finance

-

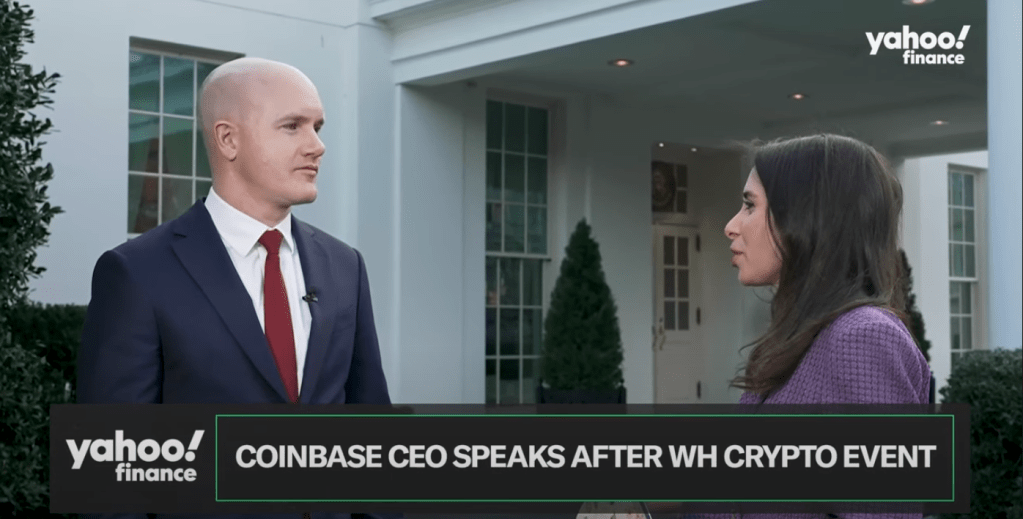

Coinbase CEO Brian Armstrong attended the first-ever White House crypto summit and praised President Donald Trump’s efforts to revitalize the industry. In an interview with Yahoo Finance Senior Reporter Jennifer Schonberger, Armstrong stated, “President Trump really breathed life back into this industry over the last few years. We really felt like we were being unlawfully…

-

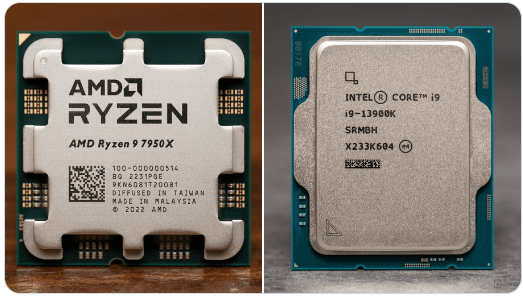

Intel and AMD, the two titans of the CPU industry, have recently unveiled their flagship processors: Intel’s Core i9-13900K and AMD’s Ryzen 9 7950X. The Core i9-13900K boasts 24 cores and 32 threads, operating at a base frequency of 3.0 GHz, with turbo frequencies reaching up to 5.8 GHz. In contrast, the Ryzen 9 7950X…

-

Robinhood co-founder and CEO Vlad Tenev joined CNBC’s Squawk Box to discuss the U.S. administration’s establishment of a strategic Bitcoin reserve, calling it a “sensible approach” to integrating digital assets into the national financial system. His remarks followed the White House Crypto Summit, where industry leaders and policymakers convened to discuss the role of Bitcoin…

-

At the 2024 Digital Assets Conference in São Paulo, BlackRock once again positioned itself at the forefront of the cryptocurrency market, expanding its reach by discussing the impact of Bitcoin and launching its Bitcoin ETF in Brazil. Jay Jacobs, head of Thematics and Active Equity ETFs at BlackRock, highlighted how Bitcoin is evolving as a…

-

Bitcoin’s scarcity is one of its most significant features, with only 21 million coins ever to exist. This scarcity equates to approximately 0.0025 BTC per person on the planet, based on the current global population of 8 billion. According to INDIANHODL, this allocation isn’t an annual amount but a lifetime allotment for each individual. When…

-

In recent weeks, Coinbase has come under scrutiny from its users, particularly those advocating for Bitcoin self-custody. The crypto community is growing increasingly concerned after a series of events where Coinbase allegedly restricted user access to their Bitcoin during market pumps. This led many to urge users to withdraw their crypto from the platform immediately.…

-

Mexican billionaire Ricardo Salinas – who has an estimated net worth of $5.8 billion – has significantly increased his investment in Bitcoin, now allocating approximately 70% of his liquid portfolio to the cryptocurrency. In a recent interview, Salinas stated, “I’ve got about 70% in Bitcoin-related exposure and 30% in gold and gold miners,” highlighting his…

-

In a recent development, Tyler Winklevoss, co-founder of the cryptocurrency exchange Gemini, expressed reservations about including certain digital assets in the proposed U.S. Crypto Strategic Reserve. He emphasized that only Bitcoin meets the necessary criteria for such a reserve. Winklevoss elaborated that an asset suitable for a strategic reserve should embody characteristics of hard…

