The Bitcoin Power Law model is primarily a form of quantitative analysis, applying mathematical principles to predict Bitcoin’s long-term price trends.

It uses logarithmic transformations and regression analysis to define support and resistance levels, offering a structured approach to forecasting.

While it overlaps with technical analysis, the model’s foundation in physics-based principles places it firmly in the realm of quant analysis

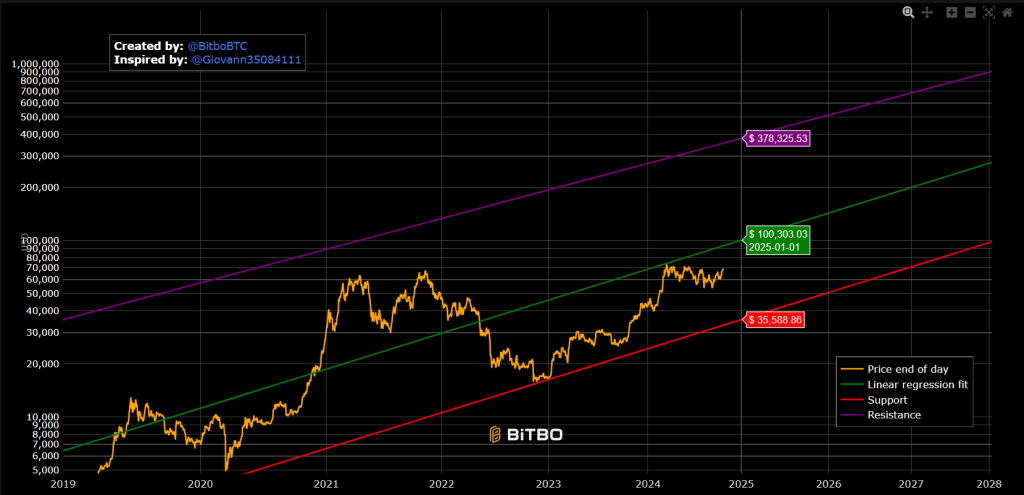

The chart provided aligns with Giovanni Santostasi’s Bitcoin Power Law model, which predicts Bitcoin’s price trajectory through a mathematical framework based on natural laws.

The power law model establishes support and resistance lines, highlighting key price levels Bitcoin should follow.

According to Santostasi’s model, Bitcoin’s price is predicted to hit $100,000 before 2028 and should not drop below that threshold afterward. It also suggests that Bitcoin could reach $1 million by 2033

In the chart, the orange line tracks the actual price of Bitcoin over time, while the red line represents the bear case or support level, predicting a minimum price of $35,588.86. The green line shows a more optimistic trajectory, targeting a price of $100,303 by January 1, 2025. On the bullish side, the purple line reflects a potential peak at $378,325.53.

A technical analysis of this pattern suggests Bitcoin is adhering to these support and resistance bands. While there have been periods of volatility, the price has historically remained within these predicted bounds, signaling a pattern of steady growth.

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment