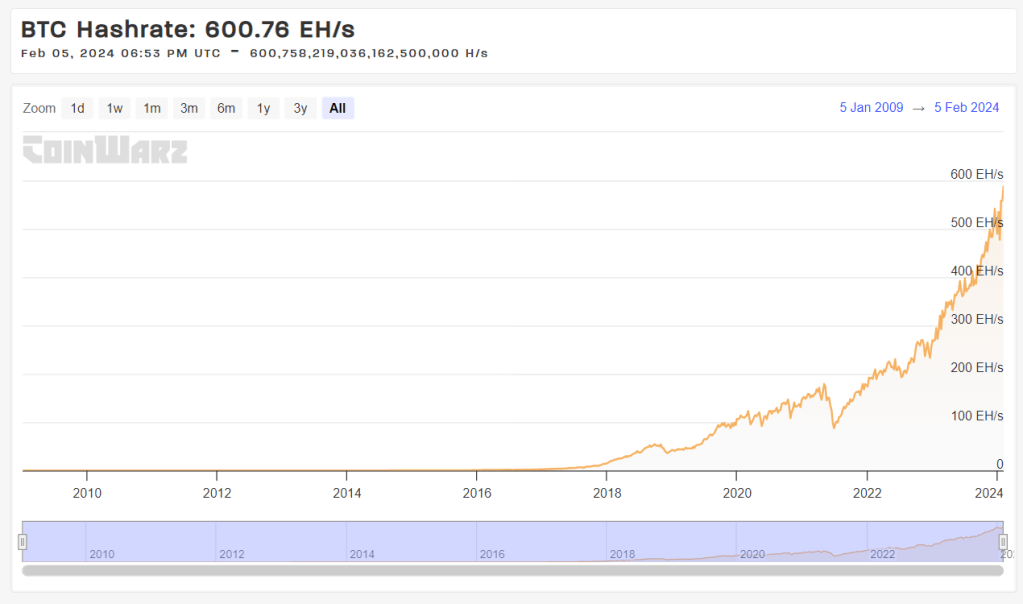

The Bitcoin network’s hash rate, a measure of the total computational power used to secure transactions and generate new blocks, is on a significant upward trajectory. As of early February 2024, the network’s hash rate reached 581.75 million terahashes per second (TH/s), marking a substantial increase from the previous year’s figures. This growth reflects a more than doubling of the network’s computational power, indicating robust participation and investment in Bitcoin mining activities.

The continued expansion of the Bitcoin network’s hash rate not only demonstrates the increasing security and resilience of the network but also highlights the growing interest and confidence in Bitcoin as a cryptocurrency. The network’s hash rate has seen fluctuations, reaching highs of up to 676.12 million TH/s in early February, showcasing the dynamic nature of Bitcoin mining activities.

This growth in hash rate is happening amidst a backdrop of environmental considerations, where Bitcoin mining’s energy consumption has been a point of concern. Innovations in utilizing flared gas for Bitcoin mining are presenting opportunities to reduce carbon emissions. The process involves converting waste gas from oil extraction, which would otherwise be flared into the atmosphere, into electricity for mining operations. Despite the environmental challenges associated with traditional energy sources, the integration of renewable and wasted energy sources like flared gas into mining operations is a step towards sustainability.

The current Bitcoin hashrate stands impressively at 624.39 EH/s, as per the latest data, indicating the network’s robust computational strength. This level of performance underscores the heightened security and efficiency of the Bitcoin network, ensuring faster transaction verifications and block generations. Such a high hashrate also reflects the competitive nature of Bitcoin mining, where miners globally contribute to the network’s operations. The peak hashrate reached a historic high of 716.21 EH/s on January 12, 2024, illustrating the network’s continuous growth and the increasing computational power dedicated to Bitcoin mining.

The geographical distribution of Bitcoin mining is also evolving. North America’s dominance in the Bitcoin hashrate is expected to wane as the industry looks towards regions with lower electricity costs, such as South America and Africa, following the Bitcoin halving event in April 2024. This shift is anticipated to lead to a more globally distributed mining landscape, which could affect the network’s dynamics and potentially lead to more decentralized and diverse mining operations. The halving event, which reduces the block subsidy, is likely to compress miners’ margins, prompting a search for more cost-effective mining solutions across different regions.

Disclaimer: Bitcoin Versus is not a financial advisor. This media platform reports on financial subjects purely for educational and entertainment purposes only. The information provided on this platform is not intended as investment, tax, legal, or other professional advice. You should not rely on this information as a substitute for individual advice from a licensed professional. Do your own due diligence and contact a professional financial advisor for any advice on how to invest your money.

Leave a reply to Bitcoin Crosses the $1 Trillion Market Cap Threshold – Bitcoin Versus Cancel reply