-

Tom Lee, co-founder and managing partner of Fundstrat Global Advisors, recently shared his optimistic outlook on Bitcoin’s price trajectory for 2025. In an interview on CNBC’s ‘Squawk Box,’ Lee expressed confidence that Bitcoin will surpass the $150,000 mark this year, attributing this anticipated growth to increasing institutional adoption and broader acceptance. Lee highlighted that…

-

Michael Saylor, Executive Chairman of Strategy, has unveiled a comprehensive digital assets framework, asserting that the United States could unlock a $100 trillion economic opportunity by adopting strategic digital asset policies. Saylor’s proposal emphasizes the establishment of a clear taxonomy for digital assets, categorizing them into digital commodities, currencies, securities, tokens, non-fungible tokens (NFTs),…

-

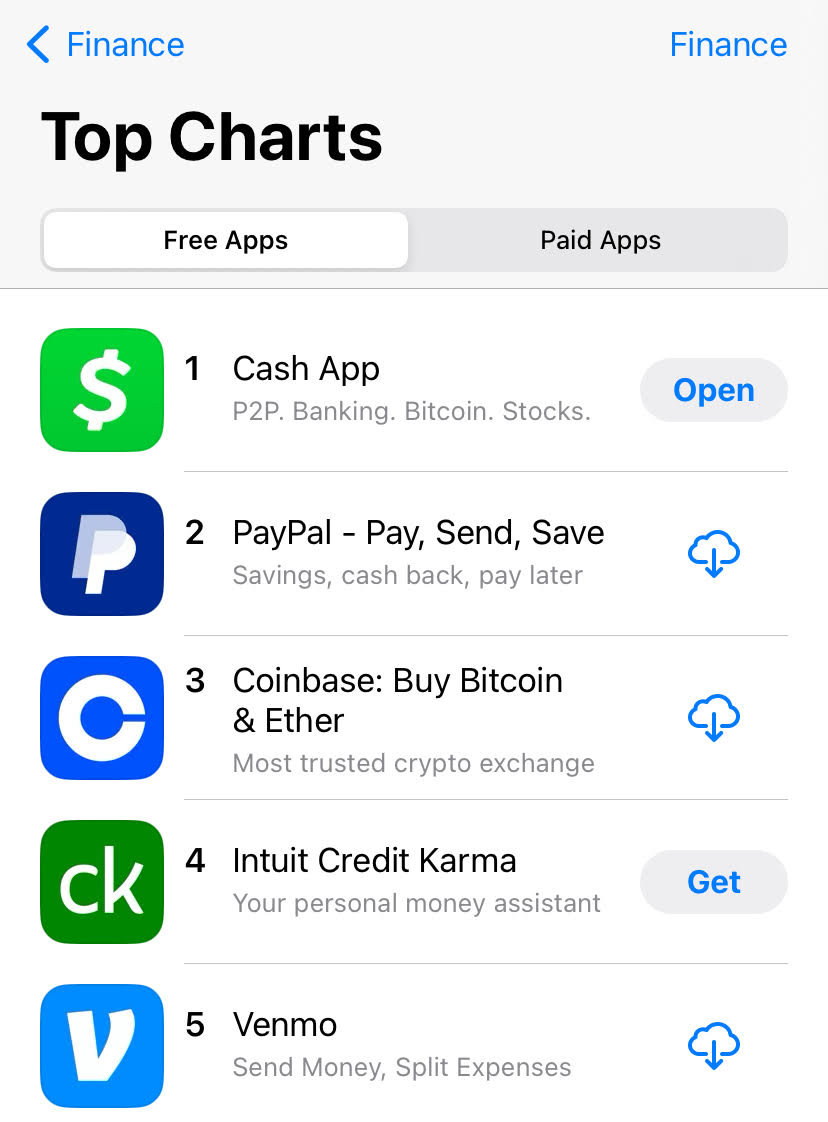

PayPal has announced that U.S. businesses can now buy, sell, and hold cryptocurrency directly through their PayPal accounts. This shift marks a significant step in mainstream adoption of digital currencies, allowing businesses to easily manage their crypto assets in a seamless and user-friendly interface. This integration is designed to cater to the growing demand for…

-

Tether has indeed outperformed BlackRock in profits for 2023, marking a significant shift in the financial landscape. Tether reported a profit of $6.2 billion, surpassing BlackRock’s $5.5 billion. This achievement is largely driven by Tether’s investments in low-risk, high-yield assets like U.S. Treasury bills, which have benefited from rising interest rates globally. The company’s strategic…

-

The Human Rights Foundation (HRF) has announced a significant contribution to the Bitcoin ecosystem, granting 1 billion satoshis (around $590,000) to 20 global projects through its Bitcoin Development Fund. These initiatives focus on education, privacy, decentralizing mining, and providing private financial solutions to human rights groups. This funding reinforces Bitcoin’s role as a tool for…

