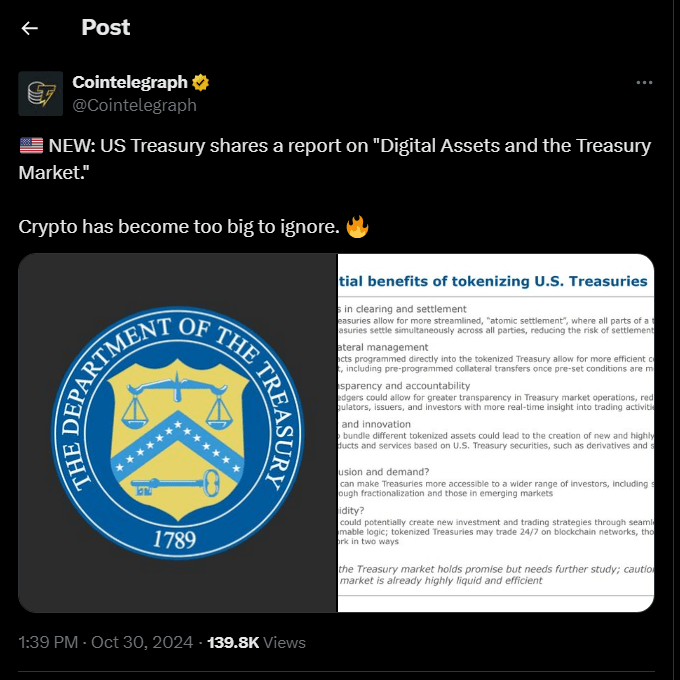

The U.S. Department of the Treasury has released a comprehensive 17-page report addressing the rapid growth and implications of digital assets and tokenization within the financial sector.

The report emphasizes the need for robust regulatory frameworks to manage the evolving landscape of digital finance.

The document also examines the role of stablecoins, noting their increasing use in digital transactions. The Treasury suggests that central bank digital currencies (CBDCs) could offer a more secure alternative, potentially replacing privately issued stablecoins in the future.

In response to the report, financial institutions are urged to adopt best practices and collaborate with regulatory bodies to foster innovation while safeguarding against systemic risks.

The Treasury’s findings aim to balance the benefits of digital asset integration with the imperative of financial security.

BitcoinVersus.tech is not a financial advisor. This media platform reports on financial subjects purely for informational purposes.

Leave a comment