annual inflation rate in the U.S. clocking in at 7.7%, the real value of these raises comes under scrutiny.

Tracing Corporate Profits

The United States’ corporate landscape has witnessed varying profit shares. From 1950-1970, it hovered near 16% of GDP. Between 1970-2000, there was a slight uptick to about 17%. The past decade, however, saw it oscillate around the 22% mark. It’s also noteworthy that high-paying roles, especially those at senior or executive levels, bear substantial turnover costs as a percentage of their salary, indicating a broader corporate strategy.

In the face of stagnant U.S. wage growth, the consistent rise of Bitcoin underscores its merit as a wise investment. For those feeling the pinch of the dwindling dollar’s purchasing power, turning to this burgeoning cryptocurrency might just be the financial safeguard they need in these uncertain times

Bitcoin Versus is not a financial advisor. This media platform reports on financial subjects purely for educational and entertainment purposes only. The information provided on this platform is not intended as investment, tax, legal, or other professional advice. You should not rely on this information as a substitute for individual advice from a licensed professional. Do your own due diligence and contact a professional financial advisor for any advice on how to invest your money.

Leave a reply to MARA Secures $200M Credit Line with Bitcoin Collateral – Bitcoin Versus Cancel reply