-

The U.S. Securities and Exchange Commission (SEC) has approved options trading for BlackRock’s iShares Bitcoin Trust (IBIT) ETF. This marks a pivotal moment for institutional and retail investors, providing them with more tools to hedge risks and speculate on Bitcoin’s price movements. The options will be listed on the Nasdaq exchange under the ticker IBIT…

-

Early Bitcoin addresses from 2009, dormant for over a decade, have suddenly become active, sparking intrigue across the crypto space. A total of 250 BTC, currently worth $15.95 million, was moved from five different addresses. These addresses were among the very first Bitcoin mining addresses, operational in January 2009, just a month after Bitcoin’s inception.…

-

In a surprising financial turn, Tether, the issuer of the USDT stablecoin, surpassed BlackRock, the world’s largest asset manager, in 2023 by generating a profit of $6.2 billion. This achievement highlights a notable shift in the financial landscape, where cryptocurrency companies are increasingly outperforming traditional financial giants. BlackRock, which manages an astounding $10 trillion in…

-

Franklin Templeton, the renowned global investment firm, has officially lodged a proposal with the U.S. Securities and Exchange Commission (SEC) to launch an innovative cryptocurrency exchange-traded fund (ETF). Trading under the ticker ‘EZPZ’, the fund aims to provide investors with diversified exposure to the largest digital assets, initially focusing on Bitcoin (BTC) and Ethereum (ETH).…

-

Germany’s Commerzbank has officially announced its move to offer Bitcoin and cryptocurrency trading to its 11.6 million retail customers. This marks a significant step for traditional banks embracing the digital asset revolution. The bank is partnering with Crypto Finance, a subsidiary of Deutsche Börse, to provide secure and regulated access to Bitcoin and Ethereum trading…

-

The cryptocurrency ETF market has seen a stark contrast in performance between Bitcoin and Ethereum, as recent net flows highlight significant differences in investor sentiment. Since the launch of their respective ETFs, Bitcoin ETFs have attracted a net flow of ₿305.4k, showcasing strong demand and investor confidence in Bitcoin’s potential. On the other hand, Ethereum…

-

The central banks of Norway and Switzerland have notably increased their investments in MicroStrategy, a firm that holds a substantial amount of Bitcoin. Norges Bank, responsible for managing Norway’s Government Pension Fund, now holds over 1.12 million shares, while the Swiss National Bank has acquired 466,000 shares, marking a 60% increase from the previous quarter.…

-

eToro, one of the leading global trading platforms, has reached a settlement with the U.S. Securities and Exchange Commission (SEC) over charges related to its cryptocurrency offerings. The platform has agreed to pay $1.5 million as part of the settlement and will be restricting its cryptocurrency trading services in the United States. This move comes…

-

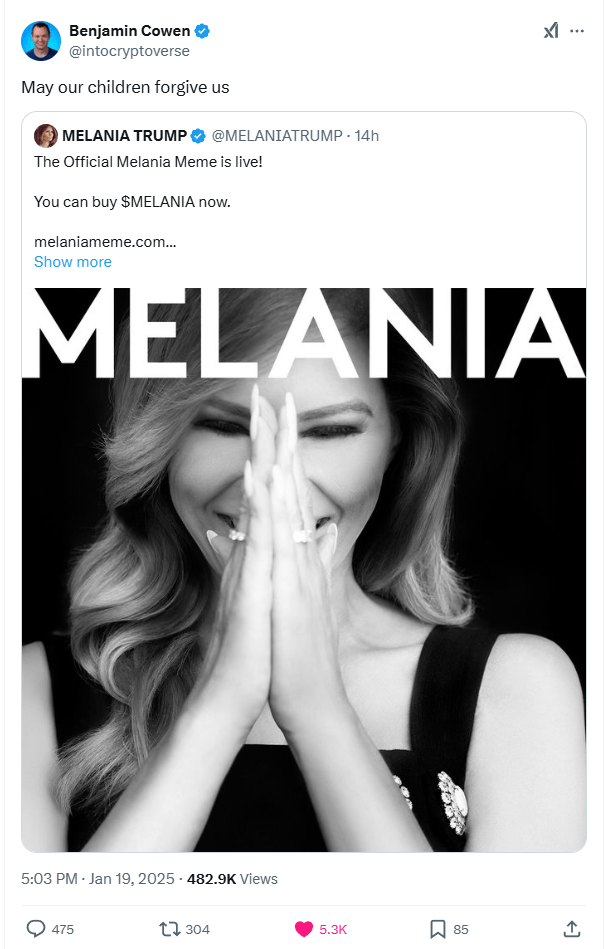

First Lady Melania Trump has introduced her own meme coin, $MELANIA, following the recent launch of her husband Donald Trump’s $TRUMP cryptocurrency. The $TRUMP coin experienced a volatile surge, reaching a market capitalization of approximately $32 billion shortly after its release. Similarly, $MELANIA quickly amassed a market cap exceeding $2 billion. Despite these impressive figures,…

