This is the finale of a three-part series on Power is Money.

I explore the intersection of the Kardashev scale’s energy classifications, the law of conservation of energy in physics, and the physics-to-economics model to get a better grasp of our economic progress.

Bitcoin emerges as a significant innovation within this framework, embodying the principles of energy efficiency.

Put simply, I’m trying to explain Bitcoin’s value using principles from physics within an economic context. Ultimately, Bitcoin continues to challenge (and win against) traditional economic models.

Furthermore, Bitcoin is redefining how we value our planet’s resources.

This concluding segment ties together concepts within physics and economics, culminating in a comprehensive understanding of how energy shapes our financial realities.

Bitcoin and the Relation to The Kardashev scale

Michio Kaku, a renowned theoretical physicist, has gone on record on several occasions to express his thoughts on the significance of the Kardashev Scale within the realm of theoretical physics. He’ll usually say something like:

“We physicists rank civilizations not by politicians and great men and great leaders; we rank them by energy. A Type 1 Civilization has mastered planetary energy. All the energy of the sun that falls on their planet – the weather, earthquakes, volcanoes. They play with hurricanes. That’s Type 1…”

These profound words lay the foundation for an understanding of wealth and progress from the intersection of physics and economics.

Essentially, our ability to control energy defines our potential, much like the Kardashev Scale predicts the advancement of civilizations based on their energy usage. Bitcoin mining is an energy-intensive process, and as such, it has spurred innovation in renewable energy sources and more efficient energy use, as miners seek cost-effective ways to power their operations. This drive towards energy efficiency can catalyze broader societal shifts towards cleaner and more sustainable energy practices, potentially accelerating our progress on the Kardashev Scale.

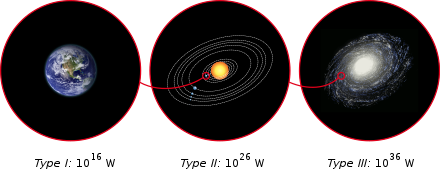

The Kardashev Scale is a theoretical framework proposed by Russian astrophysicist Nikolai Kardashev in 1964 to measure a civilization’s level of technological advancement based on its energy consumption. A Type I civilization can use all the energy resources of its planet, while a Type II civilization can harness the entire energy output of its star, such as through a hypothetical Dyson Sphere. A Type III civilization can utilize energy on the scale of its entire galaxy.

(Source: Wikipedia)

Currently, humanity is classified as a Type 0 civilization, as we have not yet achieved the level of energy efficiency and utilization to be considered a full Type I civilization. However, the rise of Bitcoin and its underlying technology presents a unique intersection of energy use and technological advancement that could be a significant factor in our transition towards becoming a Type I civilization.

There are extended concepts of the Kardashev scale that imagine even more advanced civilizations that can control energy across multiple galaxies or the entire universe. The Kardashev scale is simply a way to imagine the potential progress of humanity (or extraterrestrial civilizations) in terms of energy mastery and technological capability.

Bitcoin is Digital Energy

The law of conservation of energy states that energy cannot be created or destroyed, only transformed from one form to another. In the context of Bitcoin mining, this scientific principle finds a distinct parallel. Bitcoin mining is the process by which new Bitcoin are created and transactions are verified and added to the blockchain ledger. It requires substantial computational power, which in turn, demands a significant amount of electrical energy.

El Salvador is a pioneer in implementing econophysics into their economic model, as the country has implemented its own Bitcoin mining project named ‘Lava Pool,’ using clean geothermal energy from volcanoes. By tapping into geothermal power, El Salvador is turning the earth’s heat into electricity for Bitcoin mining, without using up the earth’s resources. This is a practical example of the law of conservation of energy, which states that energy cannot be created or destroyed, only changed from one form to another. Here, the country is converting volcanic heat, a natural and renewable energy source, into electric energy needed for Bitcoin mining, supporting innovation and eco-friendliness.

Bitcoin mining’s use of electrical energy is a direct application of the law of conservation of energy within the digital realm, an area largely untouched by the first wave of digital information. As MicroStrategy Chairman Michael Saylor puts it, “That entire wave – digital music, digital maps, digital messages that created the Apple, Amazon, and Facebooks – it didn’t include the transformation of digital energy.” Bitcoin’s emergence is groundbreaking; as Saylor notes, “Satoshi figured out how to implement the conservation of energy in cyberspace.”

Understanding the Physics to Economics Model

The Physics to Economics Model (PEM) brings this concept down to Earth, linking a society’s economic growth to how well it manages energy. Bitcoin is a real-world example of this model at work. It shows that economic success can come from the smart use of energy, as seen in the energy-intensive process of Bitcoin mining that supports and secures its network. This simple idea – that energy leads to economic power – is reshaping how we think about money in the 21st century.

The Physics to Economics Model (PEM) steps beyond traditional Keynesian economic theory, offering a fresh perspective by treating economics as a physical science. This model contends that just as energy in physics can change its surroundings, economies must be understood in terms of their capacity to do “economic work” — to grow, build, and innovate.

Bitcoin Verifies The Physics To Economic Model

The Physics to Economics Model draws parallels between kinetic energy in physics and economic activity. It implies that just as a truck’s kinetic energy determines its impact, an economy’s “economic kinetic energy” must be strong enough to propel growth and increase wealth.

Bitcoin serves as a testament to the Physics to Economics Model. Bitcoin is not just a technological innovation; it embodies the principle that energy can be converted into economic value. In Bitcoin mining, for example, electrical energy is used to power computational work that verifies transactions and secures the blockchain — a clear case of energy directly fueling economic activity.

The intersection of the Kardashev Scale, the principle of conservation of energy, and the physics to economics model casts Bitcoin in a new light. As civilizations evolve, their mastery over energy determines their place on the Kardashev Scale — from harnessing the power of a planet to potentially controlling the energy of the galaxy. Additionally, Bitcoin represents a real-world application of these theories, illustrating how energy can be conserved and transformed into economic value through Bitcoin mining. Furthermore, Energy efficiency and smart resource management are key to economic acceleration as suggested in the Physics to Economic Model. Bitcoin exemplifies the potential of harnessing energy in a way that could echo through our economic structures, emphasizing its overall significance for future innovation and growth in society.

Bitcoin Versus is not a financial advisor. This media platform reports on financial subjects purely for educational and entertainment purposes only. You should not rely on this information as a substitute for individual advice from a licensed professional. Do your own due diligence and contact a professional financial advisor for any advice on how to invest your money.

Leave a reply to Sports: Max Keiser to Host Bitcoin Golf Event in January 2025 – Bitcoin Versus Cancel reply