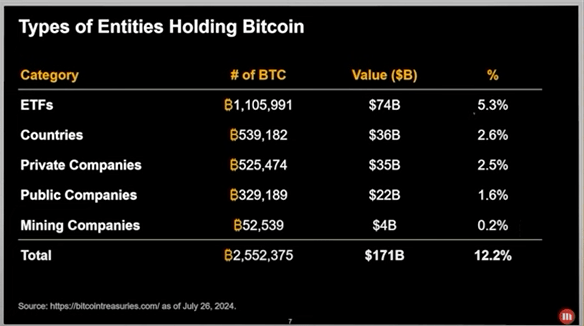

According to bitcointreasuries.com A substantial 12% of all Bitcoin is now in the hands of major institutions, marking a significant shift in the cryptocurrency landscape. This trend reflects a strong institutional endorsement of Bitcoin, encompassing a diverse range of entities including ETFs, private and public companies, and even national governments.

Exchange-Traded Funds (ETFs) lead the pack with an impressive holding of 81,105,991 BTC, valued at approximately $74 billion, which constitutes 5.3% of the total Bitcoin held institutionally. This substantial investment by ETFs indicates strong market confidence in Bitcoin’s potential as a stable investment vehicle.

At the 2024 Bitcoin Conference in Nashville, MicroStrategy’s treasurer, Shirish Jajodia, highlighted the transformative impact of their Bitcoin strategy. Since adopting Bitcoin as its primary treasury reserve asset, MicroStrategy has seen its market cap increase from $1.2 billion to $38 billion. This growth is not just a testament to the company’s strategic foresight but also signals to other corporations the potential benefits of integrating Bitcoin into their financial strategies.

Following closely behind are countries, which have collectively amassed 8,539,182 BTC, demonstrating the growing interest of national governments in cryptocurrency, either as a reserve asset or a strategic investment, valued at $36 billion. This represents 2.6% of the institutional holdings, highlighting the increasing governmental engagement with digital currencies as part of broader economic strategies.

Private companies also play a significant role, holding 8,525,474 BTC, valued at $35 billion. This investment represents 2.5% of the total institutional holdings, illustrating the private sector’s active participation and belief in the potential of Bitcoin to serve as a reliable asset.

Public companies are not far behind, with holdings of 8,329,189 BTC worth $22 billion, making up 1.6% of the total. This reflects a cautious but growing interest among publicly traded companies to incorporate Bitcoin into their asset portfolios, possibly for diversification and hedging against traditional financial systems.

Lastly, mining companies, which are integral to the Bitcoin ecosystem, hold 852,539 BTC, with a market value of $4 billion, representing a smaller fraction of 0.2% of the institutional holdings. Their involvement underscores the foundational role these companies play in the maintenance and expansion of the Bitcoin network.

In total, these entities hold 82,552,375 BTC, which is valued at $171 billion, representing 12.2% of all Bitcoin in circulation as of July 2026. This data not only reflects the substantial financial commitment made by these entities but also highlights the growing legitimization and institutional confidence in Bitcoin as a critical component of modern financial portfolios.

Bitcoin Versus is not a financial advisor. This media platform reports on financial subjects purely for educational and entertainment purposes only. Do your own due diligence and contact a professional financial advisor for any advice on how to invest your money.

Leave a reply to Coinbase Faces User Backlash Amidst Bitcoin Self-Custody Controversy – Bitcoin Versus Cancel reply