-

In a bold prediction, Michael Saylor, the co-founder of MicroStrategy, has forecasted that Bitcoin will reach a price of $13 million per coin over the next 21 years. Saylor believes Bitcoin’s global importance will continue to rise, growing to represent 7% of all global capital, up from its current share of 0.1%. He outlined these…

-

U.S. Senator Cynthia Lummis has announced plans to establish a strategic Bitcoin reserve, aiming to strengthen the U.S. dollar and address the national debt. The proposal suggests that the U.S. government acquire approximately 1 million bitcoins over five years, representing about 5% of the total Bitcoin supply. The proposed reserve would be managed by the…

-

Cryptocurrency markets are notoriously volatile, and traders have long relied on technical chart analysis to make decisions. This method involves identifying patterns, using indicators like moving averages and RSI, and drawing trendlines to predict future price movements. However, as markets evolve, many traders are turning to quantitative analysis (quant analysis) for a more data-driven approach.…

-

MicroStrategy has once again expanded its Bitcoin portfolio, acquiring an additional 18,300 BTC for $1.11 billion. This latest purchase brings the company’s total Bitcoin holdings to 244,800 BTC, making it the largest corporate holder of Bitcoin globally. The company’s CEO, Michael Saylor, remains a strong proponent of Bitcoin, consistently reinforcing its value as a hedge…

-

The U.S. government has reached a new milestone in its fiscal history, spending over $1 trillion on interest payments for its national debt in 2024. This figure marks the highest annual interest payment in the nation’s history, driven by surging debt levels and high interest rates. The national debt has now ballooned to $35.3 trillion,…

-

BlackRock, the world’s largest asset management firm, recently emphasized Bitcoin’s potential to act as a safeguard in these turbulent times. According to the company, Bitcoin could serve as a hedge against global disorder, offering protection from the vulnerabilities of traditional financial structures. BlackRock’s advocacy for Bitcoin was further solidified with the launch of its Bitcoin…

-

As the tech world debates the future of AI and Bitcoin, Fred Krueger has emerged as a leading voice, advocating for Bitcoin as the superior investment choice. At the recent All In Conference, Krueger emphasized that despite AI’s transformational potential, only a few companies, such as Nvidia, are profiting from it. His outlook echoes caution,…

-

Fred Krueger, a prominent Bitcoin advocate with a strong background in Wall Street, recently issued a bold statement targeting altcoin and NFT enthusiasts. In a social media post, Krueger declared, “Altcoiners, I hate to break it to you. Your coin will be worthless in 10 years. Your NFT will have zero bidders. Bitcoin will be…

-

Michael Saylor, executive chairman of MicroStrategy, has forecasted that Bitcoin could hit $13 million per coin within the next 21 years. Speaking on CNBC, Saylor explained that his projection is based on Bitcoin eventually accounting for 7% of global capital, a significant leap from its current 0.1% share. He believes Bitcoin’s market capitalization could soar…

-

Mark Karpelès, the former CEO of the defunct Mt. Gox cryptocurrency exchange, is preparing to launch a new platform called EllipX by the end of September 2024. Based in Poland, this new exchange aims to serve European users initially, with plans for global expansion. EllipX will focus on transparency and user-friendliness, addressing the growing demand…

-

The Japanese government is set to reform its cryptocurrency tax policies by significantly reducing the maximum tax rate on crypto earnings from 55% to 20%. This proposed change is aimed at aligning the tax treatment of cryptocurrencies with that of traditional financial assets, such as stocks. Currently, crypto profits are taxed under a miscellaneous income…

-

On September 1, 2024, Qatar announced a significant development in its financial sector with the introduction of the QFC Digital Assets Framework. This framework, established by the Qatar Financial Centre Authority (QFCA) and the Qatar Financial Centre Regulatory Authority (QFCRA), sets new legal and regulatory standards for digital assets in the Qatar Financial Centre (QFC).…

-

Bitcoin’s value trajectory may be on a scientific path to $1 million by 2033, thanks to Stephen Perrenod’s unique power law model predicting a long-term growth pattern rooted in mathematical principles and natural phenomena His analysis uses the “Bitcoin Power Law,” a model that employs mathematical patterns often seen in nature, such as scaling laws…

-

Zurich Cantonal Bank (ZKB), one of Switzerland’s largest financial institutions, has announced a significant move into the cryptocurrency market. The bank now allows its customers to trade and store Bitcoin and Ethereum directly from its platform. This offering will integrate with the bank’s existing services, including ZKB eBanking and Mobile Banking, ensuring that customers can…

-

According to a recent analysis by VanEck, Bitcoin’s value could skyrocket to $2.9 million per coin by 2050. This bold prediction is grounded in the expectation that Bitcoin will gain significant traction as both a global medium of exchange and a reserve asset. The report suggests that as traditional fiat currencies such as the U.S.…

-

According to multiple sources, including Jurrien Timmer, Director of Global Macro at Fidelity, the investment firm has made several bold forecasts regarding Bitcoin’s future value. One such prediction is that one Bitcoin may be worth $1 billion by 2038. This prediction is based on Timmer’s analysis of Bitcoin’s growth potential, drawing parallels with the historical…

-

Michael Saylor, co-founder and executive chairman of MicroStrategy, is scheduled to present a Bitcoin investment strategy to Microsoft’s board of directors before December 10. Saylor, a prominent advocate for Bitcoin adoption, has publicly encouraged Microsoft to integrate Bitcoin into its financial strategy, suggesting it could significantly enhance shareholder value. In a recent X Spaces discussion…

-

Bitcoin24 is an open-source macro model for forecasting asset growth and Bitcoin adoption over the next 21 years. It offers micro models to assess various Bitcoin strategies for individuals, corporations, institutions, and nation-states. Users can input assumptions and adjust parameters to explore different scenarios, providing a clear perspective on potential growth trends.

-

Anthony Pompliano, a prominent Bitcoin advocate and investor, has reignited debate over the idea of a United States Bitcoin strategic reserve. In a recent post on X.com, Pompliano suggested that the United States print $250 billion and allocate 100% of it to purchasing Bitcoin. His reasoning centers on Bitcoin’s unique characteristics as a hedge against…

-

Anthony Pompliano, Founder and CEO of Professional Capital Management, recently offered an insightful perspective. Pompliano describes Bitcoin as “gold with wings,” emphasizing its potential to protect against market downturns while offering substantial growth. In a recent appearance on Market Domination Overtime, Pompliano discussed why he remains optimistic about Bitcoin’s future, despite the recent price volatility.…

-

Billionaire investor Paul Tudor Jones has significantly increased his fund’s Bitcoin holdings through BlackRock’s iShares Bitcoin Trust ETF. Recent filings with the U.S. Securities and Exchange Commission (SEC) reveal that Tudor Investment Corporation now holds over 4.4 million shares in the ETF, a substantial rise from the 869,565 shares reported in June. This expansion reflects…

-

Michael Saylor, CEO of MicroStrategy, has publicly offered to assist Microsoft in developing a Bitcoin investment strategy. In a recent post on X (formerly Twitter), Saylor addressed Microsoft CEO Satya Nadella, stating, “If you want to make the next trillion dollars for [Microsoft] shareholders, call me.” This proposal follows Microsoft’s announcement of a shareholder vote…

-

Acurx Pharmaceuticals, a publicly traded biopharmaceutical company, has announced plans to purchase up to $1 million in Bitcoin as a treasury reserve asset. This decision aligns with strategies employed by companies like MicroStrategy, which has significantly invested in Bitcoin. The company’s CEO, David P. Luci, stated that Bitcoin’s growing demand and acceptance as a primary…

-

Coinbase has successfully conducted its first crypto transaction between artificial intelligence (AI) agents on its platform. This historic event marks a significant milestone in the integration of AI with blockchain technology. The transaction, which took place on August 30, 2024, involved one AI agent using crypto tokens to acquire AI tokens from another AI agent.…

-

Senator Cynthia Lummis has introduced the BITCOIN Act, proposing that the U.S. Treasury acquire 1 million bitcoins over five years to establish a strategic reserve aimed at bolstering the dollar and countering inflation. MicroStrategy Chairman Michael Saylor supports the initiative, suggesting that such an acquisition could potentially reduce the national debt by $16 trillion. The…

-

In a recent critique, Bitcoin advocate Max Keiser questioned Warren Buffett’s relevance in the evolving financial landscape, highlighting the cryptocurrency’s ascent over traditional investment vehicles. In recent post Keiser remarked, “Does anyone remeber Warrne Buffet?” Bitcoin’s market capitalization has recently surpassed that of Berkshire Hathaway, the conglomerate led by Buffett. As of November 22, 2024,…

-

Thumzup Media Corporation, a publicly traded company on Nasdaq under the ticker TZUP, has announced its decision to allocate up to $1 million of its treasury reserves into Bitcoin. CEO Robert Steele emphasized that Bitcoin’s finite supply and resistance to inflation make it a robust addition to the company’s financial strategy. The board’s approval reflects…

-

Semler Scientific, a healthcare technology firm, has expanded its Bitcoin holdings by purchasing an additional 215 bitcoins for $17.7 million between November 6 and November 15, 2024. The acquisition was made at an average price of $82,502 per bitcoin, inclusive of fees and expenses. Since adopting a Bitcoin treasury strategy on May 28, 2024, Semler…

-

Undoubtedly, before September of 2024, one could ascertain that Michael Saylor and his company MicroStrategy, was an absolute failure for the past 20 years or so. Ultimately the question comes down to this, can you custody bitcoin in a safer manner than MicroStrategy? They have a custody partnership with Coinbase but I suspect that they…

