In the financial world, the emergence of Exchange-Traded Funds (ETFs) for gold, specifically SPDR Gold Shares (GLD), marked a pivotal point. Launched in November 2004, GLD transformed gold investing, making it more accessible and liquid. This shift in gold investment offers a crystal-clear parallel to the potential journey of Bitcoin ETFs in the digital asset realm.

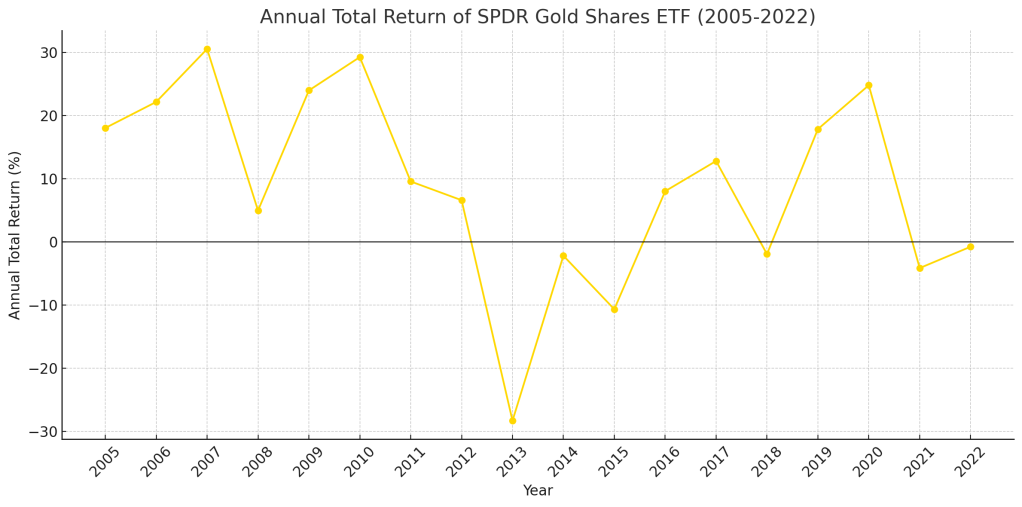

The impact of GLD on the gold market is quantifiable. Since its inception, GLD has experienced significant fluctuations in annual total returns. For instance, it saw a high of 30.56% in 2007 and a sharp decline of -28.33% in 2013. Its performance continued to oscillate, with notable spikes of 29.27% in 2010 and 24.81% in 2020. These figures showcase how GLD democratized gold investment, bringing more players and variability to the market.

Turning to Bitcoin, the cryptocurrency world watches with bated breath for a similar ETF innovation. A Bitcoin ETF would mirror the effects seen with gold, potentially increasing Bitcoin’s market awareness and liquidity. Such a development could lead to greater stability and growth in Bitcoin’s value, akin to the impact observed in the gold market post-GLD.

Drawing from GLD’s history, the introduction of a Bitcoin ETF could signify a turning point for cryptocurrency, attracting new investors and solidifying Bitcoin’s standing in the financial ecosystem. While still speculative, the parallel to gold’s ETF journey offers valuable insights into the possible future of Bitcoin as a mainstream digital asset.

Bitcoin Versus is not a financial advisor. This media platform reports on financial subjects purely for educational and entertainment purposes only. Do your own due diligence and contact a professional financial advisor for any advice on how to invest your money.

Leave a reply to VanEck Will Donate 5% of Bitcoin ETF Profits to Support Bitcoin Core Developers – Bitcoin Versus Cancel reply