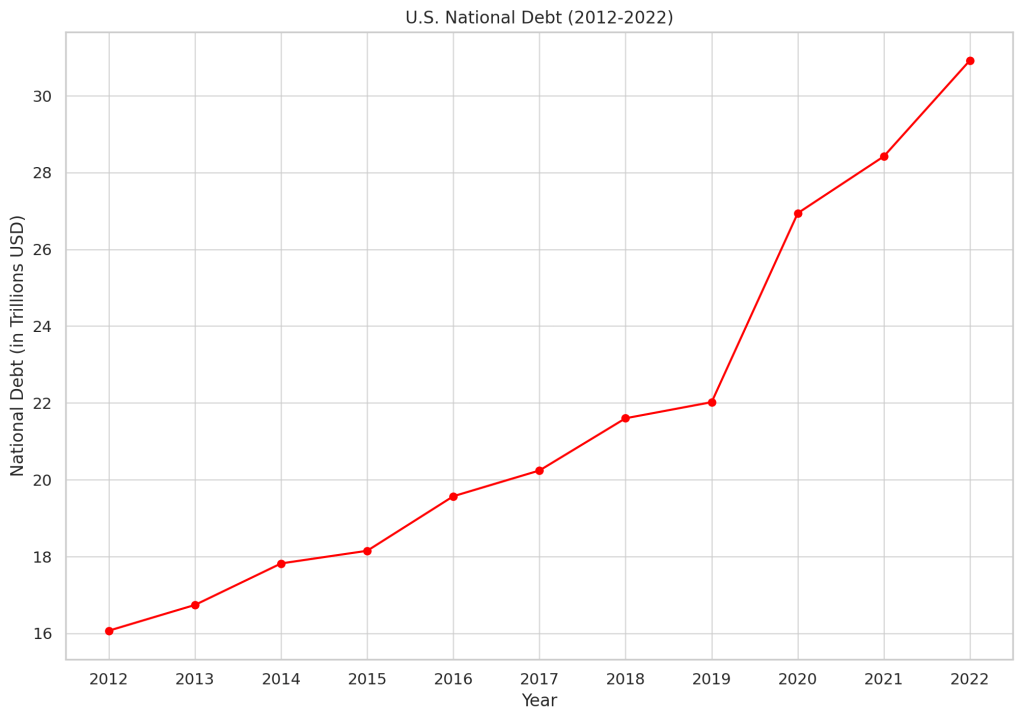

The U.S. national debt has been on an upward trajectory, escalating from $16.07 trillion in 2012 to a striking $30.92 trillion by 2022.

This period saw a gradual increase initially, with the debt climbing modestly year-over-year, reflecting a growing economy and increased government spending. However, a significant jump occurred in 2020, where the debt soared to $26.94 trillion, likely influenced by expansive fiscal policies and emergency spending in response to the COVID-19 pandemic. This trend continued into the subsequent years, marking a notable escalation in the nation’s financial obligations.

However, when this U.S. National debt is priced in Bitcoin, an interesting trend emerges. In the earlier years, when Bitcoin’s value was relatively low, the national debt measured in Bitcoin reached into the trillions. As Bitcoin’s value surged, especially in recent years, the national debt, when converted into Bitcoin, markedly decreased, dropping to mere millions by 2022. This trend not only highlights the growing national debt but also underscores Bitcoin’s dramatic rise in value over the years.

The U.S. National Debt, when priced in Bitcoin, reveals an exponential strengthening of the value of Bitcoin from 2012 to 2022. In 2012, the debt stood at around 3.04 trillion Bitcoin, drastically reducing to 23.63 billion Bitcoin by 2014. This downward trend continued, with the debt amounting to 1.58 billion Bitcoins in 2018 and further decreasing to 648 million Bitcoin in 2022 (Keep in mind Bitcoin’s total supply is capped at 21 million).

Bitcoin Versus is not a financial advisor. This media platform reports on financial subjects purely for educational and entertainment purposes only. The information provided on this platform is not intended as investment, tax, legal, or other professional advice. You should not rely on this information as a substitute for individual advice from a licensed professional. Do your own due diligence and contact a professional financial advisor for any advice on how to invest your money.

Leave a reply to Bitcoin Dada is Empowering Ugandan Women with Bitcoin Education – Bitcoin Versus Cancel reply