-

The United States Department of Defense has failed its annual financial audit for the seventh consecutive year, unable to fully account for its $824 billion budget. The audit, conducted by independent auditors, revealed that the Pentagon could not provide sufficient financial data to support a clean opinion, highlighting ongoing challenges in financial management and accountability.…

-

Bitcoin’s price has surpassed $90,000 for the first time, driven by market optimism following President-elect Donald Trump’s victory and his pro-cryptocurrency stance. The cryptocurrency reached a record high of $91,110, marking a 32% increase since the November 5 election. Galaxy Digital CEO Mike Novogratz suggests that if the U.S. establishes a Bitcoin reserve, the cryptocurrency’s…

-

Austin’s rental market is experiencing challenges, with vacancy rates climbing and rental prices decreasing. As of September 2023, the city’s rental vacancy rate reached 11%, surpassing the national average of 6.6% and indicating a substantial increase from previous years. Rental prices have also declined. Austin’s median apartment rent has fallen significantly, with a 15% decline…

-

The U.S. Securities and Exchange Commission (SEC) has issued a Wells notice to OpenSea, one of the largest NFT marketplaces, signaling its intent to pursue legal action. The SEC alleges that non-fungible tokens (NFTs) traded on the platform qualify as securities, marking a significant shift in the regulatory landscape. OpenSea CEO Devin Finzer confirmed the…

-

MicroStrategy has ascended into the top 100 U.S. publicly traded companies by market capitalization, now valued at approximately $96 billion. This milestone reflects a 528% surge in its stock price this year, primarily driven by its strategic acquisition of Bitcoin. The company currently holds 331,200 BTC, valued at around $30 billion, underscoring the significant impact…

-

Goldman Sachs has increased its investment in Bitcoin exchange-traded funds (ETFs), as revealed in a recent filing with the U.S. Securities and Exchange Commission (SEC). The Wall Street firm now holds approximately $710 million across various Bitcoin ETFs, underscoring a growing institutional interest in digital assets. The SEC filing indicates that Goldman Sachs’ largest position…

-

Florida’s Chief Financial Officer (CFO), Jimmy Patronis, has announced that the state holds approximately $800 million in cryptocurrency-related investments. Patronis emphasized the state’s commitment to embracing digital assets, stating, “Crypto’s not going anywhere. We’d be a fool if we’re not prepared to do everything we can to harness the opportunities there.” In a recent interview…

-

MicroStrategy (MSTR) remains committed to its aggressive bitcoin (BTC-USD) accumulation strategy, with Executive Chairman Michael Saylor confirming the company’s ongoing purchases, irrespective of market fluctuations. This approach has positioned MicroStrategy as a significant player in the cryptocurrency market, with over 214,000 bitcoin in its possession. The company’s strategy is not just about holding bitcoin but…

-

Italy’s government has decided to reduce the proposed capital gains tax on cryptocurrency transactions from 42% to 28%, following significant feedback from industry stakeholders and political figures. The initial proposal, introduced in October 2024, aimed to increase the tax rate from the existing 26% to 42%, sparking widespread concern among investors and businesses within the…

-

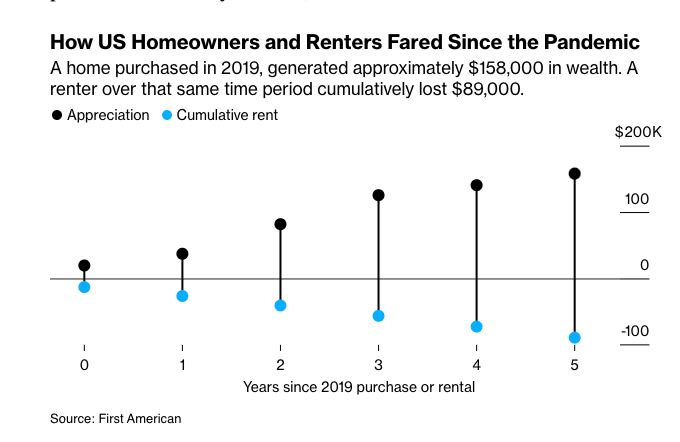

Recent analyses reveal a significant financial disparity between U.S. homeowners and renters over the past five years. Individuals who purchased homes in 2019 have, on average, seen their net worth increase by approximately $158,000, primarily due to substantial home price appreciation during this period. In contrast, renters have missed out on this wealth accumulation, with…

-

President-elect Donald Trump has nominated Howard Lutnick, CEO of Cantor Fitzgerald, as the next U.S. Secretary of Commerce. Lutnick, 63, has been a key fundraiser for Trump’s 2020 and 2024 campaigns and co-chaired the transition team. His nomination underscores Trump’s commitment to integrating business acumen into his administration. Lutnick’s leadership at Cantor Fitzgerald, a prominent…

-

Gold prices have risen by 24% year-to-date, reaching a one-week high of $2,621.95 per ounce on November 19, 2024. This increase is attributed to a softer U.S. dollar and market anticipation of Federal Reserve interest rate decisions. Analysts at Goldman Sachs project that gold could reach $3,000 per ounce by the end of 2025, driven…

-

Coinbase has projected that the cryptocurrency sector could encompass 20% of the global GDP in the near future, drawing parallels to the rise of e-commerce in past decades. This expectation was expressed in a report highlighting the potential for crypto adoption to mirror the growth experienced by online commerce. CEO Brian Armstrong previously emphasized that…

-

The history of U.S. median home prices tells a story of economic resilience and volatility. Beginning with steady growth in the mid-20th century, prices have responded to inflation, economic cycles, and shifts in supply and demand, leading to unprecedented levels in 2024. Examining these trends offers insight into the forces that continue to shape the…

-

VanEck, a prominent asset management firm overseeing $100 billion in assets, has projected Bitcoin’s price to reach $180,000 in the current market cycle. Matthew Sigel, VanEck’s head of digital assets research, expressed confidence in Bitcoin’s trajectory, stating, “We think it’s just getting started.” Sigel highlighted the absence of technical resistance, indicating a favorable environment for…

-

The median price of new homes in the United States, when measured in Bitcoin, has experienced a significant decline over the past decade. In 2012, purchasing a median-priced new home required approximately 50,616 BTC. By 2024, this figure had dropped to just 5 BTC. This trend reflects Bitcoin’s substantial appreciation against the U.S. dollar, outpacing…

-

BitcoinVersus.Tech Editor’s Note: If you would like to support to help further secure the integrity of our research initiatives, please donate Bitcoin’s value has surged, reaching approximately $94,000 in November 2024. This significant increase mirrors the rapid appreciation of housing prices in the 1970s, when median home values in the United States rose from $23,000…

-

Detroit has announced plans to accept cryptocurrency payments for taxes and city fees starting in mid-2025, positioning itself as the largest U.S. city to embrace digital currencies for municipal transactions. The city will collaborate with PayPal to facilitate these payments. PayPal will handle the acceptance of cryptocurrencies such as Bitcoin and Ethereum, converting them into…

-

Elon Musk has publicly endorsed Howard Lutnick, CEO of Cantor Fitzgerald, for the position of U.S. Treasury Secretary, highlighting Lutnick’s potential to “actually enact change.” Lutnick, a prominent figure in the financial sector, has been a vocal advocate for cryptocurrencies, particularly Bitcoin. Under his leadership, Cantor Fitzgerald has managed Tether’s Treasury portfolio since 2021 and…

-

In a significant development, the defunct cryptocurrency exchange Mt. Gox has transferred 32,371 Bitcoin (BTC), valued at approximately $2.2 billion, to unmarked wallet addresses. Blockchain analytics firm Arkham Intelligence reported that on November 5, 2024, Mt. Gox moved 30,371 BTC to the wallet address “1FG2C…Rveoy” and an additional 2,000 BTC to another unmarked address. This…

-

-

ARK Invest, led by Cathie Wood, made headlines on August 27, 2024, by selling a significant portion of its Bitcoin holdings. The sale involved 1,717 Bitcoin, marking the largest single dump from ARK’s Bitcoin fund. This move has sparked considerable discussion in the cryptocurrency community, as it comes at a time when Bitcoin is under…

-

Federal agents conducted a raid on the Manhattan residence of Polymarket CEO Shayne Coplan, seizing his phone and electronic devices. The action followed Polymarket’s accurate prediction of Donald Trump’s victory in the 2024 presidential election. The FBI has not publicly disclosed the reasons for the raid. However, sources suggest potential allegations of market manipulation and…

-

TIAA, a prominent financial services organization managing approximately $1.3 trillion in assets, has disclosed holdings of $51,921 in Bitcoin exchange-traded funds (ETFs) through recent SEC filings. The SEC’s approval of spot Bitcoin ETFs in January 2024 marked a significant milestone, enabling investors to gain direct exposure to Bitcoin through regulated financial products. This regulatory advancement…

-

The Kingdom of Bhutan has reportedly amassed a Bitcoin reserve exceeding $1 billion, positioning it among the world’s leading state-level cryptocurrency holders. Blockchain analytics firm Arkham Intelligence disclosed that Bhutan’s government, through its investment arm Druk Holding & Investments (DHI), holds approximately 12,568 BTC, valued at over $1 billion as of November 11, 2024. Bhutan’s…

-

Bitcoin’s price took a notable dip near the close of trading on Wall Street, dropping to approximately $87,000. After opening the day at about $91,772, Bitcoin’s value fluctuated as the market reacted to a mixture of economic indicators and investor sentiment. By the end of the day, the cryptocurrency had settled around $87,500 signaling potential…

-

Following the German government’s decision to sell approximately 50,000 Bitcoin at $54,000 per coin, recent market dynamics have shown the potential financial impact of holding versus selling digital assets. With Bitcoin now trading at around $87,161, Germany’s early liquidation led to $1.1 billion in missed profits. The strategic decision, initially seen as a prudent way…

-

On November 13, 2024, Bitcoin’s price surged to an unprecedented $91,000, marking a significant milestone in the cryptocurrency market. The rise of Bitcoin has been attributed to a combination of factors, including increased institutional investment and favorable regulatory developments. Former NBA star Scottie Pippen drew parallels between Bitcoin’s achievement and the Chicago Bulls’ 1991 championship…

-

Incredible developments have emerged for MicroStrategy ($MSTR), which saw a 26% rally today. Despite this surge, the NAV multiple, a measure reflecting MicroStrategy’s market cap relative to its Bitcoin holdings (Net Asset Value), dropped to 3.1x from 3.4x last Friday. This lagging NAV multiple suggests that MicroStrategy may be undervalued relative to its Bitcoin holdings,…

-

Coinbase, one of the world’s largest cryptocurrency exchanges and custodial platforms, showcases an undeniable preference for Bitcoin among its users, as reflected in the sheer volume of Bitcoin under its custodial care. With a total holding of $112.66 billion in assets, Coinbase’s portfolio is significantly shaped by Bitcoin, which alone accounts for $86.61 billion, translating…

-

The recent surge in Bitcoin’s value has led to a significant increase in the number of crypto millionaires. According to the latest data, the number of Bitcoin millionaires has more than doubled over the past year, rising by 111% to reach 85,400 individuals. This dramatic growth has been fueled by Bitcoin’s rally, which has seen…

-

El Salvador‘s strategic investment in Bitcoin has yielded substantial returns, with the nation’s holdings now generating a profit exceeding $120 million. President Nayib Bukele’s administration began accumulating Bitcoin in 2021, aiming to integrate cryptocurrency into the country’s financial system. Recent surges in Bitcoin’s value have significantly enhanced the value of El Salvador’s digital assets. The…

-

Alliance Bernstein has projected Bitcoin’s price could surge to $200,000 by the end of 2025. Analysts point to the increasing interest from institutional investors and the limited supply of Bitcoin as key driving factors behind this forecast. The growing adoption by larger financial entities is anticipated to propel Bitcoin’s value significantly higher as competition for…

-

In a significant development within the financial sector, BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed its iShares Gold Trust (IAU) in assets under management (AUM), marking a pivotal shift in investor preferences. As of November 8, 2024, IBIT’s AUM reached approximately $33.1 billion, overtaking IAU’s $32.9 billion. Launched in January 2024, IBIT has experienced rapid…

-

In a remarkable financial surge, Bitcoin has outperformed silver during the latest bull market, highlighting the growing dominance of Bitcoin over traditional commodities. As of November 12, 2024, Bitcoin’s price has soared to $85,327, marking a significant increase from previous levels. In contrast, silver’s price has experienced a modest decline, with the iShares Silver Trust…

-

Jan van Eck, CEO of investment management firm VanEck, has expressed strong confidence in Bitcoin’s future performance, predicting that the cryptocurrency will continue to reach new all-time highs. In a recent interview, van Eck emphasized Bitcoin’s maturation and its growing acceptance as a store of value, stating, “Bitcoin is the obvious asset that’s growing up…

-

On November 11, 2024, total spot Bitcoin exchange-traded fund (ETF) trading volume reached an unprecedented $6.9 billion, reflecting a surge in investor interest and market activity. This milestone underscores the growing acceptance of Bitcoin ETFs as a mainstream investment vehicle. BlackRock’s iShares Bitcoin Trust (IBIT) led the market, recording over $4.1 billion in daily trading…

-

Florida’s Chief Financial Officer, Jimmy Patronis, has formally requested the State Board of Administration (SBA) to evaluate the feasibility of incorporating Bitcoin into the state’s pension fund investments. In a letter dated October 29, 2024, Patronis emphasized Bitcoin’s potential to diversify the state’s portfolio and act as a hedge against the volatility of traditional asset…

-

MicroStrategy, under the leadership of Executive Chairman Michael Saylor, has expanded its Bitcoin holdings by acquiring an additional 27,200 BTC for approximately $2.03 billion. This purchase, completed at an average price of $74,463 per Bitcoin, brings the company’s total holdings to 279,420 BTC, acquired at an aggregate cost of about $11.9 billion, averaging $42,692 per…

-

Ripple Labs CEO Brad Garlinghouse has expressed strong confidence in the future approval of an exchange-traded fund (ETF) for XRP, the cryptocurrency associated with his company. In a recent interview on Bloomberg Crypto, Garlinghouse stated that an XRP ETF is “just inevitable,” highlighting the growing demand from both institutional and retail investors for access to…